IMF Executive Board Concludes 2018 Article IV Consultation with The Bahamas

On May 4, 2018, the Executive Board of the International Monetary Fund (IMF) concluded the 2018 Article IV consultation with The Bahamas, on a lapse of time basis.

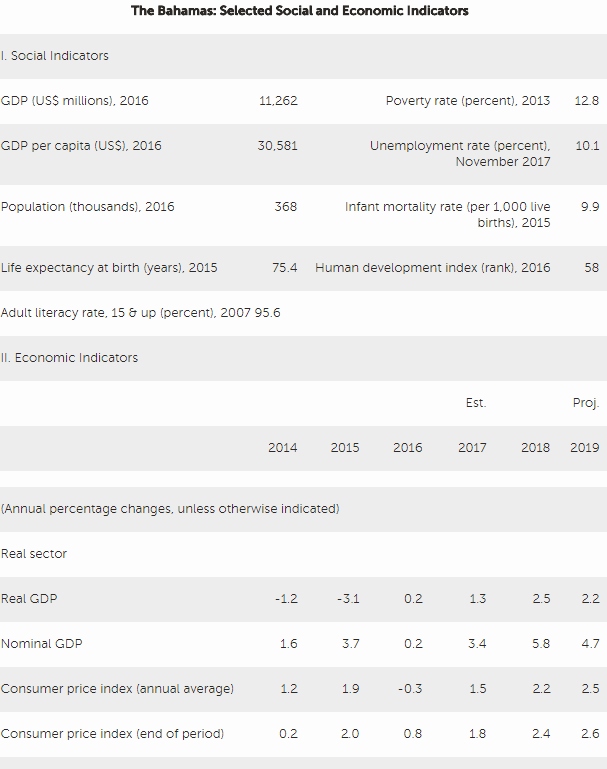

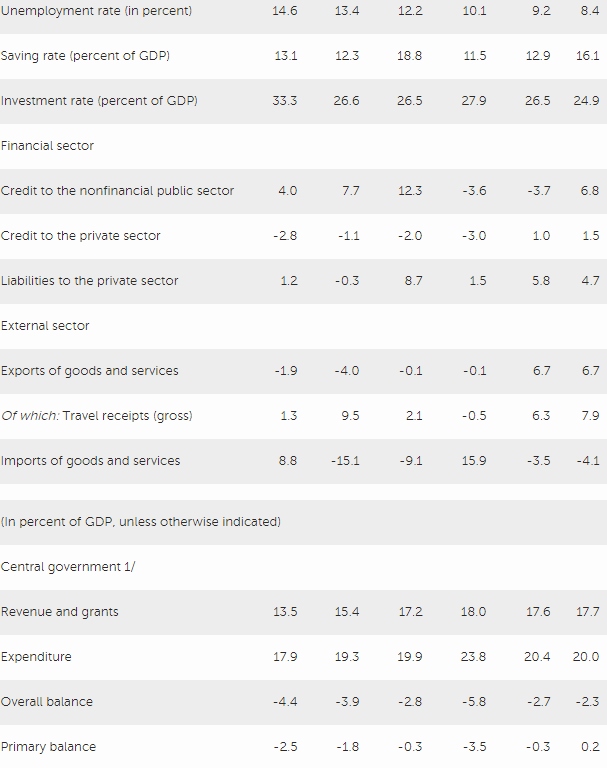

Real GDP is estimated to have expanded by 1.3 percent in 2017. Economic activity has been supported by the completion of Baha Mar, new FDI-financed projects, and post-hurricane reconstruction activity. However, air tourist arrivals declined 4 percent in 2017, reflecting the impact of Hurricane Matthew on hotel infrastructure in the Grand Bahama Island. Baha Mar created about 4,000 jobs by March 2018 and helped reduce the unemployment rate to 10.1 percent in November 2017, from 11.6 percent one year earlier. Inflation remains low despite higher oil prices. Headline year-on-year inflation reached 1.8 percent in December 2017, up from 0.8 percent in December 2016.

After reaching 5.8 percent of GDP in FY2017, the central government fiscal deficit is declining on the back of lower spending. Data for the first 7 months of FY2018 show a decline in the deficit to 1.6 percent of GDP, 1.2 percentage points of GDP lower than a year earlier, excluding the one-off purchase of promissory notes issued by Resolve. The government successfully placed an external bond for US$750 million in November 2017.

Commercial banks remain liquid and well capitalized. As of end 2017, the average capital adequacy ratio stood at 33.3 percent, well above the regulatory requirement of 17 percent and liquid assets represented 29.0 percent of total assets, and more than double the statutory minimum. The stock of nonperforming loans (NPLs) declined to 9.2 percent of total loans, from 11.4 percent at end-2016. Despite ample capital and liquidity in the system, banks remain cautious in making new loans, which has kept credit to private sector, excluding NPLs, broadly flat. Pressures on correspondent banking relationships (CBR) have not resulted in major disruptions so far.

