IMF Executive Board Concludes 2018 Article IV Consultation with the Dominican Republic

On April 11, 2018 the Executive Board of the International Monetary Fund (IMF) concluded the Article IV consultation with the Dominican Republic, and considered and endorsed the staff appraisal without a meeting.

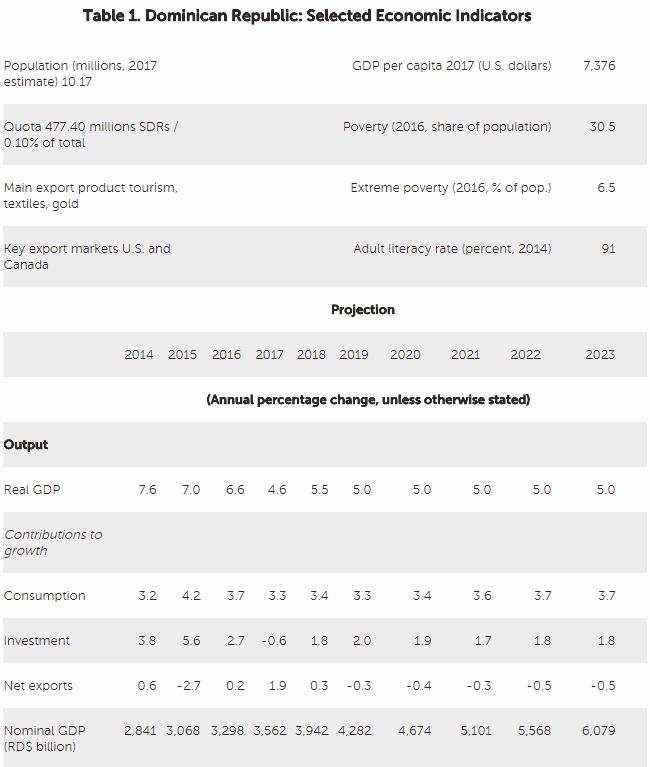

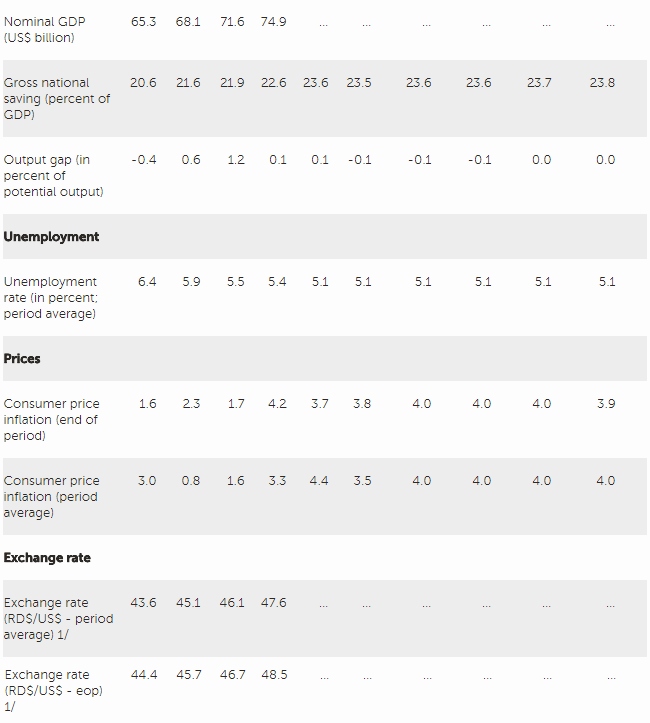

After three years of robust expansion, the economy moderated to close to its potential level. Economic activity is estimated to have expanded by 4.6 percent in 2017, following above-potential growth of 7.1 percent on average during 2014-16. The growth moderation was concentrated in the first three quarters of 2017 and was driven by a cyclical correction in domestic demand (especially investment), tighter financial conditions , uncertainty related to legislative reforms and economic disruptions caused by the close passage of two category five hurricanes in September 2017. More accomodative monetary policy and a rebound in activity following the hurricanes then contributed to a strong recovery in the last quarter of the year. Labor markets continued to improve with the recovery in employment and real wages over the past two years, and unemployment fell further to 5.1 percent, near historical lows. Headline inflation returned to the central bank’s 4±1 percent target band, and the external position strengthened significantly.

