IMF Executive Board Concludes 2018 Article IV Consultation with Malawi

On April 30, 2018, the Executive Board of the International Monetary Fund (IMF) concluded the Article IV consultation with Malawi. At the same time, the Board also approved a new three-year Extended Credit Facility Arrangement for Malawi and a press release on this was issued separately.

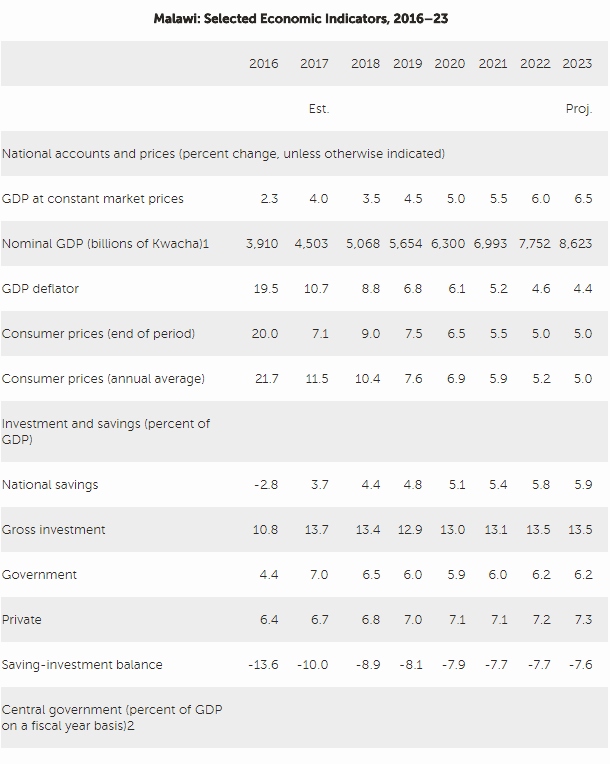

The economy recently rebounded from two years of drought. Growth picked up from 2.3 percent in 2016 to an estimated 4.0 percent in 2017 owing to a recovery in agricultural production. Inflation has been reduced below 10 percent—from high double digits in recent years—due to the stabilization of food prices, prudent fiscal and monetary policies, and a stable exchange rate. The current account deficit narrowed to 10.0 percent of GDP in 2017 from 13.6 percent in 2016, following lower maize imports and higher prices for some exports. The banking system remains stable though vulnerabilities have somewhat increased.