Real GDP growth is projected at 2½ percent in 2018 and 2¼ percent in 2019 on the back of stronger growth in the United States; the phased opening of Baha Mar; and a pickup in foreign direct investment. Medium-term growth is projected to remain at 1½ percent, reflecting significant structural impediments.

The current account deficit is estimated to have widened to 16.4 percent of GDP in 2017, from 7.7 percent of GDP in 2016. The increase is due to a surge in imports of goods and services related to the completion of Baha Mar, the recovery in oil prices, and lower tourism receipts due to the impact of Hurricane Matthew. The 2017 cyclically-adjusted current account deficit, after deducting FDI-related imports, is estimated to be above the level consistent with fundamentals and desirable policy settings. Foreign reserves strengthened to US$1.4 billion by end-2017, equivalent to 3.6 months of imports of goods and services, boosted by the sovereign external bond placement in November 2017.

Executive Board Assessment

In concluding the 2018 Article IV Consultation with The Bahamas, Executive Directors endorsed staff’s appraisal as follows:

The Bahamian economy has turned the corner but significant challenges remain. Near-term economic prospects are improving, with real GDP growth projected to reach 2½ percent in 2018, on the back of the phased opening of Baha Mar, a stronger U.S. economy, and a pickup in FDI. However, significant structural impediments require bold policy action to unlock medium-term growth. Public debt ratios have declined on the back of a sizable upward revision to nominal GDP, but fiscal deficits remain above debt-stabilizing levels. External reserve buffers have improved; however, the external position is weaker than the level suggested by fundamentals and desirable policy settings.

Fiscal consolidation, with a focus on reducing current expenditure, is critical to maintain market confidence and reverse the upward trend in the public debt-to-GDP ratio. The FY2018 target is within reach. However, measures still need to be identified to bring the deficit down to desirable levels while avoiding an undue compression of capital spending. The authorities should focus on i) trimming the wage bill; ii) turning SOE’s self-sufficient; and iii) reforming the unsustainable civil servants’ pension system. Addressing also imbalances at the National Insurance Board (NIB) should reduce fiscal contingent liabilities. The Bank of The Bahamas has strengthened its capital position, but it still requires a sustainable business model, free from political interference, to keep fiscal contingent liabilities contained.

Increased reliance on preparedness and risk reduction policies, including by setting up a natural disasters savings fund, should enhance fiscal and economic resilience. The Bahamas should create a savings fund with a target size between 2–4 percent of GDP, by setting aside ½ percentage point of GDP annually during non-disaster years. In addition, insuring public assets and encouraging the broader use of private insurance, including through financial literacy training and targeted subsidies, would reduce fiscal contingent liabilities. Investing in resilient infrastructure and maintaining up-to-date building codes, land use, and zoning guidelines are also critical elements of an adequate disaster risk management strategy.

The planned fiscal responsibility legislation is welcome. The framework should include a permanent ceiling of 1 percent of GDP on the fiscal deficit and a cap on the growth rate of current expenditure equal to the estimated long-run growth of nominal GDP. To allow space for automatic stabilizers to operate, annual budgets should target a deficit of ½ percent of GDP. Strong adherence to these targets over the medium term would keep debt on a firmly downward trajectory and would allow accumulating savings into a natural disasters fund. Completing ongoing reforms to the public financial management system is critical for the effectiveness of a medium-term fiscal framework.

The authorities should continue strengthening fiscal revenues with the intention to make the tax system more progressive; protect infrastructure and social spending; and offset a reduction in import duties under an eventual WTO accession. Introducing a zero-rate VAT for some items should be avoided as there can be better-targeted tools to assist low-income households.

Lifting growth in the medium term requires resolute implementation of structural reforms. Priorities include advancing energy sector reforms to improve the reliability of the electricity grid and reduce costs; streamlining administrative processes to improve the ease of doing business; expanding vocational and apprenticeship programs to help reduce skills mismatches and youth unemployment; and steadfast implementation of the credit bureau to improve access to credit.

Moving forward with the planned amendments to the central bank law would bring it closer to international best practices and would strengthen the peg’s credibility. The reduction in central bank lending to the government is welcome. The planned amendments, which include provisions to improve central bank governance; clarify its objectives; and tighten limits to central bank lending to the government, should lead to a more robust legislation.

Strong compliance with AML/CFT and tax transparency standards should help mitigate the withdrawal of CBR and safeguard the integrity of the financial sector. Steps to strengthen the AML/CFT framework and to comply with tax transparency standards, including by committing to implement the OECD’s international standards on tax transparency, are welcome. It is critical to work closely with the CFATF and the FATF to swiftly address the strategic deficiencies in the AML/CFT regime identified in the 2017 Mutual Evaluation Report (MER).

Source: International Monetary Fund

- 291 reads

Human Rights

Fostering a More Humane World: The 28th Eurasian Economic Summi

Conscience, Hope, and Action: Keys to Global Peace and Sustainability

Ringing FOWPAL’s Peace Bell for the World:Nobel Peace Prize Laureates’ Visions and Actions

Protecting the World’s Cultural Diversity for a Sustainable Future

Puppet Show I International Friendship Day 2020