Executive Board Concludes 2018 Article IV Discussions with Cabo Verde

On March 26, 2018, the Executive Board of the International Monetary Fund (IMF) concluded the 2018 Article IV consultation with Cabo Verde.

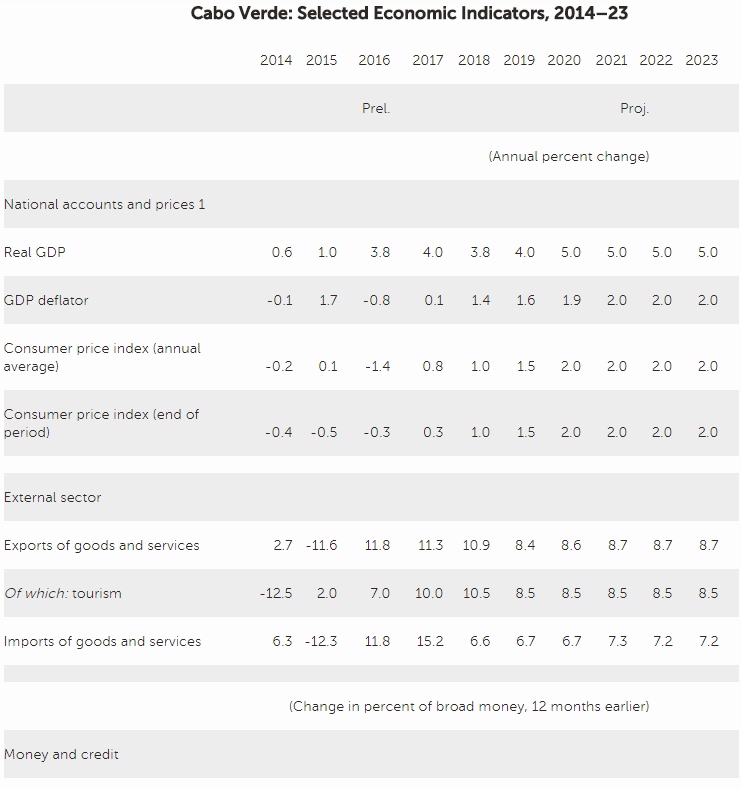

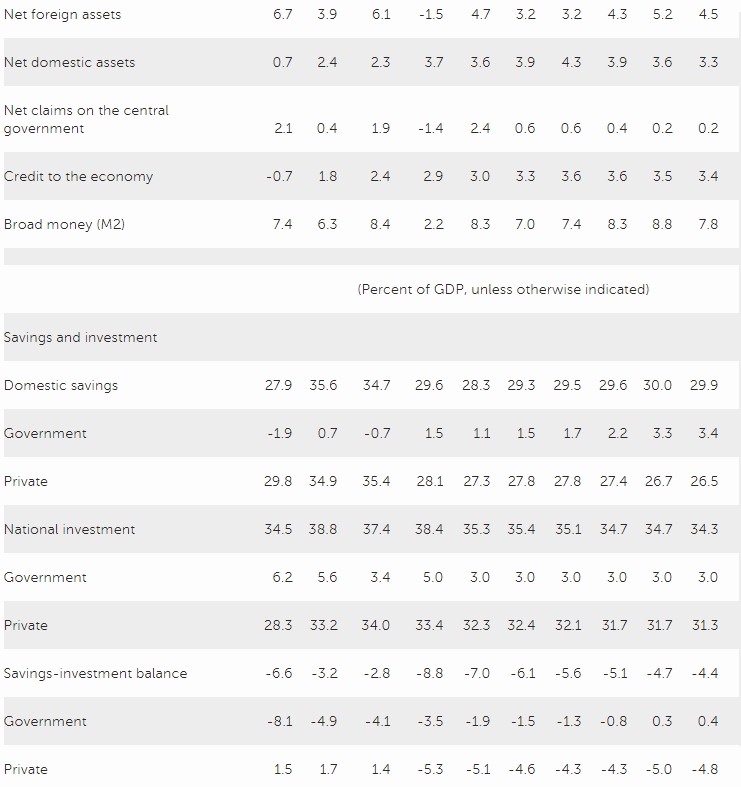

The economic recovery is gaining momentum, reflecting a more favorable external environment and the payoff of ongoing economic reforms. In 2017, the economy is estimated to have expanded by 4 percent supported by the double digit-growth in tourist arrivals, the recovery in credit to the private sector, and stronger consumer and business confidence. These factors are expected to boost growth further to 4.3 percent in 2018. Over the medium term, real GDP growth is projected to stabilize at around 4 percent. Average inflation turned positive (0.8 percent) in 2017, reflecting the increase in energy prices. The current account deficit is estimated to have widened to 8.8 percent of GDP as the higher tourism receipts were more than offset by the rapid increase of imports, partly owing to higher oil prices, and a decline in remittances; and was mostly financed by FDI.

