Outrageous! Taxpayer’s Human Rights Are Denied Once Again in the Tai Ji Men Tax Case

Do people in Taiwan have any protection against the tyranny of unconscionable judges and tax officials? How should they fight for their human rights? Tai Ji Men dizi sued judges Chiu-Hua Lin, Jin-Chang Zhuang, and Shyi-Shyan Liu at the Tai-Chung High Administrative Court on March 9, 2017, following the judges’ wrong decision in the Tai Ji Men tax case, which is a case of injustice that has dragged on for over 20 years.

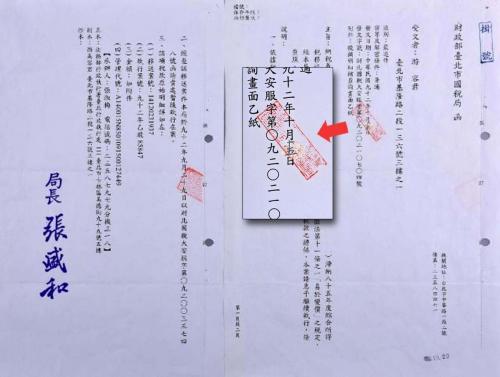

Tai Ji Men dizi pressed charges against judges for making a wrong decision and against tax officials for illegal tax collection on March 9, 2017.

Tai Ji Men shifu and dizi have exhausted all the possible remedies to right the wrongs in the case, but justice is still not served to this day. Tai Ji Men dizi were so enraged that they also pressed charges against tax agents Ching-Hua Ruang, Ming-Shan Peng, and Ya-Jing Lin for illegal tax collection, which is against Article 129.1 of the Criminal Law. Tai Ji Men dizi will also start a civil case to sue the government for damages and send a petition to the Control Yuan to impeach these government officials. The purpose of their lawsuits is to awaken the public to their human rights in taxation, to advance tax and law reform, and to promote an effective reward-punishment system in the government so that government officials that fail to perform their duties will be timely eliminated.

A Bill of Indictment Is Merely a Statement to Be Verified in a Court of Law

The Tai Ji Men tax case originated from the Tai Ji Men criminal case. In 2007, the court of the third instance made a final decision that exonerated all the defendants in the Tai Ji Men case and confirmed that there was no fraud, no tax evasion, and no violation of the Tax Collection Act. All the defendants were awarded national compensation for wrongful detention in 2009. In a democratic nation under the rule of law, this should have ended the ordeal of the innocent Tai Ji Men shifu and dizi; however, the taxation bureau used the bill of indictment transferred by the prosecutor of the Tai Ji Men criminal case to impose taxes on Tai Ji Men before the court examined the validity of the bill of indictment. This is ridiculous because a prosecutor’s bill of indictment is merely a statement that is to be verified in a court of law. Nevertheless, the taxation bureau continues to use the bill of indictment, which has been confirmed as erroneous by three instances of trial, to issue unjustified tax bills to Tai Ji Men to this day.

Dr. Claudius Petzold, assistant professor at Fu Jen Catholic University and former prosecutor in Germany, stated that there are no false cases fabricated for political purpose in Germany because the government pragmatically decides each case on its merits.

Kenneth Jacobsen, Professor of Law at Temple University Beasley School of Law, U.S.A., has studied the Tai Ji Men tax case for nearly two years and strongly criticized the taxation bureau’s handling of the Tai Ji Men tax case. He said, “I do not feel that I can find a case involving more due process violations than the Tai Ji Men tax case. The NTB did not fulfill due process when repeatedly issuing tax bills based on an indictment abandoned in three instances of criminal trial.”

Over the past 20 years, the criminal courts, the Control Yuan, and the Executive Yuan have all claimed that the bill of indictment was invalid. More than 250 legislators have pointed out the taxation bureau’s violations of due process and the rules of evidence and demanded the taxation bureau to cancel its illegal tax bills to Tai Ji Men.

In 2015, the Taipei High Administrative Court and the Supreme Administrative Court both cancelled the taxation bureau’s tax demand on Tai Ji Men. However, that still has not concluded the whole injustice case, and the wrong decision made by the three judges on March 9 even further aggravated the innocent taxpayers’ pain.

In this day and age, the tax officials in Taiwan still follow the practices of previous authoritarian regimes and show no respect for taxpayers’ human rights.

It is a traditional Chinese custom for a dizi to give a monetary gift to his/her shifu, and under Article 406 of the Civil Law, the receiver of a gift is not responsible for a gift tax. The shifu (masters) of thousands of martial arts and religious organizations in Taiwan have never been taxed for receiving gifts, but why was the shifu of Tai Ji Men taxed?

In 2011, the taxation bureau conducted an open investigation into the Tai Ji Men tax case, and the results show that 100% of the respondents declared that their monetary gifts to Tai Ji Men shifu were truly gifts. Nevertheless, the taxation bureau arbitrarily claimed that half of them were gifts and the other half were tuition fees. By doing so, the tax officials were suspicious of the crime of illegal tax collection. Additionally, for the purpose of collecting more taxes, the taxation bureau has even forged documents during its handling of the Tai Ji Men tax case.

