IMF Executive Board Concludes 2017 Article IV Consultation with Papua New Guinea

On December 1, 2017, the Executive Board of the International Monetary Fund (IMF) concluded the Article IV consultation with Papua New Guinea.

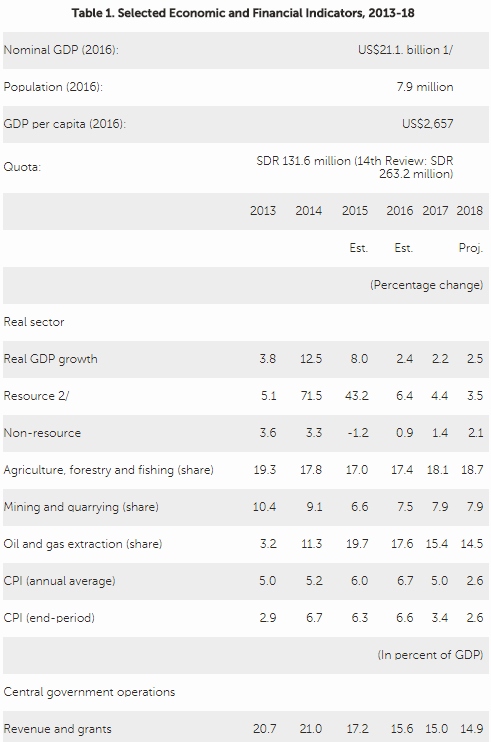

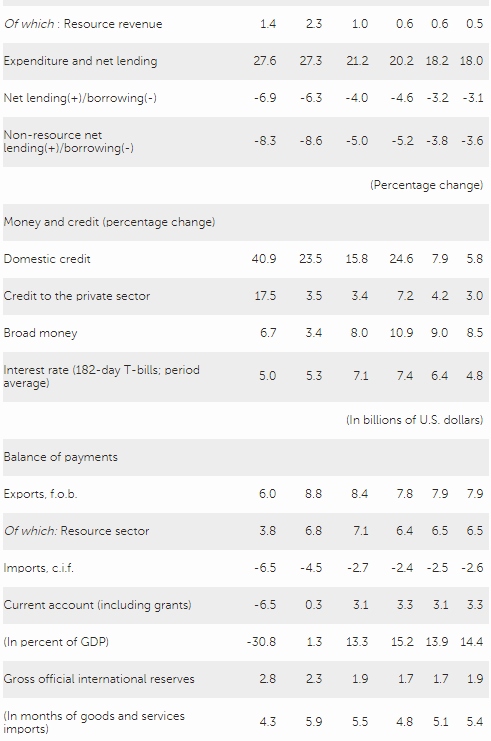

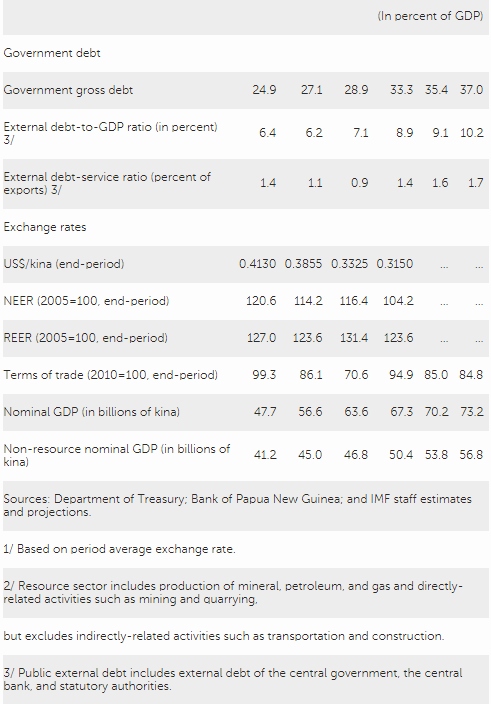

In 2015-16, growth of the Papua New Guinea (PNG) economy slowed sharply, to under 3 percent, in response to falls in major export commodity prices, the completion of the huge PNG LNG pipeline project, and a severe drought, and in 2017 economic activity has remained subdued. Slow growth, generous tax treatment of the LNG project, the drought and weak tax administration have all contributed to declining tax revenues and a substantial fiscal deficit and increasing debt-to-GDP ratio. Inflation was boosted to over 6 percent by drought effects, but is beginning to ease. Although PNG is running a large current account surplus, it is also experiencing large financial account outflows related to project debt repayments, resulting in a shortage of foreign exchange (FX). FX reserves have declined gradually to around $1.7 billion (covering 5 months of imports).

A new government, elected in July, is keen to address the immediate fiscal challenges as well as longer-term structural reform, and introduced a Supplementary Budget in September with bold measures to ensure a narrowing of the fiscal deficit. Nonetheless, on unchanged fiscal and monetary policies, PNG faces several more years of economic stagnation, with a growing risk of fiscal and financial instability as the debt-to-GDP ratio continues to rise and financing of deficits becomes increasingly difficult. In the absence of any major new resource project to spur investment, and with domestic activity depressed by FX shortages and import compression, the outlook is for growth to remain under 3 percent, while inflation continues to ease.

Near-term risks to the outlook are tilted to the downside, reflecting the potential for fiscal deficit financing difficulties to force a sharp consolidation, together with increasing distortions associated with the FX shortage. Over the medium term, risks are more balanced owing to the upside potential of new resource sector projects and, possibly, a pickup in commodity export prices.

Executive Board Assessment

Executive Directors noted that weak prices for major export commodities, a severe drought, and the end of a major investment project have led to weak growth since 2016, with adverse effects on the fiscal balance. Large financial account outflows related to project debt repayments have contributed to a shortage of foreign exchange. In these circumstances, Directors recommended that decisive steps be taken to strengthen Papua New Guinea’s fiscal and balance of payments positions.

Directors underlined that a strong commitment to fiscal consolidation over the medium term is essential to reduce the debt-to-GDP ratio and lower the risk of debt distress. They welcomed steps taken by the authorities in 2017 to reduce the deficit. Going forward, fiscal consolidation should involve expenditure measures, including streamlining public sector employment and payroll as well as prioritizing spending on education, health care and infrastructure. The implementation of a medium-term strategy to increase revenues is also important to support higher and more inclusive growth.

Directors stressed that increased exchange rate flexibility is needed to address the foreign exchange shortage and to offset the output effects of fiscal consolidation. They recommended a gradual approach to exchange rate adjustment and flexibility to balance the impact on inflation in the short run.

Directors encouraged the authorities to implement structural reforms to strengthen Papua New Guinea’s non-resource sectors. They noted that key elements of the development strategy needed to include measures to ensure that Papua New Guinea benefits more substantially from its natural wealth.

Directors welcomed improvements in macroeconomic statistics, but encouraged further efforts to improve data completeness, timeliness and accuracy. They also encouraged the authorities to continue to improve the effectiveness of the AML/CFT framework.

Source: International Monetary Fund

- 390 reads

Human Rights

Fostering a More Humane World: The 28th Eurasian Economic Summi

Conscience, Hope, and Action: Keys to Global Peace and Sustainability

Ringing FOWPAL’s Peace Bell for the World:Nobel Peace Prize Laureates’ Visions and Actions

Protecting the World’s Cultural Diversity for a Sustainable Future

Puppet Show I International Friendship Day 2020