IMF Executive Board Concludes 2018 Article IV Consultation with Singapore

On July 20, 2018, the Executive Board of the International Monetary Fund (IMF) concluded the Article IV consultation with Singapore.

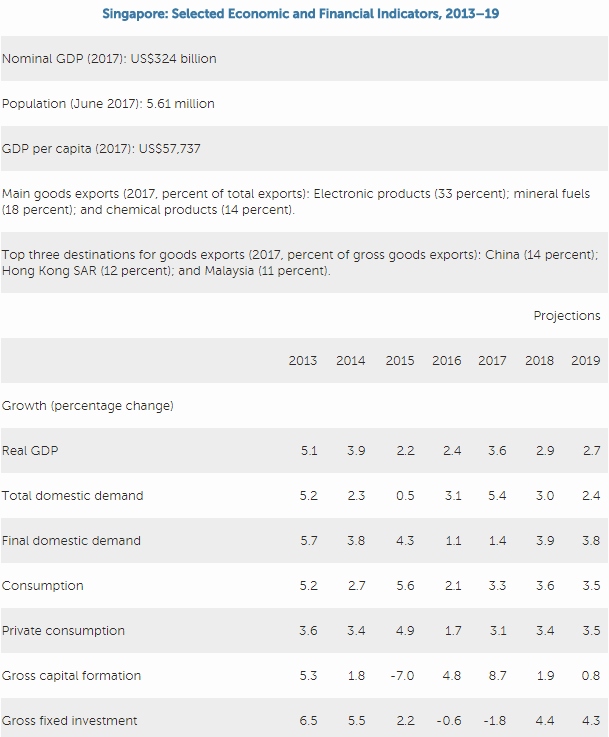

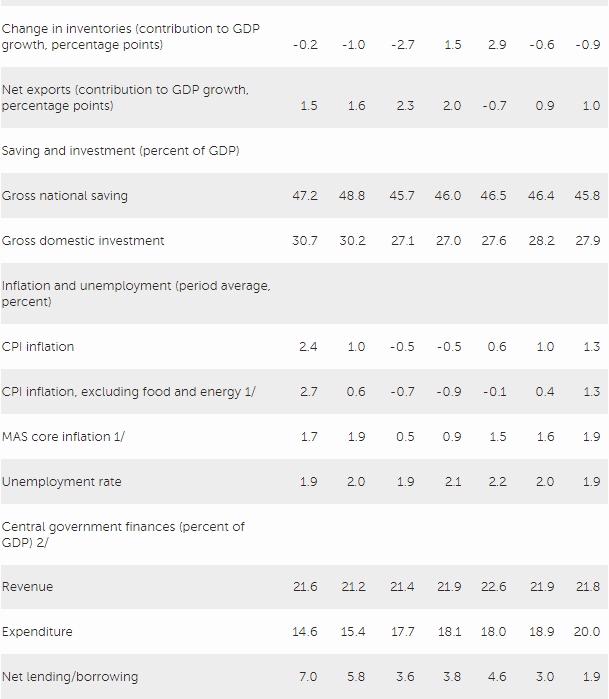

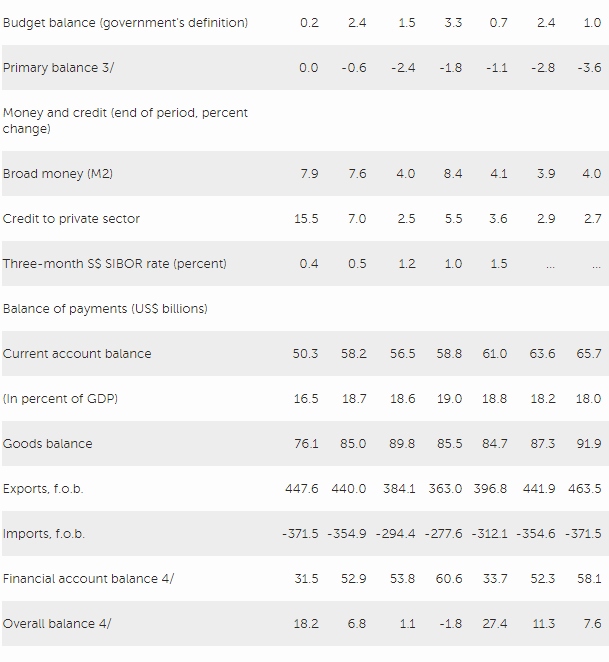

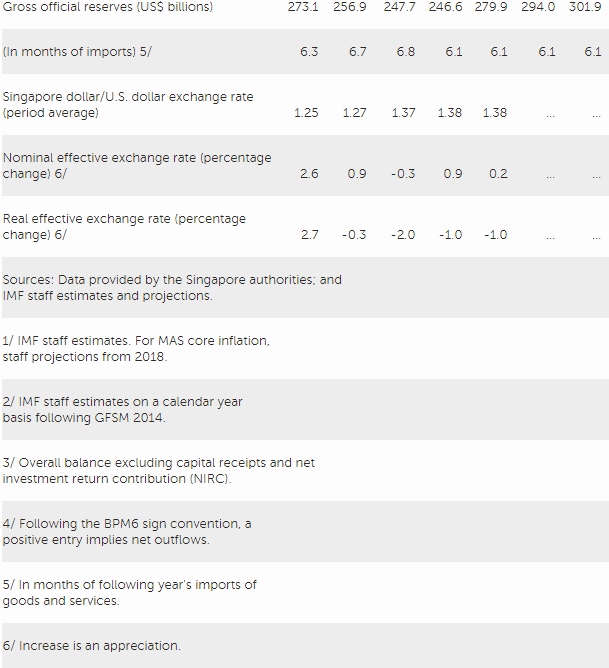

Singapore’s economy strengthened markedly in 2017, benefiting from a synchronized global expansion and a surge in electronics exports, and maintained its momentum in 2018. The strength in the externally-oriented sectors has been gradually spilling over to the rest of the economy, supporting a reduction in labor market slack and a recovery in private domestic demand. Real GDP growth reached 4.4 percent in 2018Q1 compared to a year ago and the 2017 average of 3.6 percent. Headline consumer price inflation turned positive in 2017 after remaining below zero for nearly two years. In the first four months of 2018, headline inflation decelerated, but the MAS core inflation was largely unchanged at 1.5 percent. The current account surplus has remained substantial and broadly unchanged, as a share of GDP, in the past few years.

Economic growth is expected to normalize toward its potential rate of about 2¾ percent, starting in 2018, while strengthening of labor market conditions should support higher inflation going forward. Macroeconomic policies have remained accommodative and are being recalibrated in response to the strength in the economy, while also being mindful of medium-term infrastructure and aging-related needs. Risks to the near-term growth are broadly balanced and stem from external sources. Key global downside risks include intensification of trade tensions, tighter financial conditions, and a slower-than-expected growth in major trading partners. Continued strength in global electronics trade and higher-than-expected spillover from U.S. fiscal stimulus are important upside risks. Over the medium term, a successful transition to a new growth model that aims to adopt general purpose digital technologies, strive for innovation, improve workers’ skills, and embrace a more inclusive society, should help rebalance the economy.

Executive Board Assessment

Executive Directors commended the Singaporean authorities for their strong and strategic stewardship. Directors noted that growth accelerated in 2017 and the momentum is sustained in 2018, while risks stem mainly from external sources. Inflation turned positive after two years and is expected to rise modestly. Going forward, challenges remain, including from an evolving external environment, demographics and technological change. Against this backdrop, Directors recommended continued calibration of macroeconomic policies and recognized the authorities’ pro-active approach to address structural transformation.

Directors considered that the commencement in April of monetary policy normalization was appropriate given the economy’s cyclical strength and the labor market recovery. Further normalization should be data dependent and taken in response to clear signs of inflationary pressures.

