IMF Executive Board Concludes 2016 Article IV Consultation with Angola

On January 23, 2017, the Executive Board of the International Monetary Fund (IMF) concluded the Article IV consultation with Angola.

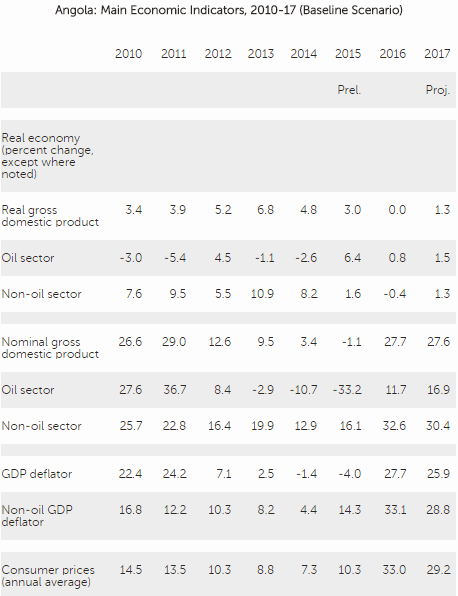

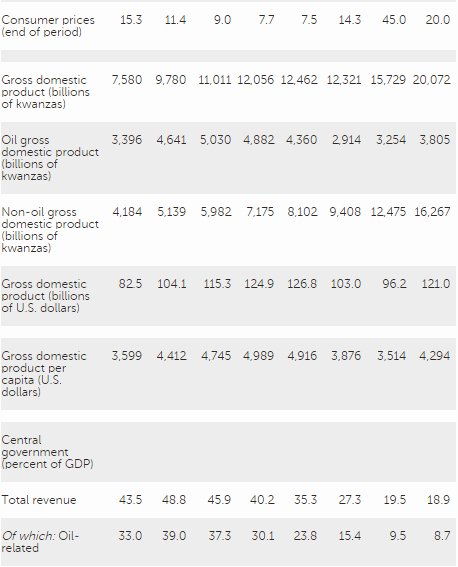

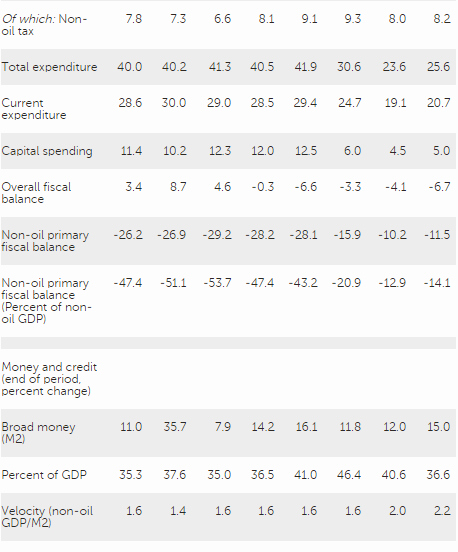

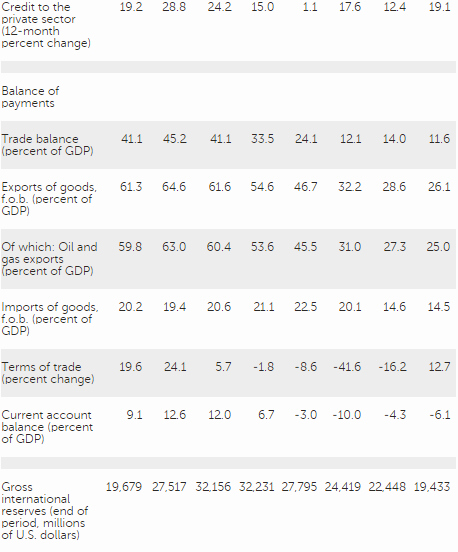

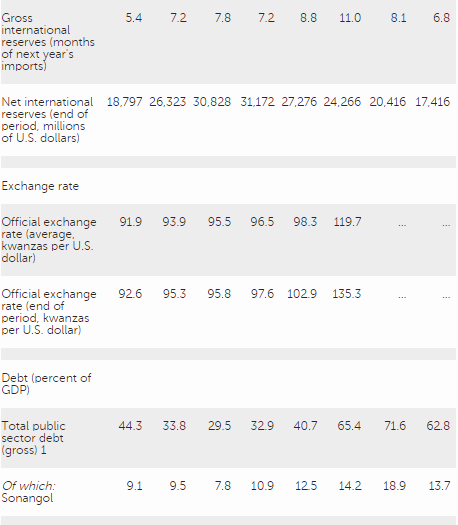

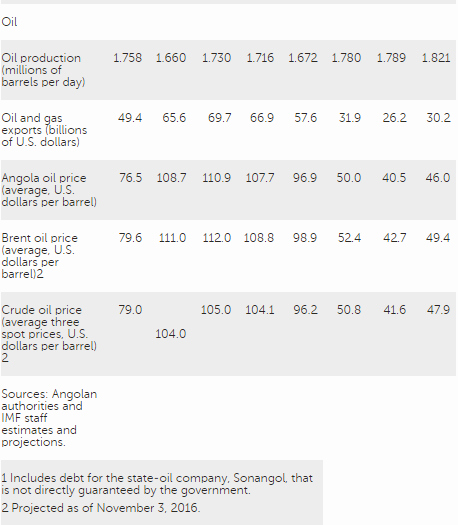

The oil price shock that started in mid-2014 has substantially reduced fiscal revenue and exports. Growth was estimated to come to a halt in 2016, with the non-oil sector contracting by ½ percent dragged down by the industrial, construction, and services sectors; industrial production, despite the potential for import substitution, was constrained by shortages of imported inputs due to limited availability of foreign exchange. Annual inflation was estimated to reach 45 percent by end 2016—the highest rate in over a decade—reflecting higher domestic fuel prices, a weaker kwanza, and the lagged effects of loose monetary conditions until the first half of the year. Non-oil primary balance in 2015-16 showed an improvement of 18 percent of GDP mainly through spending rationalization. The current account deficit, which peaked at 10 percent of GDP in 2015, is projected to be halved in 2016-17, as imports continue adjusting to limited availability of foreign exchange. International reserves are declining but remain relatively comfortable. Meanwhile, a wide spread between the parallel and primary market exchange rates remains, pointing to a significant imbalance in the foreign exchange market.

Executive Board Assessment

Executive Directors noted that the oil price shock that started in 2014 has substantially reduced fiscal revenue and exports, while growth has stopped and inflation has accelerated. Directors commended the authorities for taking steps to mitigate the impact of the shock, but urged further measures to stabilize macroeconomic conditions and address more forcefully the dependence on oil and diversify the economy.

Directors welcomed the significant non-oil primary fiscal consolidation to date, but stressed that continued fiscal adjustment will be needed going forward to put public debt on a clear downward path while supporting economic growth over the medium term. Directors urged concerted efforts to contain the growth of the wage bill, improve the quality of public investment, continue streamlining subsidies while expanding well-targeted social assistance for the poor, and strengthen nonoil revenue, including by implementing a VAT in due course. They also emphasized the need to clear domestic payments arrears and welcomed plans to restructure state-owned enterprises. Directors noted that adopting a medium-term fiscal framework would help reduce the pro-cyclicality of public spending and improve investment planning.

