State Violence: People's Suffering for 20 Years

Uncover the Truth of False Cases, Benchmark Cases for Transitional Justice, History of Blood and Tears of Tai Ji Men's Grandmaster and Disciples due to Injustice

According to statistics released by the Administrative Enforcement Agency, there were 6.53 million tax default cases pending compulsory enforcement in 2015. Based on a total of approximately 8.47 million households in that year, three out of four households owed taxes and were subject to compulsory enforcement. This shows that the 20-year unjust Tai Ji Men tax case is not unique and merely represents one of the many unjust and erroneous cases. The Tai Ji Men case, which began with the government's political crackdown in the name of suppressing evil religious cults at the end of 1986, is a false case jointly manufactured by the prosecution and the National Taxation Bureau (NTB) and is referred to as the Tax Law 228 Incident by legal scholars.

Prosecutor Kuan-jen Hou conducted his investigation based on "intuition"instead of evidence and found someone guilty just when henoticed "a glint in the eyes"(picture from the Internet).

Prosecutor Kuan-jen Hou of the Taipei District Prosecutors Office overlooked the fact that summons had been issued successively by the Kaohsiung Prosecutors Office and the Hsinchu Prosecutors Office for interrogation and investigation due to poison-pen letters 20 days prior to his investigation. But no illegality was found and these matters were closed. Relying on the same false tips without interrogation and verification in advance, he directly launched illegal raids on 19 locations including Tai Ji Men's facilities in Taiwan and residences of some disciples through hundreds of prosecutors, police officers and investigators with loaded guns. This seriously violated the principle of no double jeopardy. He also seriously violated the principle that matters under investigation should not be disclosed to the public by continuously disclosing false investigation details to media during investigation, resulting in a series of over 400 false reports and over 70 telecast reports by 12 television stations. As a result, there are still some media and people left with false impressions, resulting in continued harm to Tai Ji Men.

After a final not-guilty criminal decision was rendered, Tai Ji Men's grandmaster and wrongfully detained disciples received national compensation for wrongful detention.

After the illegal raids, Kuan-jen Hou then incarcerated victims to force testimonies out of them. The grandmaster and his wife as well as two Tai Ji Men disciples were illegally detained, followed by illegal freezing of all assets with no penny left and with absolutely no regard to the basic sustenance of the people concerned. Finally, he even concealed evidence favorable to the victims and indicted them on the trumped-up charge of raising goblins, which completely demonized and framed Tai Ji Men's grandmaster and disciples. In addition, he even admitted during the voluntary investigation by the Control Yuan that he had issued instructions, without the approval of his supervisor, to all local county and city governments to shut down Tai Ji Men's facilities as well as their utility supply after he indicted the victims in this case.

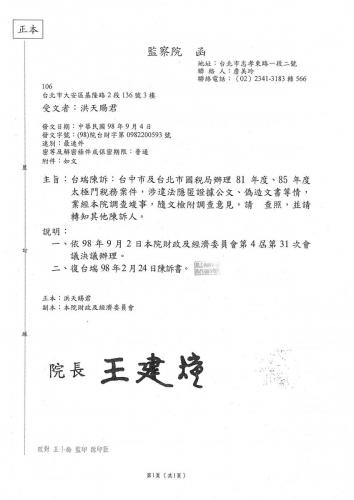

Control Yuan conducted its own investigations into the Tai Ji Men case and identified 8 flaws of criminal prosecution and 7 violations of tax authority. The Tai Ji Men case was listed as the benchmark of human rights protection by Control Yuan.

In addition to going beyond his authority and persecuting Tai Ji Men for its total annihilation, Kuan-jen Hou even colluded with the NTB to bring Tai Ji Men into complete extinction through heavy taxes and penalties.

To resist state violence, urge true legal and tax reform and save Taiwan by promoting conscience, 23 organizations from different sectors in Taiwan organized a ceremony on the establishment of the tower of light on December 19 to commemorate the December 19 Human Rights Day.