The economic outlook remains positive . The monetary easing in mid-2017 is expected to support a continued recovery in economic activity in 2018. Lower lending rates and stronger credit growth following the easing, combined with higher real wages and employment, are expected to continue to support domestic demand. Growth is expected to increase to 5.5 percent in 2018 and then to moderate to its medium-term potential rate of around 5 percent. Inflation is expected to remain within the central bank’s 4 +/- 1 percent target band, while the external current account deficit will gradually widen to its historical levels with higher oil prices and stronger domestic demand. However, risks around the outlook persist, with the main downside risks stemming primarily from external factors, including higher world oil prices, tighter-than-anticipated global financial conditions, and weaker-than projected external demand.

Executive Board Assessment

The timely policy response to the economic slowdown in early 2017 has put the economy back on an even keel. Economic activity and its projected growth are reverting to potential, inflation is within the central bank’s target, unemployment is near historical lows, and the external current account deficit has narrowed. The overall economic outlook remains positive but risks persist, with the main downside risks stemming from higher oil prices, weaker-than-projected external demand, and tighter-than-anticipated global financial conditions. In this context, the key challenge will be to build resilience to these risks by rebuilding policy buffers, reinvigorating structural reforms, and further reducing poverty and inequality.

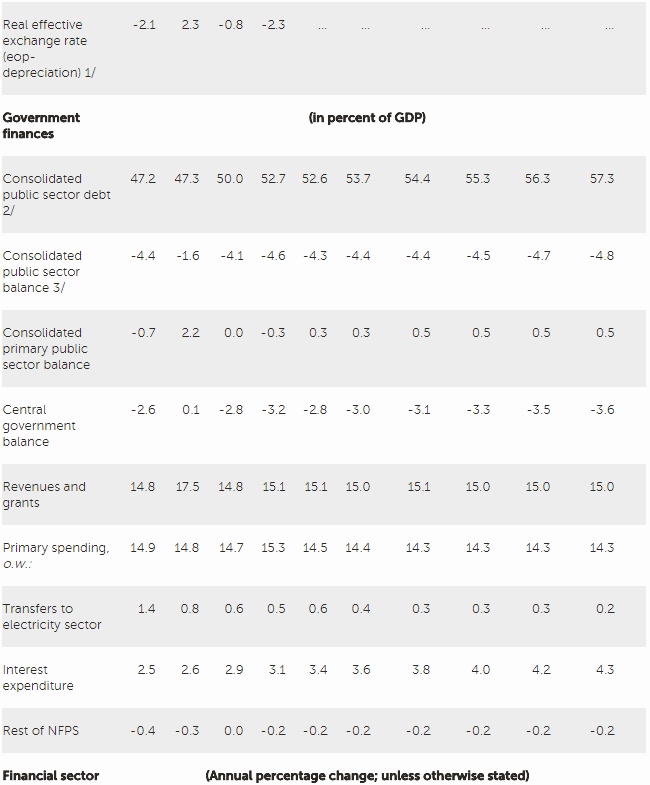

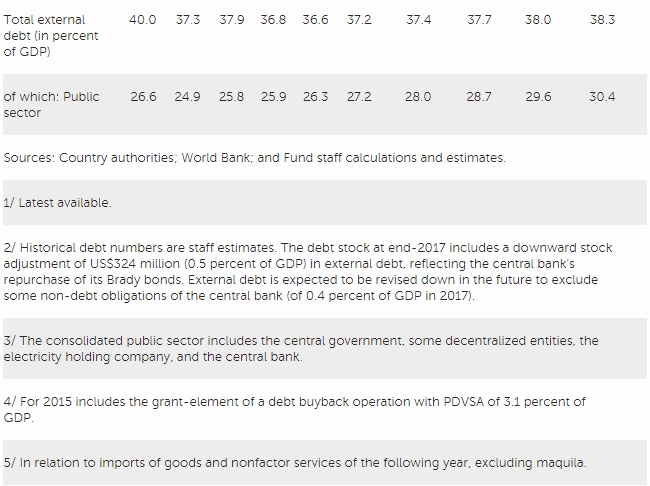

Despite welcome efforts to bolster the revenue base, more meaningful action will be required to strengthen the fiscal position. Favorable international financial conditions and strong growth in recent years have kept fiscal vulnerabilities at bay, but public debt continued to increase and the growing interest burden relative to a narrow revenue base is making debt less affordable. Welcome reforms to improve the debt profile and address weaknesses in tax and customs administration are yielding strong results, as evidenced by recent peso debt issuance in the global markets, narrowing bond spreads and increases in the tax base. However, these are not sufficient to offset structural spending pressures, especially in the face of tightening global financing conditions and increasing oil prices. A meaningful fiscal adjustment will be needed to rebuild the buffers and reverse the upward debt dynamic, but its design would need to be particularly mindful of its impact on growth, poverty and inequality. The adjustment should focus on widening the tax base (including through streamlining of tax incentives and exemptions), simplifying the tax system, and rationalizing inefficient expenditures, while prioritizing fiscal space towards increasing public investment and social spending to protect the most vulnerable.

