IMF Executive Board Concludes 2016 Article IV Consultation with the Lao People's Democratic Republic

On January 30, 2017, the Executive Board of the International Monetary Fund (IMF) concluded the Article IV consultation with the Lao People's Democratic Republic.

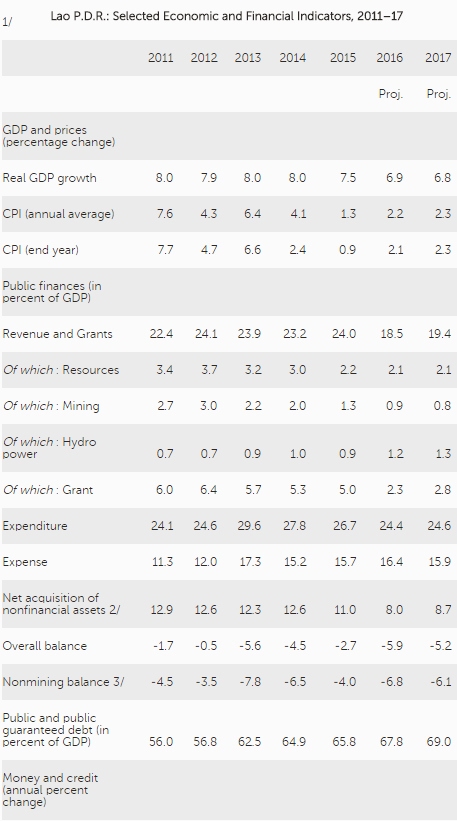

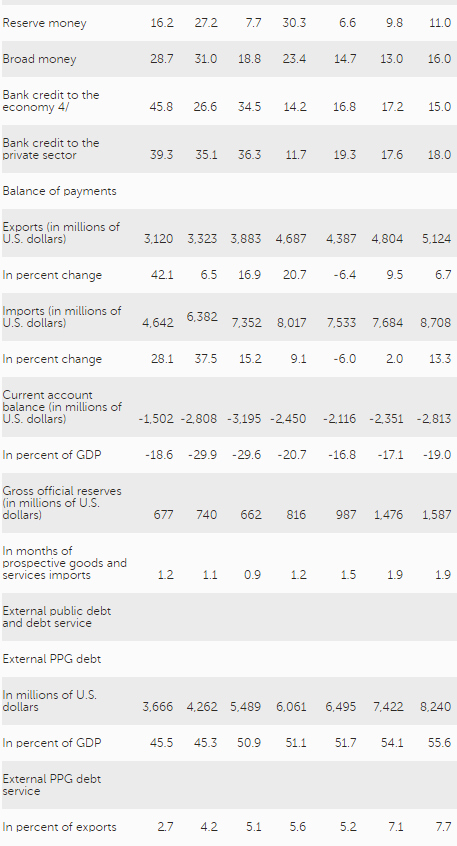

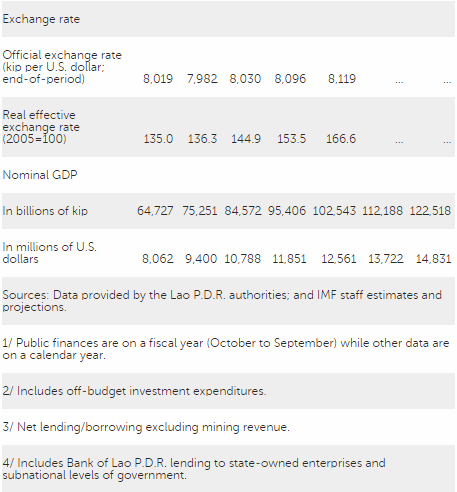

Real GDP growth is expected to moderate from 7.5 percent in 2015 to 7 percent in 2016. Domestic activity has slowed following a less favorable external environment, and credit growth has also moderated from a high level. Inflation is expected to remain low and stable at around 2 percent at end-2016, aided by a strengthening kip exchange rate. The current account deficit is expected to remain high at 17 percent of GDP in 2016 but has narrowed from 20 percent of GDP in 2014. Gross international reserves, at 2 months of prospective imports of goods and services (US$998.6 million, September 2016) remain low by partner country standards. While the overall banking system is well capitalized, state-owned bank balance sheets show signs of weakness, with rising nonperforming loans (NPLs) and weak capital and profitability. The fiscal deficit is expected to have widened to 6 percent in fiscal year 2016 owing to weak tax revenue growth and rising current spending. Public-and-publicly-guaranteed debt (excluding arrears) is projected at 68 percent of GDP in nominal terms (56 percent of GDP in present value terms) at end-2016, a level which elevates the risk of debt distress from medium to high.