111 days after his investigation, Kuan-jen Hou interrogated Yueh-sheng Shih, an NTB tax collector who had neither conducted substantive investigation of Tai Ji Men nor visited Tai Ji Men, to obtain his false testimony, in which Tai Ji Men was accused of being a cram school. The false testimony was relied on as the sole evidence to support Tai Ji Men's violation of the Tax Collection Act and tax evasion and to indict the victims in this case. On one hand, a sum of money was treated as proceeds of fraud which he requested the court to confiscate pursuant to law. On the other hand, he contradicted himself when he treated the same money as cram school tuitions and business revenues and referred it to the NTB for forcible taxation. However, the Ministry of Education, which is the highest central competent authority for cram schools, has issued circulars three times and has stated openly in the Legislative Yuan that Tai Ji Men is not a cram school.

The only issue in this case is whether the honorariums paid by Tai Ji Men disciples to the grandmaster (shifu) were gifts in nature. On July 13, 2007, a final criminal decision was rendered by the third instance criminal court and found that there was no fraud, no tax evasion and no violation of the Tax Collection Act. The decision also concluded that the honorariums for the shifu were gifts, and that the procurement engaged by some disciples for other disciples was not profit-oriented and had nothing to do with the grandmaster and wife. Victimized Tai Ji Men's grandmaster and disciples all received national compensation for wrongful detention. The Control Yuan even investigated this case three times, concluded that this case is a major unjust human rights case and included it in the major human rights protection cases set forth in the Third Consolidated Report on Human Rights Protection. The results of the Control Yuan's investigation show that Kuan-jen Hou committed eight major legal violations and confirmed serious contradictions between his indictment and evidentiary materials. The Control Yuan also concluded that Hou's prosecution did not meet evidentiary rules and could not serve as a basis of taxation, and that tax agencies also had seven major legal violations such as failure to clarify the nature of income ex officio.

For 20 years, the NTB has neglected court decisions and the Control Yuan's investigation time and again. Even though its illegal tax dispositions have been set aside by the Petition and Appeals Committee of the Ministry of Finance and administrative courts 17 times, the NTB still continues to collect taxes illegally based on the false indictment, which was rejected by three instances of criminal courts and failed to meet evidentiary rules. In compliance with a resolution adopted during an interministerial meeting organized by the Executive Yuan, the NTB conducted an open survey ex officio to investigate the nature of the honorariums. Although the results showed that all of the honorariums were gifts, still the NTB not only failed to cancel illegal tax bills pursuant to law, but also illegally divided the honorariums into half gifts and half tuitions. In doing so, the NTB duped the individuals concerned and continued its disposition that prohibited the grandmaster and his wife from disposing their assets, which exceed the outstanding taxes. Even when the assets were unfrozen by the Taipei District Court when it rendered a not-guilty decision, the NTB forced the individuals concerned to pledge their assets immediately and even illegally deprived them of their assets through illegal auctions via forgery of a government document.

It is even more outrageous that when the evidence that supported gifts was very solid and the Taipei High Administrative Court and the Supreme Administrative Court rendered decisions to set aside illegal tax dispositions once again in 2015, the NTB still conducted illegal ambush-style telephone surveys in an attempt to create unfavorable evidence to set up Tai Ji Men's grandmaster and disciples. Even under the circumstance that tax enforcement was not a concern due to excessive seizure, the NTB maliciously humiliated Tai Ji Men by seizing its emblem, patents and songs to force Tai Ji Men's grandmaster and disciples to their knees. Such stringent means of taxation bordered on kidnapping for ransom and killing the goose that lays the golden eggs is tantamount to kidnapping the entire state institution and democratic rule of law, bullies the people, seriously wastes government budgets and countless social costs and significantly violates human rights.

The unjust Tai Ji Men case began with violation of due process. This case should not have been prosecuted, much less be entangled by taxation.

To establish fraud and tax evasion, Prosecutor Kuan-jen Hou treated a sum of money as proceeds from fraud on one hand and contradicted himself when he falsely alleged the same sum of money as cram school tuitions and business revenues and illegally referred it to the NTB for illegal taxation on the other hand.

