IMF Executive Board Concludes 2016 Article IV Consultation with Finland

On November 23, 2016 the Executive Board of the International Monetary Fund (IMF) concluded the Article IV consultation with Finland.

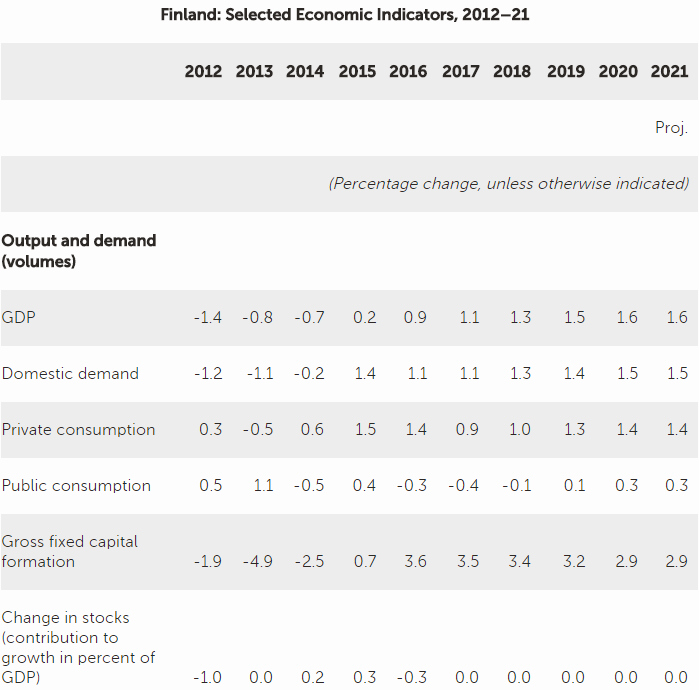

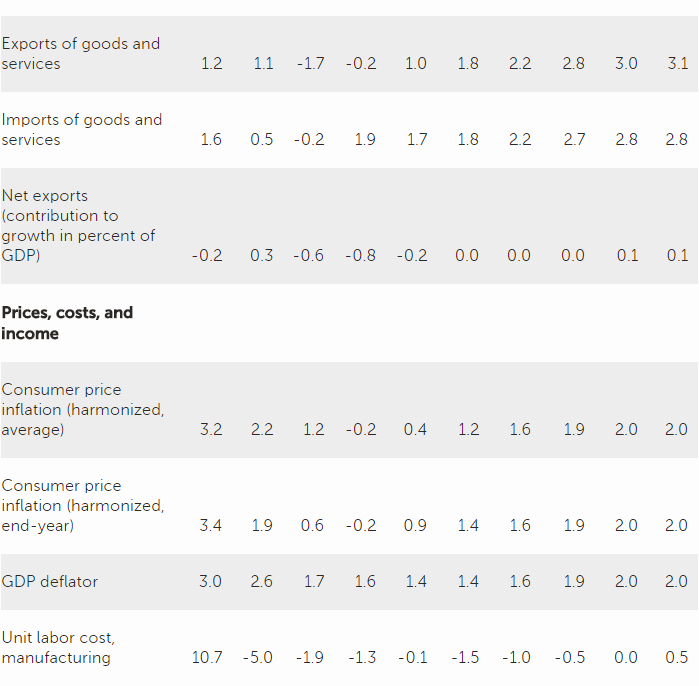

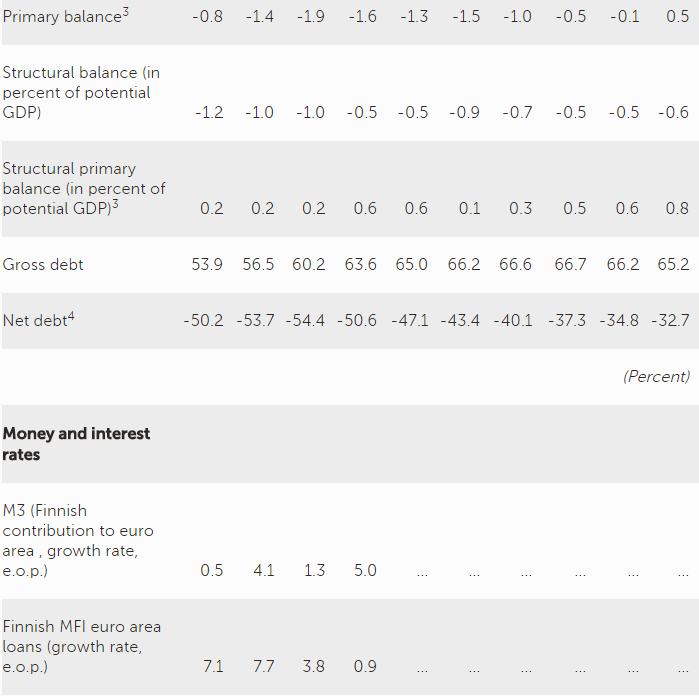

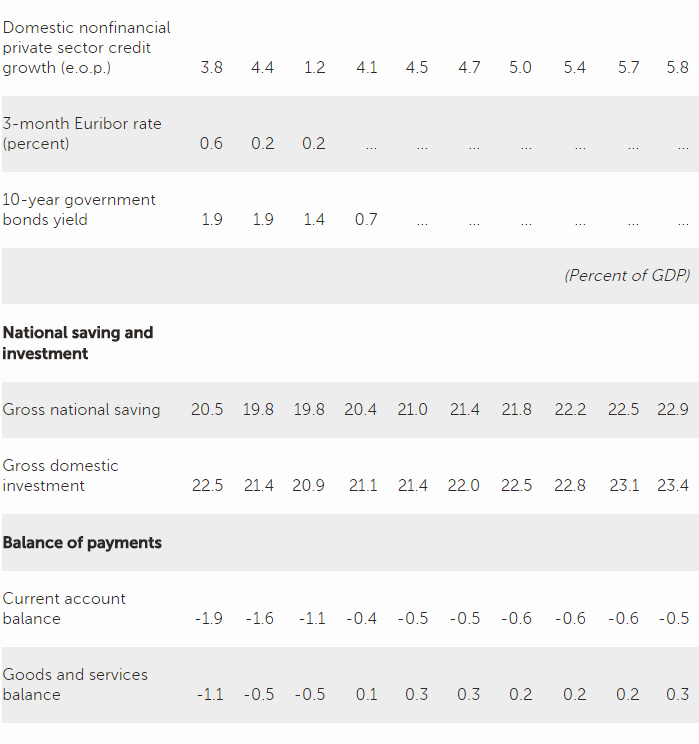

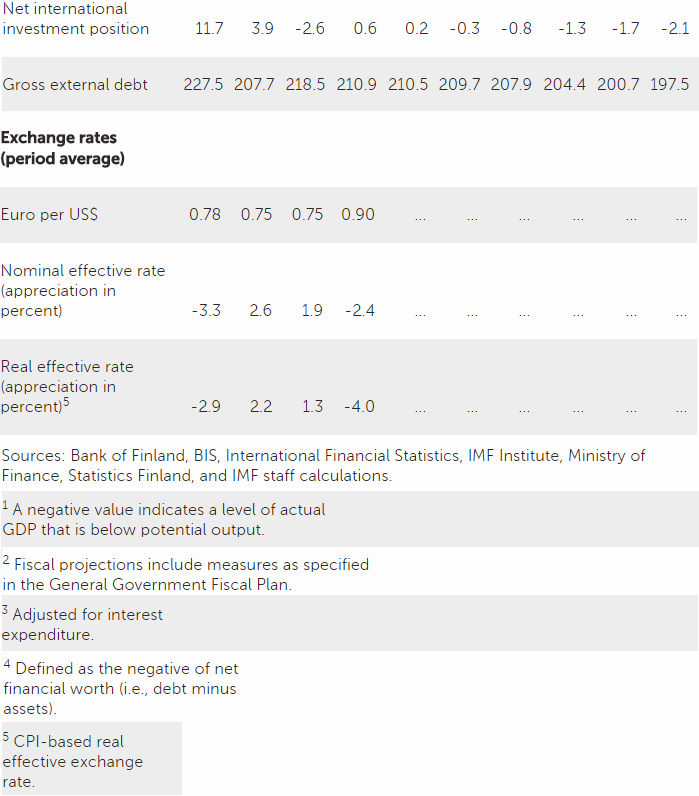

Following a deep recession, growth has turned tepidly positive again. GDP increased by 0.2 percent in 2015 driven by stronger private consumption and a rebound in investment. While net export growth was weak, falling oil prices contributed to the nominal trade balance shifting into surplus, reducing the current account deficit. Better-than-expected fiscal performance brought the deficit back under the 3 percent Stability and Growth Pact (SGP) limit in 2015. Nevertheless, fiscal space is limited, as public debt reached 63.6 of GDP, which is above the SGP threshold. Banks are well-capitalized and profitable despite the weak economy and low credit demand.