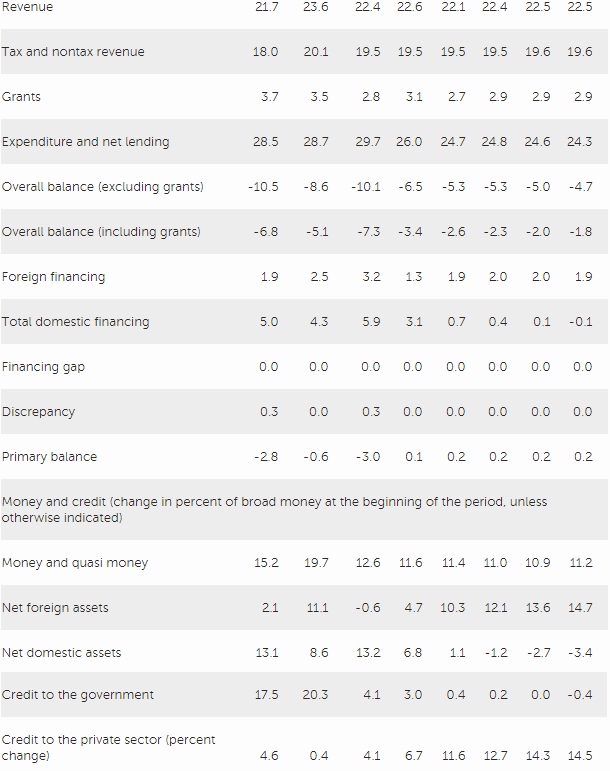

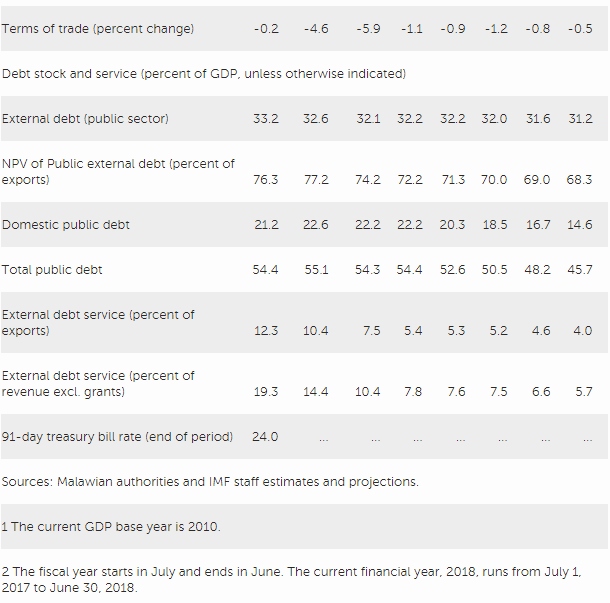

While the authorities regained control over the budget during FY16/17, this proved challenging during FY17/18. Revenue shortfalls and expenditure overruns, including the bailout of maize purchase loans by a parastatal exerted significant pressures on the budget. The authorities are implementing remedial measures to improve the fiscal position in FY18/19. These measures will also help contain public debt which has doubled over the last decade, reaching 55 percent of GDP in 2017, after the withdrawal of donor budget support, securitization of arrears, and recapitalization of the Reserve Bank of Malawi and two public commercial banks.

Economic growth is expected to increase gradually, reaching over 6 percent in the medium term. Growth will be supported by enhanced infrastructure investment and social services as well as an

improved business environment, which will boost confidence and unlock the economy’s potential for higher, more broad-based, and resilient growth and employment. Downside risks to growth include political pressures in the run-up to next year’s elections that could weaken policy discipline and reform efforts, weather-induced shocks, and declines in agricultural commodity prices.

Executive Board Assessment

“Executive Directors agreed with the thrust of the staff appraisal. They commended the authorities for achieving macroeconomic stability, and noted that economic activity has rebounded after two consecutive years of drought, driven by a recovery in agricultural production. However, growth has been insufficient to significantly reduce poverty or improve weak social indicators. Moreover, the fiscal position deteriorated in 2017 and public debt has doubled over the past decade. While the medium-term outlook is broadly favorable, risks and vulnerabilities remain.

“To address these challenges, Directors stressed the need for determined implementation of Malawi’s Growth and Development Strategy for 2018-23 and a strong commitment to the Fund-supported program under the Extended Credit Facility to entrench macroeconomic stability and ensure higher, inclusive and resilient growth. In this context, they urged the authorities to be mindful of political economy and capacity constraints faced in the past, and called for strong program ownership to achieve the ambitious growth and social-inclusion agenda.

“Directors underscored the importance of the authorities’ fiscal adjustment plans in maintaining macroeconomic stability. They noted that domestic debt rose sharply after the withdrawal of donor budget support, securitization of arrears, and bank recapitalization, raising the debt service burden and reducing space for much-needed infrastructure and social spending. Directors stressed the importance of improving debt management and broadening the coverage of domestic debt through enhancing data on state owned enterprises (SOEs).

“Directors cautioned against giving in to spending pressures in the run-up to the

2019 general elections and highlighted that increased spending efficiency will create room for more social spending and targeted infrastructure investment. Further, they emphasized the importance of prioritizing large investment projects, with concessional donor financing and private sector participation. Directors also underscored that public financial management and procurement reforms are necessary to address governance challenges and bolster donor confidence. Over the medium term, broad-based tax reforms will also foster a more efficient, transparent, and fair tax system.

“Directors encouraged greater exchange rate flexibility to cushion against external shocks.

They also highlighted the importance of strengthening the monetary policy framework and reducing fiscal dominance. Directors encouraged the authorities to strengthen banking supervision, while improving financial intermediation and access to finance.

“Directors emphasized that structural reforms are essential for growth, job creation, private sector development, economic diversification and resilience.

the need to improve the quality and coverage of critical infrastructure, reduce regulatory burdens, and streamline judicial processes. Deep agricultural market reforms would also ensure food security and ease the burden on the budget.

“It is expected that the next Article IV consultation with Malawi will be held in accordance with the Executive Board decision on consultation cycles for members with Fund arrangements.

Source: International Monetary Fund

- 216 reads

Human Rights

Ringing FOWPAL’s Peace Bell for the World:Nobel Peace Prize Laureates’ Visions and Actions

Protecting the World’s Cultural Diversity for a Sustainable Future

The Peace Bell Resonates at the 27th Eurasian Economic Summit

Declaration of World Day of the Power of Hope Endorsed by People in 158 Nations

Puppet Show I International Friendship Day 2020