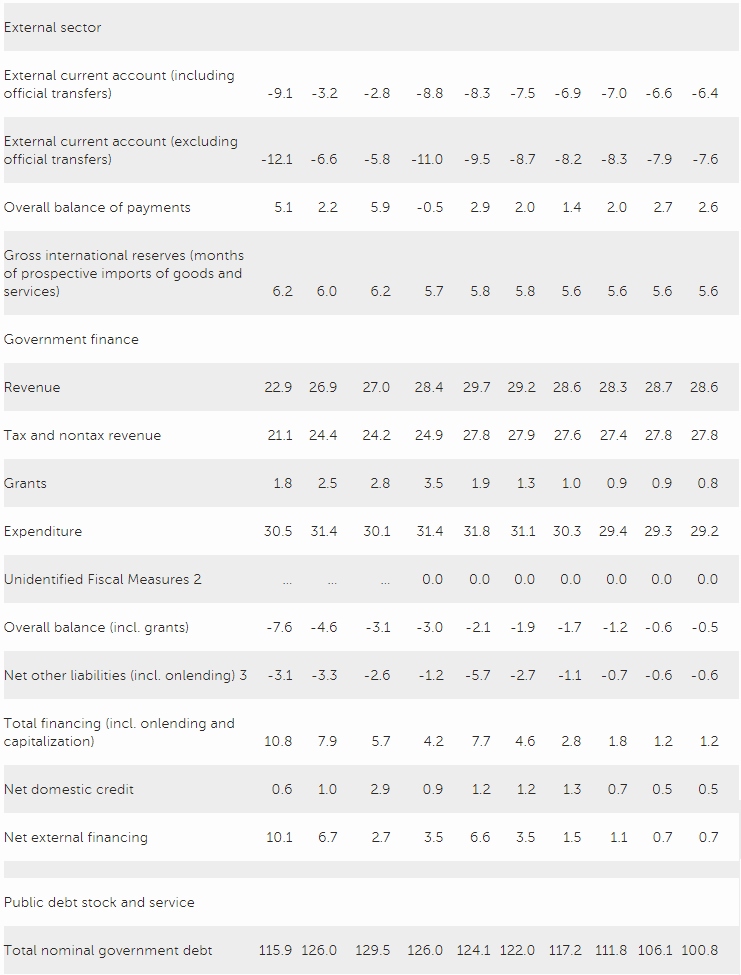

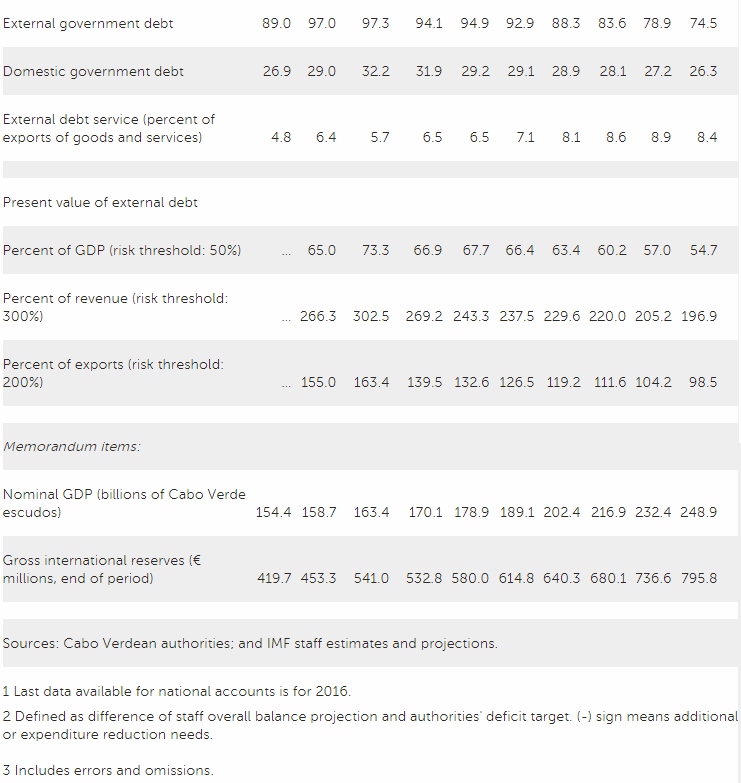

Cabo Verde achieved an impressive fiscal consolidation in recent years. In 2017, the budget deficit is estimated to have narrowed to 3 percent of GDP from 3.1 percent in 2016, and public debt to have declined to 126 percent of GDP from 129.5 percent, the first decline in a decade. The 2018 budget targets a deficit target of 3.1 percent of GDP.

Citing the absence of price pressures and adequate reserve levels, the Banco de Cabo Verde’s (BCV) cut its policy rate by 200 basis points to 1.5 percent in June, 2017. The response of credit to the economy to the monetary stimulus has been sluggish but it is now recovering, reaching 5.3 percent annual growth in November, 2017. Financial stability indicators have improved but the level of non-performing loans (NPLs) remains elevated.

Executive Board Assessment

Executive Directors agreed with the thrust of the staff appraisal. They welcomed Cabo Verde’s ongoing economic recovery, reflecting a more favorable external environment and the payoff of recent economic reforms. They agreed that the medium-term outlook is broadly stable, conditional on a decisive implementation of the authorities’ reform agenda. They stressed that the current favorable external conditions present an opportunity to accelerate reforms to address vulnerabilities and make progress toward the goal of promoting higher and inclusive growth.

Directors commended the substantial fiscal consolidation of recent years. They encouraged the authorities to sustain and deepen the adjustment efforts through a combination of revenue and expenditure measures to reduce the high level of public debt. This will help lower the risk of external debt distress, safeguard macroeconomic and financial stability, and support economic growth in the medium term. Directors also called for accelerating the restructuring of loss-making state-owned enterprises to eliminate their need for government support, and for strengthening fiscal institutions.

