IMF Executive Board Concludes 2017 Article IV Consultation with The Bahamas

On September 8, 2017, the Executive Board of the International Monetary Fund (IMF) concluded the Article IV consultation with The Bahamas.

Economic activity remained weak in 2016. Hurricane Matthew, which hit The Bahamas in October last year, significantly impacted tourism activity in 2016 and early 2017. However, completion of the mega resort Baha Mar and post-hurricane reconstruction activity provided a boost to job creation with the unemployment rate declining to 9.9 percent in May 2017 (down from 11.6 percent in November 2016). The opening of Baha Mar in April increased employment further by creating 2,000 new jobs in the three months to July. Inflation remains low and stable.

The central government fiscal deficit is estimated to have reached 5.7 percent of GDP for the fiscal year ending in June, 2017, up from 3½ percent of GDP in FY2016, due to sharp increases in the wage bill, post-hurricane cleanup and reconstruction spending, temporary tax reliefs, and disruptions in revenue collection. The central government debt-to-GDP ratio is estimated to have increased to 73 percent of GDP in FY2017.

Commercial banks remain liquid and well capitalized. As of March, 2017, the average capital adequacy ratio stood at 27.8 percent, well above the regulatory requirement of 17 percent and liquid assets represented 25.6 percent of total assets. Nonperforming loans (NPLs) declined to 11.1 percent of total loans, down from 14.2 percent in 2015. However, banks have maintained a cautious lending attitude in an environment of low growth. Consequently, the total stock of credit to the private sector has remained flat.

Real GDP growth is projected to pick up to 1¾ percent in 2017 and to 2½ in 2018, driven by a stronger U.S. economy, the phased opening of Baha Mar, and related construction activity. Post-hurricane reconstruction and a pickup in FDI-financed investment should also support the recovery. However, medium-term growth would remain low, reflecting significant structural bottlenecks.

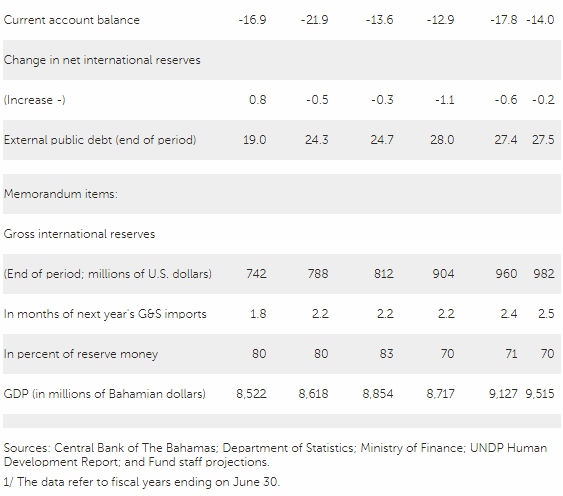

The current account deficit is estimated to have declined to 12.9 percent of GDP in 2016, down from 13.6 percent of GDP a year earlier, reflecting lower oil prices and a temporary increase in current transfers associated with payments of re-insurance claims from Hurricane Matthew. However, the deficit is expected to widen to 17¾ percent of GDP this year due to a surge in Baha Mar-related imports of goods and services to complete the resort. Over the medium term, the current account deficit is projected to narrow to 7.1 percent of GDP but would still be weaker than the level consistent with fundamentals and desirable policy settings.

Executive Board Assessment

Executive Directors welcomed the expected pick up in near‑term growth, driven by a stronger U.S. economy and the phased opening of the mega resort Baha Mar. However, they noted that the economy continues to face significant challenges, including from structural bottlenecks and rising public debt. Directors welcomed the authorities’ strong commitment to fiscal discipline and agreed that continued strong fiscal consolidation and monetary and financial sector policies, as well as deeper structural reforms are necessary to generate stronger growth, improve competitiveness, tackle unemployment, and enhance resilience to natural disasters. Directors expressed solidarity with countries, including The Bahamas, that are bracing for or grappling with the impacts of Hurricane Irma.

Directors emphasized that restoring fiscal sustainability is a top priority. They encouraged the authorities to adhere to their fiscal consolidation plan to reduce the public debt burden and strengthen external buffers. Directors underscored that the consolidation effort should focus on cutting current expenditures, in particular, reducing the wage bill and making state‑owned enterprises self‑sufficient. They also underscored that reforming the National Insurance Board and the civil servants’ pension system, should support fiscal adjustment and reduce long‑term fiscal risks.

Directors commended the authorities’ efforts to strengthen fiscal revenues. They highlighted that introducing a low‑rate income tax over the medium‑term would help make the system more progressive and protect the needed infrastructure and social spending. Directors advised against introducing exemptions from VAT and instead recommended taking advantage of the planned expenditure review to create space for better‑targeted tools to protect vulnerable households.

Directors noted that adopting a fiscal rule, as part of a medium‑term fiscal framework, should enhance fiscal discipline. To further strengthen fiscal and economic resilience, Directors also recommended integrating into the fiscal framework a well‑designed savings arrangement as an additional buffer against recurring natural disaster shocks. They also underscored that finding a permanent solution for the Bank of Bahamas is necessary to reduce fiscal contingencies.

Directors called for a faster resolution of nonperforming loans to strengthen financial stability and support the economic recovery. They also noted that strong compliance with AML/CFT and tax transparency standards should help stem the withdrawal of correspondent banking relationships. Directors recommended reducing central bank holdings of government bonds to strengthen the credibility of the peg and support financial stability.

Directors emphasized that stronger reforms are needed to improve competitiveness and lift medium‑term growth. They encouraged the authorities to move forward with the introduction of a credit bureau, step up efforts to reform the energy sector, streamline administrative processes to improve the business environment, and reduce labor market inefficiencies.

Source: International Monetary Fund

- 397 reads

Human Rights

Fostering a More Humane World: The 28th Eurasian Economic Summi

Conscience, Hope, and Action: Keys to Global Peace and Sustainability

Ringing FOWPAL’s Peace Bell for the World:Nobel Peace Prize Laureates’ Visions and Actions

Protecting the World’s Cultural Diversity for a Sustainable Future

Puppet Show I International Friendship Day 2020