Strengthening the fiscal policy framework should support efforts to improve the fiscal position. A medium-term fiscal framework, which would anchor fiscal policy decision-making in longer-term debt sustainability objectives, would reduce policy uncertainty and strengthen its credibility with the markets. Ongoing efforts to develop such a framework are welcome. Reforms to enhance transparency in the public procurement processes, strengthen public financial management practices and align public statistics with international norms will further contribute to increase policy transparency and predictability, and should be supplemented by wider coverage and timeliness of fiscal statistics.

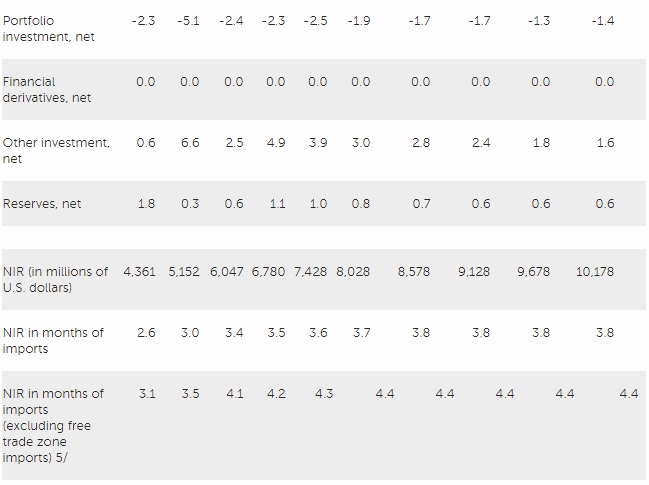

The neutral monetary policy stance with a tightening bias is consistent with current economic conditions. The neutral stance should help maintain output close to potential and inflation within the central bank’s target, but tighter monetary policy may be required if inflation rises faster than expected. The central bank’s inflation targeting framework has contributed positively to price stability and would be further enhanced through greater exchange rate flexibility, which would increase resilience to external shocks by providing an automatic adjustment mechanism. The external position is moderately stronger than warranted by medium-term fundamentals and desirable policy settings, but is expected to realign over the medium term with the projected recovery in private domestic demand, especially as structural reforms to improve the investment environment and social outcomes take hold. Its continued strength in the near-term provides an important opportunity to continue building reserve buffers, which have strengthened considerably since the 2003–04 financial crisis.

Perseverance with efforts to strengthen financial sector oversight will enable the financial system to continue supporting strong and inclusive growth. Reforms put in place in the fifteen years since the financial crisis have supported a recovery in the health of the financial system, which compares favorably to regional peers. The ongoing emphasis on strengthening oversight over systemic macro-financial risks will further contribute to financial stability, especially as information on household and firm indebtedness is developed, and as the macroprudential policy framework is finalized to enhance policy flexibility to respond to systemic risks. Continued efforts to improve prudential regulation and supervision will complement these reforms, with the objective of fully aligning the regulatory and supervisory framework with international best practice. Remaining gaps in the supervisory periphery, including the oversight of the largest nonbank institutions, should be filled. Finally, efforts to strengthen the anti-money laundering framework are welcome, with its effective implementation important to promoting integrity in the financial system.

Growth- and socially-oriented structural reforms will be important to enhancing the economy’s growth potential and addressing remaining social challenges. The authorities’ ongoing reforms to strengthen the doing-business environment and improve outcomes in health, education and infrastructure, as well as to advance the reform agenda for the electricity sector, are welcome and will help to boost the economy’s growth potential. The challenge will be to complement these efforts with concrete and immediate policy actions to sustainably reform the electricity sector, and with more ambitious reforms to reduce high transportation costs, simplify the tax system and strengthen the institutional environment. Reforms to widen the coverage of social security and ensure an adequate retirement income will be important to strengthen social outcomes. A stronger fiscal position would also contribute to improved social outcomes by easing pressures on financial resources and interest rates, and providing space to refocus spending towards social safety nets and infrastructure.

Source: International Monetary Fund

- 310 reads

Human Rights

Fostering a More Humane World: The 28th Eurasian Economic Summi

Conscience, Hope, and Action: Keys to Global Peace and Sustainability

Ringing FOWPAL’s Peace Bell for the World:Nobel Peace Prize Laureates’ Visions and Actions

Protecting the World’s Cultural Diversity for a Sustainable Future

Puppet Show I International Friendship Day 2020