Directors agreed that the monetary policy stance of the Banco de Cabo Verde (BCV) has been appropriate in the absence of pressures on inflation or reserves, and consistent with the objective of protecting the currency peg. Nonetheless, they urged the BCV to remain vigilant as economic conditions evolve. They welcomed the measures adopted to strengthen the monetary policy transmission mechanism, and encouraged the BCV to step up efforts to enhance its liquidity management capacity and reduce the high level of excess liquidity in the banking system.

Directors welcomed the improvement in financial stability indicators. Nonetheless, they urged the authorities to give priority to the resolution of the high level of legacy nonperforming loans. Directors agreed that fostering financial intermediation is important to strengthen the role of the private sector as the engine of growth. They recommended focusing reforms on strengthening collateral repossession and improving the credit information system.

Director agreed that the loss of correspondent banking relationships represents a vulnerability, given Cabo Verde’s reliance on migrant remittances and deposits. They urged the authorities to continue to strengthen the AML/CFT framework in line with international standards and to cooperate effectively with other jurisdictions on tax issues.

Directors welcomed the authorities’ Strategic Plan for Sustainable Development to improve the business environment and build on the progress in improving governance and fighting corruption. They underscored that steady implementation of structural reforms is critical to boost potential output growth and reduce poverty. To increase productivity and address the high levels of youth and female unemployment, priority should be given to improving the efficiency and flexibility of the labor market, as well as the quality and relevance of education. Strengthening and better targeting social protection programs would also be important.

It is expected that the next Article IV consultation with Cabo Verde will be held on the standard 12-month cycle.

Source: International Monetary Fund

- 302 reads

Human Rights

Fostering a More Humane World: The 28th Eurasian Economic Summi

Conscience, Hope, and Action: Keys to Global Peace and Sustainability

Ringing FOWPAL’s Peace Bell for the World:Nobel Peace Prize Laureates’ Visions and Actions

Protecting the World’s Cultural Diversity for a Sustainable Future

Puppet Show I International Friendship Day 2020