If such sum of money is proceeds from fraud, it should be confiscated pursuant to law without giving rise to the issue of taxation. Now that this case was derived from a criminal case, the tax agencies should have waited a final criminal decision to ascertain the nature of income before deciding if tax bills were to be issued. However, obviously aware of the contradiction in the nature of relevant amounts in the indictment, the NTB neither waited for a final court decision to ascertain the nature of income pursuant to the legislative spirit of Article 177 of the Administrative Litigation Act nor assumed ex officio its burden of proof to conduct entry-by-entry substantive audit pursuant to law. Instead, the NTB has forcibly collected taxes for as long as 20 years based on nothing but the fabricated amount in the false indictment in the criminal case.

Professor Kenneth Jacobsen, a law professor at Temple University in the United States and a well-known human rights lawyer who has studied the Tai Ji Men case for nearly two years, once mentioned that there are many serious violations of due process in the Tai Ji Men case. For example, two prosecutors had investigated this matter and found no legal violation before an ambitious third prosecutor emerged for four-month continued suppression without giving the victims any chance to explain the sources of finance. He had seized and attached assets directly and detained relevant individuals before he could figure out how to collect evidence. In a civil society, the accusation of raising goblins is sufficient to call into question the mental condition of this prosecutor. Any court will dismiss such ludicrous accusation immediately when is brought up.

In fact, Kuan-jen Hou completed his indictment on April 15, 1997 and voluntarily disclosed it to the public on April 16. It was not until the morning of April 17 that he instructed investigators to search for evidence that supported the charge of raising goblins at Tai Ji Men. It turned out that one "peach wood sword" was seized and exaggerated as evidence for supporting the charge of raising goblins. He absolutely ignored that peach wood swords have long been used as a religious implement to destroy and eliminate demons and evil spirits in Chinese society, not to mention that the peach wood sword seized for this case was a gift to the grandmaster from a disciple named Tsui-yu Cheng and had absolutely nothing to do with this case.

After the peach wood sword was found, Kuan-jen Hou interrogated the grandmaster if he had raised goblins for the first time and the grandmaster replied negatively in the afternoon of the same day. However, the indictment had been disclosed to the media on April 16, the day before. That he indicted first and collected evidence later before finally interrogating the grandmaster seriously violated due process. When interviewed by the media on May 5, 1997, Kuan-jen Hou audaciously claimed that he had concluded "intuitively" that the defendant had raised goblins based on "a glint from the eyes" of the defendant. His investigation not based on evidence and science seriously undermined the credibility of the judiciary.

What is even more unbelievable is that while he had stated that when this case was transferred to the Taipei District Court, the peach wood sword would be included in the evidence for admission in the court, the peach wood sword disappeared. When the grandmaster's attorney applied for the return of evidence after this case was concluded with a not-guilty final decision, the Taipei District Prosecutors Office simply could not find the peach wood sword, no matter how hard they tried. Therefore, the only evidence relied on by the prosecution to support the charge of raising goblins was vaporized. If this was not a setup, what is a setup?

In 2002, the Control Yuan actively investigated and listed eight major legal violations of Kuan-jen Hou and requested the Ministry of Justice to impose a strict sanction. The Control Yuan also confirmed that the prosecution based on the indictment, which contradicts evidentiary materials, did not meet evidentiary rules. Therefore, the prosecution should not have been instituted pursuant to law. Prosecutor Kuan-jen Hou also admitted that he had not investigated ex officio during the Control Yuan's investigation. Such indictment is not a supportable basis for taxation. The Tai Tsai Su Tzu No. 09313512360 Circular of September 29, 2004 from the Ministry of Finance also pointed out clearly that supplemental taxes and penalties should not be imposed simply based on materials such as referral paper, transcripts or indictments from prosecuting and investigation agencies. In addition, the NTB admitted in its letter dated March 7, 2000 to the Taipei Field Office of the Bureau of Investigation that "the details, nature and amounts assessed by the Bureau are all based on the materials and calculations communicated by the Office." This shows that the NTB had failed to conduct ex officio investigation when the first tax bill was issued, and that no tax bill should have been issued.

Since the final criminal decision confirmed that the honorariums were gifts, the NTB should cancel illegal tax dispositions pursuant to law.

