Finance & Economics

Taxation: Eight jurisdictions removed from EU list

Eight jurisdictions have been removed from the EU's list of non-cooperative jurisdictions for tax purposes, following commitments made at a high political level to remedy EU concerns.

- Read more

- 223 reads

Macroeconomic Imbalance Procedure: Well-designed but not implemented effectively, say EU Auditors

The European Commission is not implementing the Macroeconomic Imbalance Procedure (MIP) in a way which ensures effective prevention and correction of imbalances, according to a new report from the European Court of Auditors. The auditors conclude that the MIP is generally well-designed and based on good-quality analysis. But at some important stages, the process is political rather than technical.

- Read more

- 231 reads

IMF Staff Concludes Visit to Latvia

An International Monetary Fund (IMF) staff team led by Ben Kelmanson and Iva Petrova (outgoing and incoming mission chief, respectively) visited Latvia from January 22-28 to review recent macroeconomic developments and start the analytical work ahead of the next annual review of the country’s economy (the Article IV consultation).

- Read more

- 266 reads

Germany Contributes EUR 24.6 Million Towards Urban Resilience in Somalia

The German Government announced its commitment of EUR 23.4 million to support infrastructure work in Somalia. Channeled through the World Bank’s Multi Partner Fund (MPF) the contribution will strengthen municipal planning and implementation capacity to improve access to basic infrastructure.

- Read more

- 250 reads

NTU Statement on the Delay of Obamacare Tax Increases

National Taxpayers Union (NTU) President Pete Sepp released the following statement on Jan 23, 2018 in response to the delay of three major Obamacare taxes included in the Continuing Resolution to fund the government through February 8th.

- Read more

- 293 reads

Launch of the NAO – University of Birmingham Tax Centre

The National Audit Office (NAO) and University of Birmingham have announced the establishment of the National Audit Office–University of Birmingham Tax Centre – a collaboration to inform improvements in the administration of the tax system.

- Read more

- 498 reads

Many Hurricane Victims Qualify for Earned Income Tax Credit; Special Method Can Aid Workers Whose Income Dropped

The IRS is urging victims of last year’s hurricanes, especially those who lived in areas affected by Hurricanes Harvey, Irma and Maria, to see if they qualify for the Earned Income Tax Credit (EITC). According to the IRS, many people whose incomes dropped in 2017 may be eligible to choose a special option for figuring the EITC, a credit for low- and moderate-income workers and families.

- Read more

- 498 reads

2018 Personal Income Tax Season Officially Opens Jan. 29

The Internal Revenue Service (IRS) has announced that they will begin accepting federal returns on Jan. 29, one week later than last year, to ensure the security and readiness of its tax processing systems and to assess the potential impact of recent federal tax legislation on 2017 returns. Tax returns are processed by the IRS before they are released to states. The Vermont Department of Taxes is ready to begin processing returns immediately upon receipt starting on Jan. 29th.

- Read more

- 311 reads

Unemployment to remain high, quality jobs harder to find in 2018 – UN labour agency

A worker sorts a green leaf tea before it reaches the main processing floor at the Kitabi Tea Processing Facility in Rwanda.

- Read more

- 264 reads

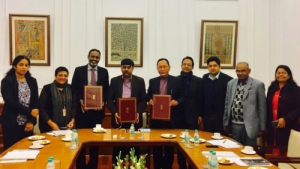

Project Signing: Government of India and World Bank Sign $120 million Agreement to Improve Access to Water Supply in Uttarakhand

- Read more

- 249 reads

Human Rights

Ringing FOWPAL’s Peace Bell for the World:Nobel Peace Prize Laureates’ Visions and Actions

Protecting the World’s Cultural Diversity for a Sustainable Future

The Peace Bell Resonates at the 27th Eurasian Economic Summit

Declaration of World Day of the Power of Hope Endorsed by People in 158 Nations

Puppet Show I International Friendship Day 2020