The recovery is likely to continue but growth is set to remain slow at about 0.9 percent in 2016 and 1.1 percent in 2017. This outlook is subject to downside risks. Weaker-than-expected global growth could further slow the recovery, while a protracted uncertainty surrounding post-Brexit arrangements could weigh on confidence and investment. Domestically, fiscal and structural policy efforts could weaken the recovery in the near-term, even if their longer run effects should be positive.

The government has made progress on its ambitious structural reform agenda. The Competitiveness Pact agreed by social partners will reduce labor costs, increase hours worked, and aims to introduce more firm-level flexibility in the wage bargaining system. Draft bills on the reform of health and social services provision are being discussed with stakeholders. A fiscal consolidation plan is also being implemented. The short-term pace of consolidation has been eased in return for reforms, without jeopardizing medium-term adjustment goals. Work is continuing on the macroprudential policy framework and efforts to deepen regional cooperation are ongoing.

Executive Board Assessment

Executive Directors welcomed Finland’s return to positive growth, but noted that the recovery will be slow and fragile and faces downside risks. Against this backdrop, Directors underscored that reviving growth remains the country’s preeminent challenge, and should be achieved with ambitious structural reforms and prudent macroeconomic and financial policies.

Directors commended the recent progress on structural reforms, including the reduction in the maximum duration of unemployment benefits and the agreement on the Competitiveness Pact to reduce labor costs. They recommended closely monitoring the implementation of the pact to ensure that the wage bargaining process becomes more flexible at the firm level and better aligns wages with productivity. Directors agreed that the draft bills on the health and social services reform constitute major progress, and encouraged the authorities to develop the important remaining elements of the new system quickly. Given the complexity of this reform, they noted that clear and timely communication with stakeholders as well as regular progress assessment will be critical.

Directors emphasized that efforts are also needed in other priority areas. In this regard, they noted substantial scope for product market reforms, particularly in the retail sector and in state-dominated sectors, which could increase competition and yield productivity gains. To promote innovation, Directors generally advised reversing cuts to public research and development (R&D) spending and creating stronger incentives for private R&D. They also called for strengthening active labor market programs (ALMPs) and for additional measures to increase affordable housing in urban areas to facilitate labor mobility.

Directors emphasized that fiscal policy needs to strike a balance between safeguarding long-term sustainability and protecting the nascent economic recovery. In this regard, they generally welcomed the near-term easing of the fiscal stance in return for structural reforms. A few Directors considered that Finland has additional fiscal space that could be employed. A number of Directors, however, stressed the importance of adhering to the fiscal rules under the Stability and Growth Pact, including in the context of staff’s recommendation to implement faster the remaining growth package spending. Directors

recommended making the composition of fiscal policy more growth-friendly, including by reallocating resources toward R&D spending, well-designed ALMPs, and productive public investment, and away from poorly-targeted transfers and tax expenditures. They noted that if growth disappoints, automatic stabilizers should be allowed to operate fully. More broadly, Directors agreed that the decisive implementation of the structural reform agenda remains critical to securing long-term fiscal sustainability.

Directors welcomed the Financial System Stability Assessment’s finding that the banks are well capitalized and profitable. They concurred that financial sector policy frameworks should be further bolstered to prepare for future risks. In this regard, Directors urged continued strengthening of bank supervision, including by ensuring effective monitoring of banks’ internal risk models and by intensifying oversight of their liquidity positions. They generally called for increasing resources allocated to supervision to reflect the growth in regulatory complexity and supervision intensity. While welcoming plans to introduce a systemic risk buffer and a floor on mortgage risk weights, Directors also suggested adding instruments based on borrower and loan characteristics to the macroprudential policy toolkit.

Directors stressed the importance of further deepening regional supervisory cooperation. They noted that a strong agreement on data sharing and cooperation between the key supervisors will be critical to mitigate risks from close regional linkages and Nordea Finland’s conversion from subsidiary into a branch. Directors recommended conducting joint stress tests, enhancing joint crisis planning, running regular crisis simulation exercises, and strengthening collaboration between Nordic macroprudential authorities.

Source: International Monetary Fund

- 315 reads

Human Rights

Fostering a More Humane World: The 28th Eurasian Economic Summi

Conscience, Hope, and Action: Keys to Global Peace and Sustainability

Ringing FOWPAL’s Peace Bell for the World:Nobel Peace Prize Laureates’ Visions and Actions

Protecting the World’s Cultural Diversity for a Sustainable Future

Puppet Show I International Friendship Day 2020