IMF Executive Board Concludes 2018 Article IV Consultation with Honduras

On May 30, 2018, the Executive Board of the International Monetary Fund (IMF) concluded the Article IV consultation with Honduras.

Honduras successfully concluded its 2014-2017 Fund-supported program. The program was instrumental in restoring investor confidence and reducing macroeconomic imbalances. It also catalyzed important structural reforms such as the modernization of the fiscal policy framework which is now anchored by a fiscal responsibility law (FRL).

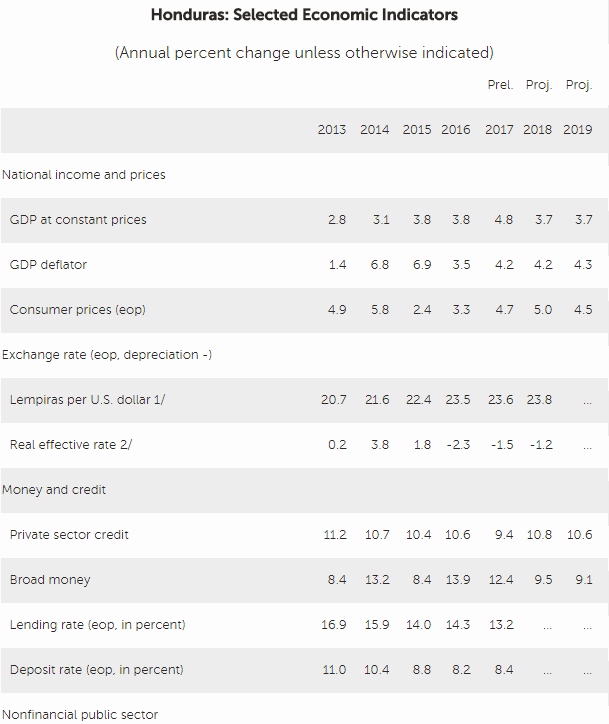

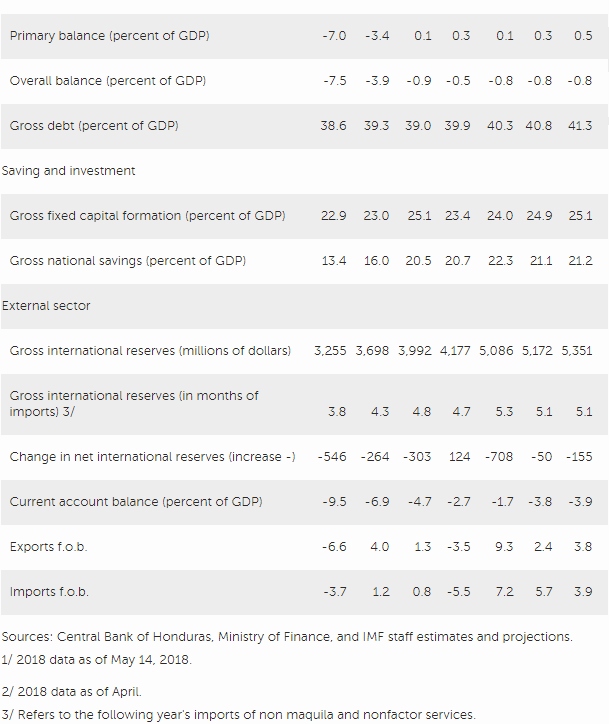

Boosted by domestic demand, mainly private consumption supported by record remittances inflows and public investment, the economy grew 4¾ percent in 2017, well above expectations. Headline inflation picked up to 4¾ percent from 3¼ percent in 2016 on the back of strong demand and rising oil prices. Honduras’ external position remains strong. International reserves were equivalent to 5.3 months of imports of goods and services at end-2017, within the Fund adequacy metrics.

The fiscal deficit increased slightly from ½ percent of GDP in 2016 to ¾ percent of GDP in 2017, still below the deficit ceiling of the FRL (1½ percent of GDP). Public revenues were boosted by a ½ percent of GDP windfall stemming from a series of tax amnesties granted after the introduction of the new tax code.

