IMF Executive Board Concludes 2017 Article IV Consultation with the Republic of Tajikistan

On November 03, 2017, the Executive Board of the International Monetary Fund (IMF) concluded the Article IV consultation with the Republic of Tajikistan.

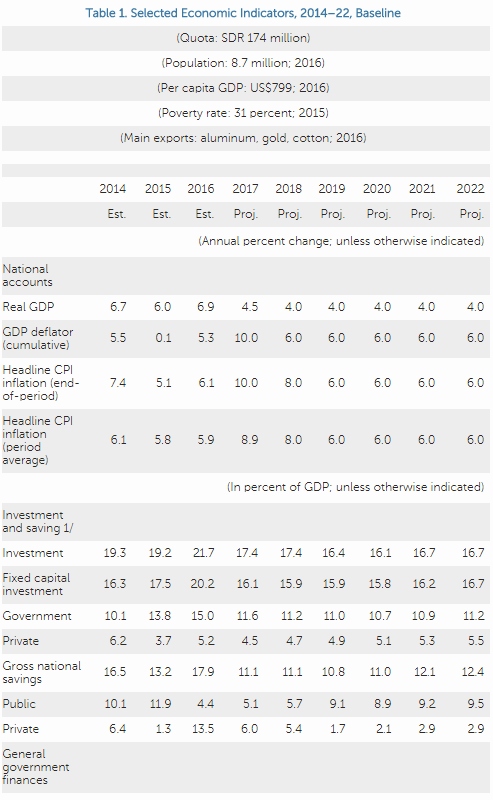

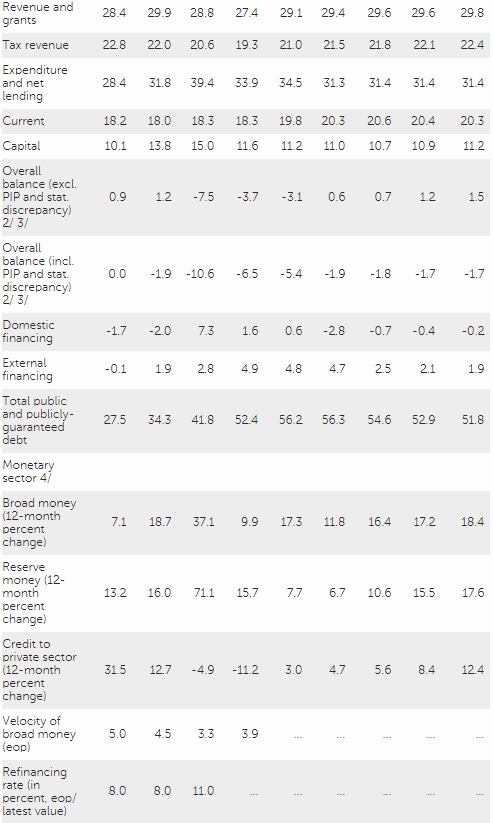

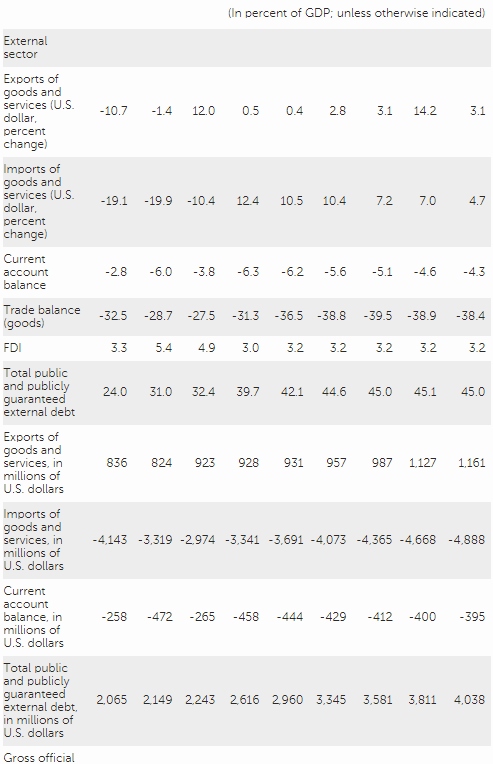

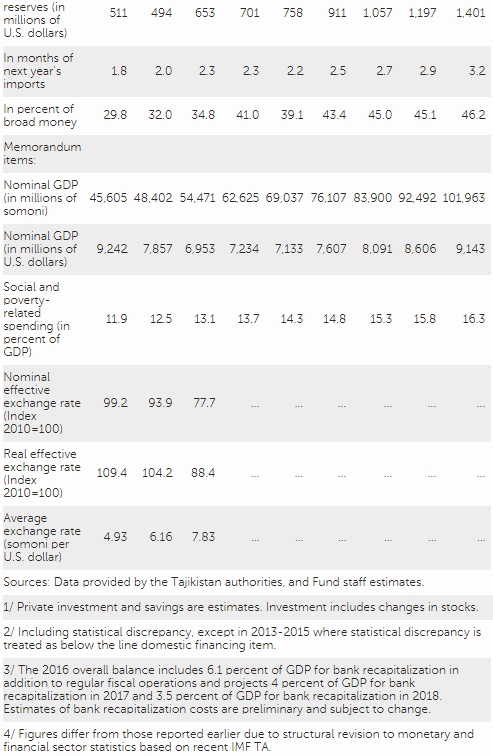

In the past few years economic activity in Tajikistan was strong, despite large external shocks that weakened the external position and exposed vulnerabilities. While remittances declined by 45 percent in nominal USD terms in 2015-16, real GDP growth was 6-7 percent supported by an expansionary fiscal policy that boosted investment in construction and industry and informal sector activity. Inflation remained low. The current account deficit widened from 2.8 percent in 2014 to 6 percent of GDP in 2015 before narrowing to 3.8 percent of GDP in 2016. End-2016 reserves provided 2.3 months of import cover. Public debt increased to nearly 42 percent of GDP. The sharp decline in remittances resulted in a large depreciation against the dollar, which in turn led to a significant escalation in banking sector stress owing to short open foreign exchange (FX) positions and FX lending to unhedged borrowers. By end-2016, nonperforming loans (overdue more than 30 days) in the banks rose to 54 percent, profitability fell, capital adequacy deteriorated and the two largest banks became insolvent and illiquid. Private sector credit declined in 2016.

Following robust growth in 2016, the macroeconomic outlook for Tajikistan is expected to be generally weaker this year and beyond. Growth is projected to decrease to 4.5 percent in 2017 and decline further to 4 percent in 2018 due to fiscal consolidation and credit contraction. Banks have made progress in reducing nonperforming loans to 48.8 percent at end-September. The authorities target a decline in the overall budget deficit (including the Public Investment Program and excluding bank recapitalization) of two percentage points of GDP, mainly by reining in capital spending. Staff projects a higher budget deficit mostly due to the need for additional bank recapitalization. The external current account deficit is projected to widen to 6.3 percent of GDP, reflecting the liquidity created by the bank recapitalization and imports for a large energy project.

Risks stem from potential delays in structural reforms, particularly in the banking sector or state-owned enterprises, which would hurt confidence and have an adverse impact on growth. Slower growth in emerging markets would reduce remittances, loans, and FDI. Tajikistan’s risk of external debt distress has increased from low to high suggesting heightened fiscal vulnerabilities to adverse shocks.

Executive Board Assessment

Executive Directors agreed with the thrust of the staff appraisal. They commended the authorities’ response to external shocks since 2014, including allowing exchange rate flexibility and convergence, containing the government wage bill, raising the liquidity support interest rate, implementing measures to preserve financial stability, and accumulating international reserves. Nevertheless, they noted that the Tajik economy continues to face vulnerabilities, which requires maintaining a prudent macroeconomic policy stance, building fiscal and external buffers, and stepping up reforms, especially in the banking sector.