As growth continues to moderate in the near-term, inflation is projected to remain in low single digits. The current account deficit is projected to widen to around 19 percent of GDP in 2017 due to the execution of large infrastructure projects with foreign direct investment, and reserves are expected to remain at around 2 months of imports. On current trends without the resumption of fiscal consolidation, the fiscal deficit is expected to remain at around 5 percent and the public debt could rise to around 70 percent of GDP. Risks are on the downside. A failure to consolidate the fiscal position and bring down public debt could undermine confidence in the government’s macro policy framework, raise public debt further and worsen the external position. The economy is also exposed to external shocks, notably a further regional growth slowdown and a deterioration in terms-of-trade and capital inflows. Financial risks could also present risk to macroeconomic stability, particularly the growing foreign currency debt financed by foreign borrowing, and the existence of balance sheet currency mismatches in the private non-bank sector.

Executive Board Assessment

Executive Directors commended the authorities for their strong macroeconomic performance and progress on poverty reduction despite economic challenges. Directors noted, however, that there are significant vulnerabilities in the external, fiscal, and financial sectors, and that risks to the outlook could materialize from a regional growth slowdown, tightening in global monetary conditions, and capital flow volatility. Against this background, Directors emphasized the need for resuming fiscal consolidation, tighter monetary conditions with gradually increased exchange rate flexibility over the medium-term, strengthened financial sector supervision, and reforms to support economic diversification and private sector development.

Directors considered that growth-friendly fiscal consolidation anchored on reducing public debt to 55 percent of GDP over the course of the next 5 years would reduce the risk of debt distress and help strengthen the external position. They welcomed efforts to contain the public sector wage bill, improve tax administration, and reduce non-concessional financing. To ensure successful consolidation and space for well-targeted social and capital spending, Directors recommended increased measures to mobilize tax revenues, reduce exemptions, and rationalize current expenditures. Efforts to formulate a medium-term fiscal framework, enhance fiscal transparency, and reduce fiscal arrears were also encouraged.

Directors noted that the exchange rate remains overvalued and international reserves are low for precautionary purposes, particularly in the context of a large current account deficit, although they also noted that in the past the current account has largely been financed by foreign direct investment. They recommended the authorities continue allowing the exchange rate to move gradually within the official band, supported by tightening of kip liquidity, to help accumulate gross international reserves and reduce external vulnerabilities. Directors agreed that a cautious approach was warranted, given currency mismatches in the non-bank private sector, and the use of the exchange rate as an anchor for inflation. Further reform of the monetary and financial framework would help facilitate more flexibility in the future.

Directors noted the rise in nonperforming loans (NPLs) and undercapitalization of state-owned banks. To safeguard macro-financial stability, they recommended promptly addressing NPLs, phasing out regulatory forbearance, strengthening sound lending practices and supervision, and recapitalizing state-owned banks. Directors emphasized the importance of addressing supervisory weaknesses and developing a crisis management framework. They welcomed the AML/CFT law, and encouraged full implementation of the action plan as agreed with the Financial Action Task Force.

Directors welcomed progress on product and labor market openness and gains in poverty reduction. To support more inclusive and broad-based growth, they encouraged further reforms aimed at diversifying the economy, boosting private sector activity, and improving the business climate. In this context, trade integration and improvements in education and health infrastructure were encouraged. Enhancing financial deepening and financial access by small and medium-sized enterprises would also support macro stability and growth.

Directors welcomed the authorities’ interest in improving the quality and publication of economic and financial data, with technical assistance from the Fund and other development partners as needed.

Source: International Monetary Fund

- 316 reads

Human Rights

Fostering a More Humane World: The 28th Eurasian Economic Summi

Conscience, Hope, and Action: Keys to Global Peace and Sustainability

Ringing FOWPAL’s Peace Bell for the World:Nobel Peace Prize Laureates’ Visions and Actions

Protecting the World’s Cultural Diversity for a Sustainable Future

Puppet Show I International Friendship Day 2020