Monetary policy was accommodative in 2017 resulting in an increase in credit to the economy of 9½ percent. Modernization of the exchange rate regime continued as the authorities reduced surrender requirements by additional 10 percent (20 percent up to date) Financial indicators suggest that banking system is sound. As of end-2017, the 13¾ percent banks’ capital adequacy ratio was well above the regulatory minimum, and non-performing loans ratio was at historical lows (2¼ percent at end-2017).

In 2018-19, growth is expected to hover around 3¾ percent reflecting worsening external conditions. The fiscal deficit would remain somewhat below the FRL ceiling as the authorities plan to limit the increase in public debt further. The current account deficit would widen to about 4 percent of GDP both in 2018 and 2019 as remittances’ growth moderates and oil prices rise.

Key risks include tighter global financial conditions, due to the normalization of the U.S. monetary policy, and more restrictive U.S. immigration policies. Honduras is also vulnerable to domestic political polarization and potential deterioration in the institutional framework.

Executive Board Assessment

The Executive Directors commended the authorities for the successful completion of the Fund‑supported program. Directors noted the reduction in macroeconomic imbalances and the institutional enhancements, particularly the Fiscal Responsibility Law (FRL), under the program. These gains are critical factors for a favorable medium‑term outlook. Looking forward, Directors underscored the need for deeper reforms to entrench macroeconomic stability and place Honduras on a higher, more inclusive growth path.

Directors supported the authorities’ near‑term policy mix. A more prudent fiscal stance than required under the FRL will send an important signal of the commitment to maintain macroeconomic stability. Directors also welcomed the readiness to unwind the supportive monetary policy stance, if needed, to further anchor inflation expectations and contain inflationary pressures. These policies are particularly important in the context of downside risks from tightening global financial conditions, worsening terms of trade, and uncertainties related to overseas immigration policies.

Directors stressed the need for continued ambitious fiscal reforms and revenue mobilization efforts to boost potential growth, further expand the social safety net and reduce poverty. They noted the positive results of the conditional cash transfers program and its envisaged expansion within the ceilings of the FRL. A comprehensive review of large tax expenditures, and rationalization of expenditures is called for. Directors cautioned against the adverse effects of repeated tax amnesties on compliance and revenue mobilization efforts. Stronger efforts to resolve the financial situation of the state electricity company, right‑size the wage bill, and enhance the transparency and efficiency of public expenditure will also be critical.

Directors welcomed the progress made toward the modernization of monetary policy, including the reductions in surrender requirements and the introduction of collateralized transactions in the interbank market. Directors recommended speeding up the adoption of the new central bank law to enshrine the primacy of inflation as a monetary policy target. They also recommended efforts to deepen the money and foreign exchange markets to support the development of domestic capital markets, as well as more exchange rate flexibility that will provide a cushion against external shocks.

Directors welcomed the stability of the banking system and commended the progress made toward adopting Basel III standards. They recommended sustained implementation of the Financial Sector Stability Review recommendations. Relatedly, Directors called for careful monitoring of household debt, the concentration of consumer loans in public pensions fund portfolios, and the expansion of development banks toward first‑tier operations. They also underscored the need for a further strengthening of the AML/CFT framework.

Directors underscored the need to implement supply‑side reforms to boost competitiveness, growth, and job creation. They noted that strengthening the rule of law is critical to improve the business environment. Directors acknowledged the ongoing progress in fighting corruption in collaboration with international agencies and recommended enhancing the transparency of the current asset disclosure regime for public officials. Directors underscored the need for continued efforts to reduce red tape and increase the ease of doing business.

Directors emphasized the need to update national statistics for effective policy formulation and welcomed the progress made by the authorities.

Source: International Monetary Fund

- 225 reads

Human Rights

Ringing FOWPAL’s Peace Bell for the World:Nobel Peace Prize Laureates’ Visions and Actions

Protecting the World’s Cultural Diversity for a Sustainable Future

The Peace Bell Resonates at the 27th Eurasian Economic Summit

Declaration of World Day of the Power of Hope Endorsed by People in 158 Nations

Puppet Show I International Friendship Day 2020