IMF Executive Board Concludes 2018 Article IV Consultation with the Republic of Latvia

On August 31, 2018, the Executive Board of the International Monetary Fund (IMF) concluded the Article IV consultation with the Republic of Latvia.

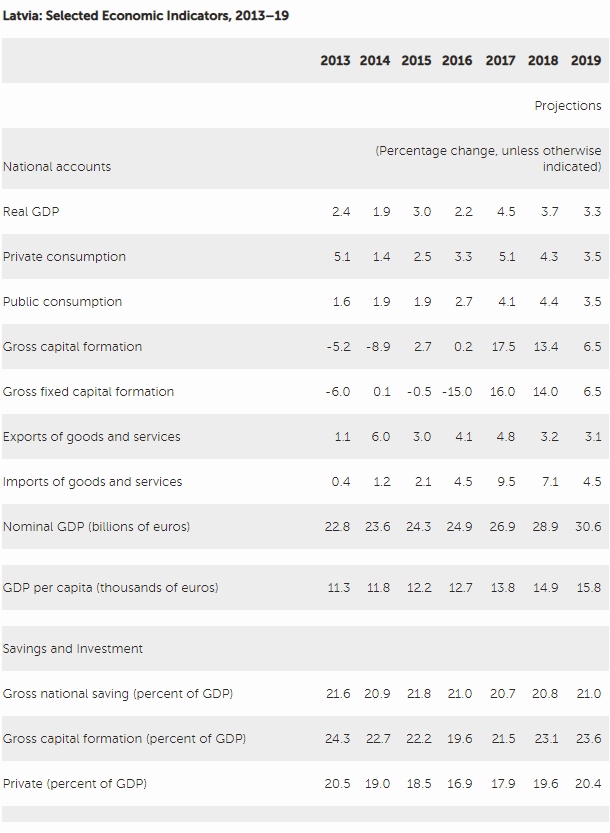

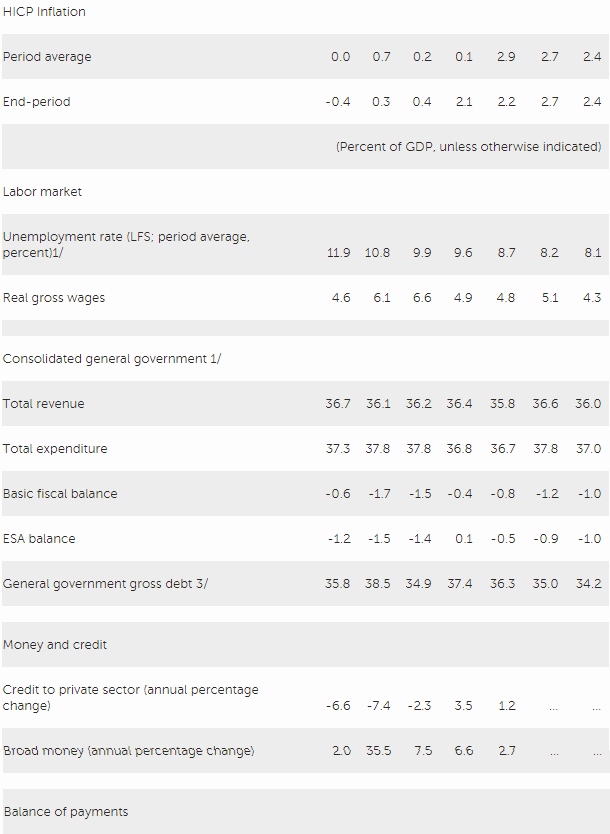

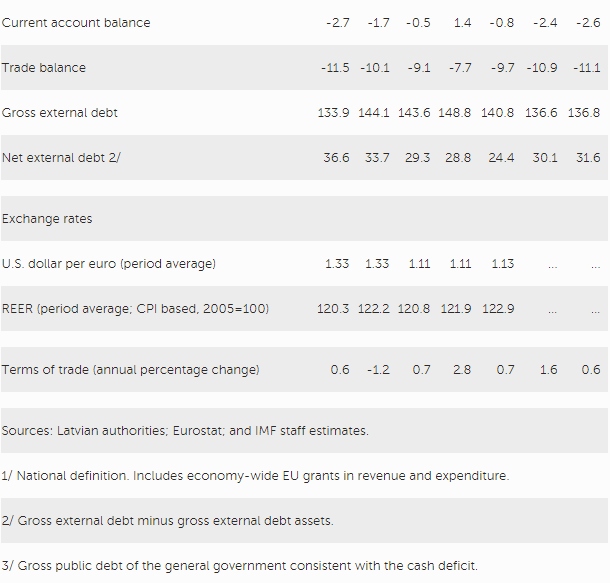

Growth in 2017 rebounded with a strong, broad-based upswing, supported by increasing wages, a recovery of private investment, and accelerated absorption of EU funds. Nominal gross wages rose by 7.8 percent, the unemployment rate declined to 8.2 percent—the lowest rate since 2008—and the average inflation rate reached 2.9 percent. With import volumes rising by 9.5 percent, the current account swung into a moderate deficit of 0.8 percent of GDP. Real GDP growth is projected to moderate to 3.7 percent in 2018, driven by continued strong domestic demand.

Government revenues overperformed in 2017, buoyed by strong economic activity and wage growth. Nonetheless, the 2017 general government structural balance recorded a deficit of 0.8 percent of GDP (ESA definition), which resulted in a positive fiscal impulse rendering fiscal policy procyclical.

Despite the suspension of activities of Latvia’s third largest bank on money laundering concerns, the banking system remains well capitalized and liquid, with capital-to-risk-weighted assets of 22.4 percent and liquid assets exceeding 80 percent of short-term liabilities at end-March 2018. Deleveraging of both households and nonfinancial corporations (NFCs) continued, with household debt to income now at half of its pre-crisis levels, and corporate debt to GDP down by more than a quarter from its peak in 2010.

Executive Board Assessment

Executive Directors commended the continuing buoyant growth in Latvia in the context of strong macroeconomic fundamentals and the authorities’ commitment to maintaining prudent fiscal balances and public debt levels. At the same time, they considered that the medium-term outlook is challenging, with risks tilted to the downside, especially on the domestic front. Directors emphasized the need to address the risk of overheating and to tackle policy challenges by focusing reforms on three key areas: easing labor market constraints and improving productivity, reviving domestic credit to support investment, and strengthening the enforcement of the AML/CFT framework to safeguard financial sector stability.

Directors noted that labor market constraints and demographic headwinds pose significant challenges to the medium and long-term outlook. They advised the authorities to focus on structural reforms that support labor market participation, reduce structural unemployment, and raise labor productivity. Reform measures could include the use of skill-matching and skill-building policies, better access to housing, revisiting the minimum wage structure, improving labor participation of targeted groups, and encouraging appropriate labor immigration.

