IMF Executive Board Concludes 2017 Article IV Consultation with the Philippines

On October 26, 2017, the Executive Board of the IMF concluded the Article IV consultation with the Philippines, and considered and endorsed the staff appraisal without a meeting.

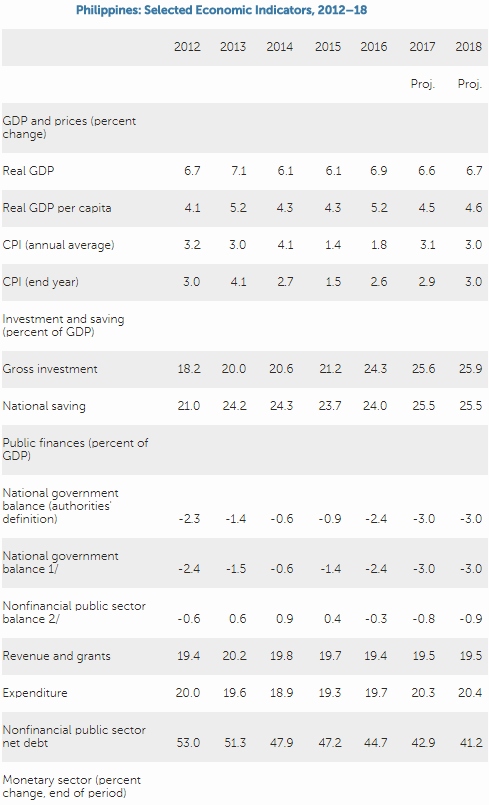

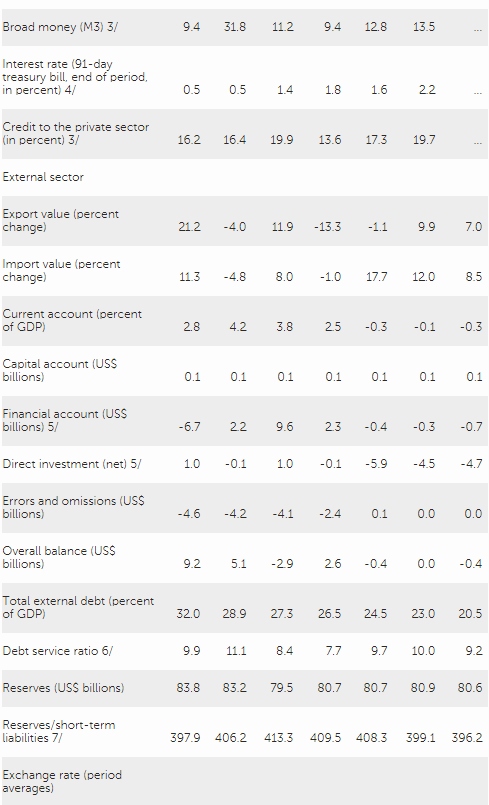

The Philippine economy has continued to perform well. Real GDP growth reached 6.9 percent in 2016 and 6.4 percent in the first half of 2017, led by robust domestic demand, a recovery in exports, and a fiscal impulse. Headline and core inflation have remained near the center of the target band (3±1 percent) in 2017, reflecting stable commodity prices and a near zero output gap. The unemployment rate remains low at 5.5 percent. The external and fiscal positions are robust, with the current account balance near zero, gross international reserves at US$81 billion (or 8.7 months of imports of goods and services), the national government deficit at 2.4 percent of GDP, and the general government net debt at 34.6 percent of GDP.

The outlook for the Philippine economy is favorable despite external headwinds. Real GDP growth is projected at 6.6 percent in 2017 and 6.7 percent in 2018, owing to continued robust domestic demand. Inflation is expected to stay near the center of the Bangko Sentral ng Pilipinas’s (BSP) target band due to stable commodity prices and well-anchored inflation expectations. The current account balance is projected to record a small deficit in 2017, because of strong infrastructure-related import growth. Public debt is expected to fall further as percent of GDP. Risks to the outlook are tilted to the downside, but the Philippines is well equipped to respond should risks materialize given its strong fundamentals and available policy space.

Executive Board Assessment

In concluding the 2017 Article IV consultation with the Philippines, Executive Directors endorsed staff’s appraisal, as follows:

The strong performance of the economy has continued, with rapid economic growth and low inflation. Economic growth is projected to remain high, supported by robust domestic demand, while inflation is expected to remain near the center of the target band. However, credit growth has accelerated, and although most indicators find no evidence of credit booms so far, some indicators suggest that credit gaps could approach early warning levels in 2017–18.

Risks to the outlook are tilted to the downside and stem mainly from external sources. The combination of high credit growth, buoyant private investment, and fiscal expansion without tax reform could lead to overheating of the economy. On the upside, approval of the first tax reform package would lead to a sustainable increase in infrastructure investment. The Philippines is well equipped to respond if risks materialize given its strong fundamentals and available policy space.