Justice Fails the People as the Taxation Bureau Continues to Ignore Real Evidence

The only point of contention in the case is whether the monetary gifts from Tai Ji Men dizi to their shifu were gifts or tuition fees of a cram school. The taxation bureau has persistently claimed that those were tuition fees of a cram school while failing to provide any evidence to support its claim. In contrast, over the past 20 years, Tai Ji Men and government agencies have time and again proved that the taxation bureau has been wrong.

Tai Ji Men dizi have provided to the taxation bureau nearly ten thousand affidavits, testifying that their monetary gifts to their shifu were truly gifts. The Ministry of Education, the competent authority of all cram schools, has stated three times that Tai Ji Men is not a cram school. The court of the third instance has confirmed that the monetary gifts from Tai Ji Men dizi to their shifu were gifts and thus exempt from income tax. The Control Yuan has pointed out that the taxation bureau failed to verify the nature of the income involved in the case. The Executive Yuan held a cross-ministerial meeting and it was resolved that the taxation bureau cannot impose taxes on Tai Ji Men based on the bill of indictment, and 7401 written responses to the taxation bureau’s open investigation following the meeting resolution all indicated that their monetary gifts to Tai Ji Men shifu were indeed gifts. In 2012 and 2013, the National Taxation Bureau of Taipei and National Taxation Bureau of the Central Area respectively admitted that Tai Ji Men is not a cram school. Since Tai Ji Men is not a cram school, there is no reason for the taxation bureau to tax it as one. In 2015, the Taipei High Administrative Court ruled in Tai Ji Men’s favor and pointed out that the taxation bureau failed to recognize the true nature of Tai Ji Men, and the Supreme Administrative Court declined the taxation bureau’s appeal.

Judge Yao-Yuan Wen, the presiding judge of the court of the second instance in the Tai Ji Men criminal case, said that it is unbelievable that the taxation bureau would issue tax bills based on the erroneous bill of indictment and would not cancel the false tax disposition based on the criminal court’s decision.

Dr. Tze-Lung Chen, Professor of Law at National Taiwan University, stated that the rules of evidence must be followed in taxation to prevent tax agents from arbitrarily levying taxes. It’s appalling that the taxation bureau would ignore all the evidence and facts provided by the taxpayers and government agencies and insist to arbitrarily tax Tai Ji Men simply based on the erroneous bill of indictment that was issued 21 years ago and abandoned by the criminal courts! How can Taiwan move forward with such a ridiculous tax system? When can transitional justice be truly realized?

The Tai Ji Men Tax Case Is Merely the Tip of the Iceberg for Taiwan’s Tax Problems

Taiwan was once one of the Four Asian Tigers, but now its economy is sinking and the starting salary university graduates can expect to earn is lower than it was 17 years ago. However, according to the Ministry of Finance, the taxation bureau still collected over NT$100 billion in surplus tax revenues in 2014, 2015, and 2016 respectively. According to the Ministry of Justice, in 2016, there were 8.09 million cases of owing taxes or dues and were pending for compulsory enforcement. This is terrible as the total number of households in Taiwan is around 8.47 million. This kind of cases has increased by 3,321,000 from 2014 to 2016. Taiwan’s tax problems have run rampant.

Taiwan Needs to Bring Its Human Rights Protection Up to Par

International experts on human rights were invited to review Taiwan’s implementation of the ICCPR and ICESCR at the “Review Meeting of the ROC’s Report Under the ICCPR & ICESCR” held in 2013 and 2017. Members of the review committee pointed out in their conclusion that the taxation bureau seriously violated human rights protected under Article 12.2 of the ICCPR in its handling of the Tai Ji Men case and considered the case as a significant case of human rights abuse.

Dr. Claudius Petzold, assistant professor at Fu Jen Catholic University and former prosecutor in Germany, stated that if the false case took place in Germany, it would be quickly resolved because it is simply a problem of an erroneous tax bill issued by a tax agent. How on earth did the Tai Ji Men tax case snowball into such a big case? There are no false cases fabricated for political purpose in Germany because the government pragmatically decides each case on its merits, said Dr. Petzold.

The U.S. Congress passed the Global Magnitsky Human Rights Accountability Act in 2016 to fight corruption and safeguard human rights around the world. Promoting human rights protection is a global trend, and Taiwan’s government needs to truly reform its judicial and tax system and timely eliminate corrupt officials to catch up with the international standards and make Taiwan a real democratic country where the rule of law and human rights prevail.

Source: Tai Ji Men

- 385 reads

Human Rights

Ringing FOWPAL’s Peace Bell for the World:Nobel Peace Prize Laureates’ Visions and Actions

Protecting the World’s Cultural Diversity for a Sustainable Future

The Peace Bell Resonates at the 27th Eurasian Economic Summit

Declaration of World Day of the Power of Hope Endorsed by People in 158 Nations

Puppet Show I International Friendship Day 2020