Further reforms can foster more inclusive labour markets in The Netherlands

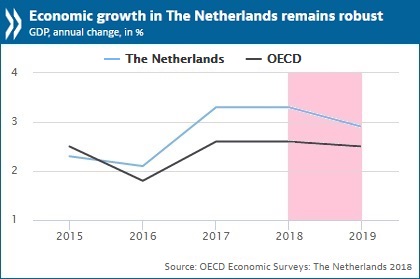

Economic performance in The Netherlands is vibrant and growth is expected to remain robust, underpinned by sound public finances, healthy job creation and high levels of confidence. The current economic expansion should be used to speed up implementation of reforms to ensure future stability and support more inclusive labour markets, according to a new report from the OECD.

The latest OECD Economic Survey of The Netherlands looks at the multiple factors behind the strong recovery, as well as the challenges facing the country moving forward. The Survey projects growth of 3.3% this year and 2.9% in 2019, and lays out an agenda for addressing potential vulnerabilities associated with the housing market and longstanding challenges posed by population ageing.

The Survey, presented in The Hague by OECD Secretary-General Angel Gurría and Mona Keijzer, State Secretary for Economic Affairs and Climate Policy, highlights a series of financial and trade-related risks to the strong outlook, particularly as concerns the exposure of a very open economy like the Netherlands to rising protectionism. It also underlines the potential for improvements to the tax system, so it supports growth and inclusiveness, and is more adapted to the changing global and digital environment. Progress in implementing measures to avoid tax base erosion and profit shifting (BEPS) should continue.

“The Dutch economy is performing extremely well, showing laudable resilience since the global financial crisis, but there are still important challenges that must be addressed to achieve sustainable and inclusive growth for the future,” Mr Gurría said. “I welcome the new policy agenda to tackle tax evasion and avoidance, as well as The Netherlands’ continuing commitment to being a leader in demonstrating how countries can adapt to a rapidly changing environment, keep markets open and strive to deliver a fairer and more sustainable globalisation.” Read the full speech.

The Survey points out that work contracts are increasingly flexible and offering lower levels of protection, while the share of non-standard forms of work, including self-employment, has risen rapidly. An increasing number of workers are no longer covered for sickness and disability risks, while tax incentives are promoting further migration to self-employment, which is close to 17% of total employment. There is also a large gender gap in part-time work, which is much more frequent among women than men.

To tackle the challenges posed by these developments, the Survey proposes a range of new reforms. It suggests the self-employed be supported in a more inclusive manner, including the phase-out of the permanent self-employment tax deduction and introduction of minimum coverage for sickness and disability insurance for workers, regardless of contract type.

To address the gender gap, the Survey calls for increases to paid paternity leave, above what is currently planned, and maintaining of existing provisions to keep childcare affordable and ensure the high quality of services.

Improving the targeting of support policies, the introduction of individual lifelong learning accounts targeted specifically at vulnerable workers and greater flexibility in tasks and hours worked for seniors would improve outcomes for marginalised workers.

Lastly, the Survey raises the need to better prepare for multiple external risks. In particular, uncertainty around Brexit is likely to create frictions in bilateral trade and investment relations. Not all sectors will be affected to the same extent. While the food and agriculture sector are likely to be hurt, financial services would gain from diverted trade in the European Union.

Source: Organization for Economic Co-operation and Development

- 231 reads

Human Rights

Ringing FOWPAL’s Peace Bell for the World:Nobel Peace Prize Laureates’ Visions and Actions

Protecting the World’s Cultural Diversity for a Sustainable Future

The Peace Bell Resonates at the 27th Eurasian Economic Summit

Declaration of World Day of the Power of Hope Endorsed by People in 158 Nations

Puppet Show I International Friendship Day 2020