The external sector remains moderately stronger than warranted by fundamentals and desirable policies. The CAB remains above its estimated norm, largely due to inadequate infrastructure, and the gap is expected to close over time as infrastructure is upgraded. The undervaluation of the REER is estimated between zero and 4 percent, considering the estimated CAB gap and the structural impediments to investment. Foreign reserves remain sizable, but this is broadly justified by the country’s exposure to natural disaster and capital flow volatility.

This setting provides a good opportunity for the authorities to pursue their inclusive growth agenda. Despite the strong economic growth in the recent years, poverty and inequality remain high and the country needs to create jobs for its young and growing population. Sustaining the growth momentum in an uncertain and volatile external environment requires protecting policy anchors, adapting policies to changing conditions, and maintaining vigilance against risks.

Staff supports the authorities’ plans to gradually scale up productive infrastructure and targeted social spending, while keeping a broadly neutral fiscal stance. Staff supports the authorities’ ambitious development agenda, but recommends calibrating fiscal policy to balance against the risk of overheating. The increase in priority spending should be financed through additional revenue mobilization, including by widening the tax base, so that the fiscal stance remains broadly neutral. Avoiding procyclicality in fiscal policy would require a tighter fiscal stance if economic growth is stronger than expected. Staff also supports the 3 percent of GDP national government deficit ceiling, which would reinforce policy credibility and keep the general government net debt on a stable path.

Staff welcomes the first tax reform package designed to create additional fiscal space, and encourages the authorities to consider additional revenue measures. The ambitious development agenda depends on a series of comprehensive tax reforms that could create additional fiscal space. Staff appreciates the breadth of the envisaged tax reforms, but cautions that reform efforts may have a lower revenue yield than originally projected because of dilution in Congress. Accordingly, staff encourages the authorities to consider lowering the threshold for PIT, raising the VAT rate, rationalizing tax concessions and exemptions, and accelerating the implementation of new excises on automobiles and petroleum products.

The stance of monetary policy remains appropriate, but the BSP should be ready to tighten if there are signs of overheating. The authorities’ intention to unwind the high banks’ reserve requirements over time would reduce macrofinancial risks. However, this reform should be carefully calibrated and timed, and should aim to keep domestic liquidity broadly unchanged. The exchange rate should continue to move freely in line with market forces, with foreign exchange intervention limited to smoothing excessive volatility in both directions.

The main systemic risks to financial stability are high credit growth and concentration. High credit growth, especially to the real estate and household sectors, merit continued monitoring. In addition, some conglomerates and real estate developers have leveraged significantly, while shadow-banking activities have expanded. The conglomerate structure and data gaps generates challenges to measure concentration but capital market development could help reduce bank loan concentration by diversifying the sources of funding for large conglomerates. Staff supports the authorities’ efforts to have legal access to information on conglomerates’ finances.

Macroprudential policies should be used to address systemic risks to financial stability. In case of a broad-based credit boom, the BSP should raise capital requirements, supported by monetary policy tightening if accompanied by overheating. Targeted macroprudential policies should be used if sectoral credit growth is excessive. Staff welcomes the early adoption of the Basel III guidelines on banks, and the role of the new financial stability department at the BSP in mainstreaming macrofinancial surveillance and strengthening the macroprudential framework.

The financial stability framework would greatly benefit from amendments of the BSP Charter. The Charter should be amended to better serve the needs of a modern financial sector and economy. Staff supports the proposed revisions that (i) introduce a financial stability mandate; (ii) extend the supervisory perimeter; (iii) establish legal protection for supervisors; (iv) increase the BSP’s capital; and (v) allow the BSP to issue its own securities.

Staff supports ongoing reforms aimed at lowering poverty and maximizing the demographic dividend. The authorities are appropriately focusing on investing in infrastructure and human capital, reducing regional disparities, eliminating quantitative restrictions in rice imports, and improving access to finance including through capital market development. Regulatory reforms to reduce the costs of doing business and openness to foreign investment would help promoting domestic competition.

Staff welcomes the recent amendment to the AML law to include casinos. Notwithstanding this notable progress, the AML/CFT framework could be strengthened further by amending the bank secrecy law and making tax evasion a predicate crime.

Source: International Monetary Fund

- 420 reads

Human Rights

Fostering a More Humane World: The 28th Eurasian Economic Summi

Conscience, Hope, and Action: Keys to Global Peace and Sustainability

Ringing FOWPAL’s Peace Bell for the World:Nobel Peace Prize Laureates’ Visions and Actions

Protecting the World’s Cultural Diversity for a Sustainable Future

Puppet Show I International Friendship Day 2020