The period beginning with the day after Kuan-jen Hou's detention of the grandmaster (December 21, 1996) and ending with the public disclosure of the indictment on April 16, 1997 lasted 117 days, in which only three investigation hearings lasting a total of 29 minutes with a total of 13 sentences in his questions were unbelievably conducted for the grandmaster. The criminal case lasted ten years and seven months and went through cross examination by 14 judges and 8 prosecutors with 9,570 minutes spent in 58 hearings in which around 200 witnesses including NTB's officials were summoned. After the evidence obtained for this case was examined piece by piece, a final not-guilty decision was rendered in 2007, finding that there was no criminal offense and no payable tax. The honorariums to the shifu were also determined to be gifts. The collective procurement by some disciples for other disciples did not involve any profit-oriented sale and had nothing to do with the grandmaster and his wife. In short, there was no tax issue at all.

The rashness and illegality of the prosecution reflect the prudence and thoroughness of the decision, which determined there was no criminal offense and no tax evasion, as rendered by the criminal court after it had expended a significant amount of time in trying this case. Therefore, the Ministry of Finance stated several times in its cancellation reasons that "if the results of a court decision in a judicial case affects the assessment of a tax matter, the original disposition agency should ex officio follow the corrective procedure." Former Finance Minister Ching-chang Yen and Vice Ministers Teh-shan Wang and Jung-chou Wang all remarked that since the Tai Ji Men tax case had been derived from a criminal case, if a not-guilty decision was rendered in the criminal case, a tax disposition would be cancelled. Such remark was based on the fact that criminal proceedings are more thorough and prudent in the examination of evidence as compared with administrative agencies and administrative courts.

Therefore, if a criminal case is connected with an administrative case, the tax agency should conclude the fact of gift according to the criminal decision according to the 29-Pan-Tzu-No. 13 Decision and the 32-Pan-Tzu-No. 18 Decision of administrative courts.

However, the NTB still ignores the findings in the criminal decision and tramples the authority of the judiciary by continuing to forcibly collecting taxes based on the illegal indictment. When facing petitions from Tai Ji Men disciples, the NTB even openly stated that "court decisions do not count." Such hubris and arrogance of the NTB flushed the authority of the judiciary down the drain. The NTB was tantamount to declaring to the people of this country that it is alright not to follow court decisions. This has set the worst example for a country under the rule of law.

Tax bills which have been wrong for 20 years have devastated the constitutional institution of this nation.

The tax bills, which were conjured up out of thin air, should not have been issued. The names of the victims have been cleared after this matter was reviewed by criminal courts, the Control Yuan, and administrative courts. The Legislative Yuan has also organized several public hearings and coordination meetings, and over 250 legislators have accepted petitions, given countersignatures and requested the NTB to cancel illegal tax bills. To end this unjust case, the Executive Yuan also conducted an interministerial meeting, in which the NTB was requested to conducted an open survey and announce the results of the survey, which attest, once again, to the fact of gift determined in criminal decisions. However, the NTB as an all-powerful agency was absolutely blind to all these and still rely on the indictment and transcripts in the criminal case as the basis of taxation even to this day. Its power has exceeds the five branches of the government. Fifth graders have learned about the constitutional system with separation of five government powers through social science studies. They have also known that the five branches of the government have their own responsibilities and that they are not supposed to exceed their authority. Otherwise, they will break the law and undermine the state institution. However, to collect taxes forcibly, the NTB has undermined the Constitution, which defines the separation of five government powers, and wasted government, administrative and judicial resources and incurred significant social costs just for the purpose of forcibly collecting taxes.

Observance of separation of five government powers secures the rule of law and human rights protection.

All men are equal before the law and clear facts and evidence should clear the names of the innocent.

Conscientious people have no fear in the face of lightening and no nightmare in the middle of the night.

Fairness should be upheld in administration pursuant to law and justice should be done under the law.

A conscientious course of action in our lives will fare us well on Judgment Day.

source: Tai Ji Men Qigong Academy

- 643 reads

Human Rights

Fostering a More Humane World: The 28th Eurasian Economic Summi

Conscience, Hope, and Action: Keys to Global Peace and Sustainability

Ringing FOWPAL’s Peace Bell for the World:Nobel Peace Prize Laureates’ Visions and Actions

Protecting the World’s Cultural Diversity for a Sustainable Future

Puppet Show I International Friendship Day 2020