Directors welcomed the steps taken by the authorities to repair the financial sector and strengthen banking supervision, but stressed that more decisive action is needed to address longstanding weaknesses in the sector. They noted that the bailout of the two large banks has appropriately been complemented with rehabilitation plans to improve their financial positions, and that two of the smaller banks that were determined to be unviable were liquidated. Nonetheless, deeper and more urgent reforms are needed, based on an assessment of the banks’ viability. Plans to resolve these banks should be time-bound, protect the public finances, and ensure equitable treatment of creditors. Directors stressed that legislation on bank resolution and emergency liquidity assistance needs to be strengthened, and weaknesses in other banks should be addressed promptly to help ensure financial stability and maintain depositor confidence.

Directors called for a careful implementation of fiscal and monetary policy to ensure macroeconomic stability. They emphasized that fiscal consolidation and concessional financing would reduce the risk of debt distress and help rebuild policy space. Expansion of the tax base and cuts in non-priority expenditure while protecting critical social outlays will be important. Disciplined implementation of the 2017 budget would be a welcome start to this consolidation. Directors also noted that a further tightening of monetary policy, including limiting the use of central bank credit to finance public investment projects, would help contain inflationary pressures.

Directors agreed that sustained and strong implementation of structural reforms, accompanied by prudent macroeconomic policies, would result in higher and more job-rich growth in the medium term. Maintaining exchange rate flexibility and strengthening the monetary policy framework will help support competitiveness, while paving the way for a transition to inflation targeting. Directors underscored that ambitious reforms to improve bank governance and performance, upgrade the financial regulatory and supervisory framework, clarify the tax code and tax administration, enhance SOE oversight and accountability, boost the efficiency of public spending, create a better business environment, and bolster anti-corruption efforts would lift growth significantly over the medium term. Directors also encouraged further development of Tajikistan’s AML/CFT framework.

It is expected that the next Article IV consultation with the Republic of Tajikistan will be held on the standard 12-month cycle.

Source: International Monetary Fund

- 376 reads

Human Rights

Fostering a More Humane World: The 28th Eurasian Economic Summi

Conscience, Hope, and Action: Keys to Global Peace and Sustainability

Ringing FOWPAL’s Peace Bell for the World:Nobel Peace Prize Laureates’ Visions and Actions

Protecting the World’s Cultural Diversity for a Sustainable Future

Puppet Show I International Friendship Day 2020