Directors underscored that monetary and exchange rate policies should play a central role in rebalancing the foreign exchange market. They welcomed the recent measures taken by the central bank to tighten liquidity conditions, but saw a need to enhance the monetary policy framework to better anchor inflation expectations and facilitate a transition to greater exchange rate flexibility. Directors underscored that a more flexible exchange rate coupled with supportive monetary and fiscal policies will be crucial in addressing foreign exchange market imbalances while containing inflation. Directors urged the phased elimination of the exchange restrictions and multiple currency practices.

Directors emphasized the need to preserve the health of the banking sector. They supported the authorities’ efforts to strengthen the bank supervision and resolution frameworks. Directors recommended conducting rigorous asset quality reviews, and welcomed the authorities’ actions to ensure that weaker banks are recapitalized. They noted that the plan to restructure and recapitalize the systemically-important state-owned BPC bank is an important step.

Directors stressed the need to address the effects of the loss of U.S. dollar correspondent banking relationships (CBRs). They welcomed the high-level dialogue the authorities have been pursuing with the home authorities of global correspondent banks to better understand regulatory expectations around CBRs. At the same time, Directors noted that the central bank should step up its data collection and analysis; develop contingency plans to mitigate the risks from, and address the drivers of, the loss of CBRs; and further strengthen the prudential and AML/CFT frameworks.

Directors welcomed the authorities’ reform agenda to tackle the constraints to economic diversification including through infrastructure and human capital development. They emphasized that these measures should be complemented by enhancing the business environment and strengthening governance, including efforts to address corruption-related risks, to foster private investment and inclusive growth.

Directors encouraged the authorities to address remaining gaps in the production of economic data.

Source: International Monetary Fund

- 270 reads

Human Rights

Ringing FOWPAL’s Peace Bell for the World:Nobel Peace Prize Laureates’ Visions and Actions

Protecting the World’s Cultural Diversity for a Sustainable Future

The Peace Bell Resonates at the 27th Eurasian Economic Summit

Declaration of World Day of the Power of Hope Endorsed by People in 158 Nations

Puppet Show I International Friendship Day 2020