Directors welcomed the planned fiscal impulse under the FY2018/19 budget. The boost in spending on infrastructure and aging-related healthcare services would help ease supply constraints and facilitate external rebalancing. Additional stimulus would be in order if downside risks to growth were to materialize. Fiscal policy should be the first line of defense if growth and inflation undershoot. As regards the medium-term, many Directors noted the need to maintain fiscal sustainability against higher recurrent spending needs, including from demographics. Directors urged a careful consideration across fiscal options, including a lower budget surplus and bringing on budget more of the government’s asset income, a higher goods and services tax (GST) and borrowing for infrastructure spending.

Directors noted Singapore’s strong external position. The current account surplus is expected to narrow gradually over the medium term as private investment recovers further and public capital spending rises. A few Directors considered that there was additional scope for the fiscal path and structural policies to reduce external surpluses. In this context, they urged a strengthening of social insurance arrangements to lower private precautionary saving, among other steps.

Directors welcomed continued monitoring of conditions in property markets and appropriate adjustment of macroprudential measures to maintain prices in line with fundamentals. The residency-based differentiation in the stamp duty (ABSD) should be eliminated and the measure phased out once systemic risks dissipate.

Directors noted that the financial sector remains healthy with adequate buffers and strong balance sheets for banks, households and corporates. However, pockets of vulnerabilities require continued monitoring. In this context, Directors welcomed the authorities’ efforts to strengthen the regulatory framework in line with Basel III principles and to enhance the AML/CFT framework. They encouraged the authorities to continue to support the development of a FinTech ecosystem while regulations would require adaptation to emerging risks. Directors noted that the upcoming FSAP intends to examine financial sector issues in detail.

Directors commended the authorities’ plans to harness automation and digital technologies to help drive productivity growth, including targeted incentives for firms to innovate and integrate and for workers to reskill and pursue lifelong learning. Directors encouraged the authorities to further foster competition and innovation, including support for new, dynamic firms. While welcoming the authorities’ broad-based and upstream approach to addressing unemployment, they also supported the adoption of broader social insurance arrangements to help workers cope with technological disruptions.

Source: International Monetary Fund

- 354 reads

Human Rights

Fostering a More Humane World: The 28th Eurasian Economic Summi

Conscience, Hope, and Action: Keys to Global Peace and Sustainability

Ringing FOWPAL’s Peace Bell for the World:Nobel Peace Prize Laureates’ Visions and Actions

Protecting the World’s Cultural Diversity for a Sustainable Future

Puppet Show I International Friendship Day 2020