International trade statistics: trends in third quarter 2019

G20 international merchandise trade continues to slow in third quarter of 2019

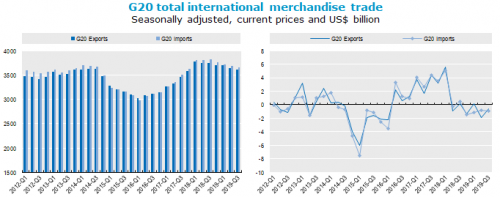

G20 international merchandise trade (in current US dollars, seasonally adjusted) continued its downward trend in the third quarter of 2019, approaching two-year lows. Compared with the second quarter of 2019, exports contracted by 0.7% and imports by 0.9%, partly reflecting a nearly 20% fall in oil prices and depreciations in most major currencies vis-à-vis the US dollar.

Trade remained weak across all G20 regions in the third quarter of 2019. The slowdown was particularly pronounced in the European Union, with exports contracting by 1.8% and imports by 0.4%. Exports and imports fell across all major EU economies, with declines of 3.6% and 1.7%, respectively, in France, and of 0.4% and 1.8%, respectively, in Germany. In Italy, trade fell for the sixth straight quarter, with exports and imports decreasing by 1.2% and 1.0% in Q3 2019.

In the United Kingdom, partly reflecting a significant fall in the value of Sterling (down 4.3% against the US dollar) and on-going Brexit uncertainty, exports contracted by 3.3% and imports by 1.6%.

Imports were also weak across all major Asian economies, contracting by 9.7% in India, 2.3% in Korea, 1.8% in China, and 0.4% in Indonesia. However, in Japan imports picked up by 0.5% as the yen appreciated against the US dollar. Exports fared generally better in the region, picking up by 4.1%, 2.2% and 1.6%, respectively, in Indonesia, Japan and China, but they contracted in India (by 3.1%) and Korea (by 0.4%). Reflecting the fall in oil prices, Saudi Arabia’s exports dropped by 6.8%.

In North America, exports from the United States fell marginally, by 0.2%, while imports decreased by 0.7%. United States exports to China remain significantly below the levels seen before the recent bilateral trade tensions, despite a pick-up in the second quarter (by 1.9%), and imports from China to the United States were down 2.1%. Mexico’s exports and imports contracted (by 0.2% and 0.4%), while Canada recorded a 1.7% decline in exports but a pick-up in imports (of 0.4%).

In South America, Brazil’s exports contracted by 3.5% while imports picked up by 15.3%, in part reflecting a spike in imports under the Repetro regime[1], which provides tax incentives on the purchase of inputs to the oil and gas industry. A significant increase in shipments to China fuelled Argentina’s exports (up 5.1% - the highest increase among G20 members in the third quarter of 2019).

Source: Organisation for Economic Co-operation and Development

- 281 reads

Human Rights

Ringing FOWPAL’s Peace Bell for the World:Nobel Peace Prize Laureates’ Visions and Actions

Protecting the World’s Cultural Diversity for a Sustainable Future

The Peace Bell Resonates at the 27th Eurasian Economic Summit

Declaration of World Day of the Power of Hope Endorsed by People in 158 Nations

Puppet Show I International Friendship Day 2020