Directors commended the authorities for setting ambitious fiscal objectives. They underlined that upfront consolidation will be needed, especially given the current procyclicality of fiscal policy. Directors encouraged the authorities to use the favorable macroeconomic conditions to mitigate overheating risks and build fiscal buffers. They noted that the ongoing tax reform would help reduce the high tax wedge and improve progressivity of the tax system, and urged the authorities to increase revenue mobilization to mitigate the upfront cost of the reform. Directors emphasized that more should be done to improve the growth friendliness and inclusiveness of the fiscal policy mix, including by reallocating spending toward better targeted social protection programs and productive investments.

Directors welcomed the authorities’ efforts to enhance regulation and lending standards that have helped improve banks’ balance sheets and supported financial sector stability. They also stressed that, over the medium term, the financial system needs to become more supportive of investment. In this regard, Directors recommended that reforms address risks from the insolvency framework and the shadow economy.

Directors expressed concern about the possible reputational impact on the financial system from money laundering allegations involving banks servicing foreign clients (BSFCs), and concurred that steadfast actions are needed to restore its reputation. Directors urged the authorities to ensure effective enforcement of AML/CFT regulations, focusing on mitigating risks from non-resident deposits and opaque companies. They also noted that changes in the banking legislation, alongside harmonization at the EU level, should provide more adequate tools to liquidate banks deemed to be failing or likely to fail. Directors stressed that such reforms, and careful management of the refocusing of BSFCs, will be key to minimize financial sector stability risks.

It is expected that the next Article IV consultation with Latvia will be held on the standard 12-month cycle.

Source: International Monetary Fund

- 231 reads

Human Rights

Ringing FOWPAL’s Peace Bell for the World:Nobel Peace Prize Laureates’ Visions and Actions

Protecting the World’s Cultural Diversity for a Sustainable Future

The Peace Bell Resonates at the 27th Eurasian Economic Summit

Declaration of World Day of the Power of Hope Endorsed by People in 158 Nations

Puppet Show I International Friendship Day 2020