IMF Completes 2016 Article IV Consultation with Honduras

On October 26, 2016, the Executive Board of the International Monetary Fund (IMF) concluded the Article IV Consultation with Honduras.

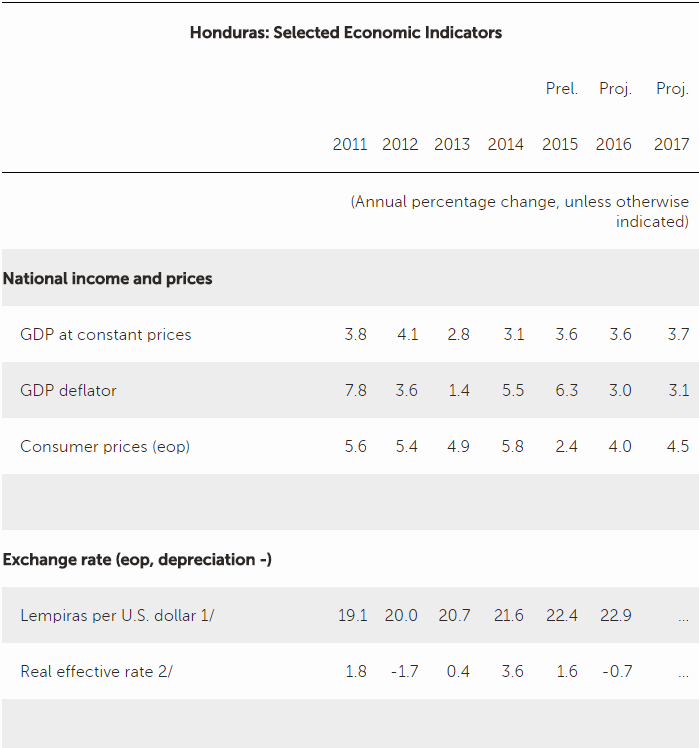

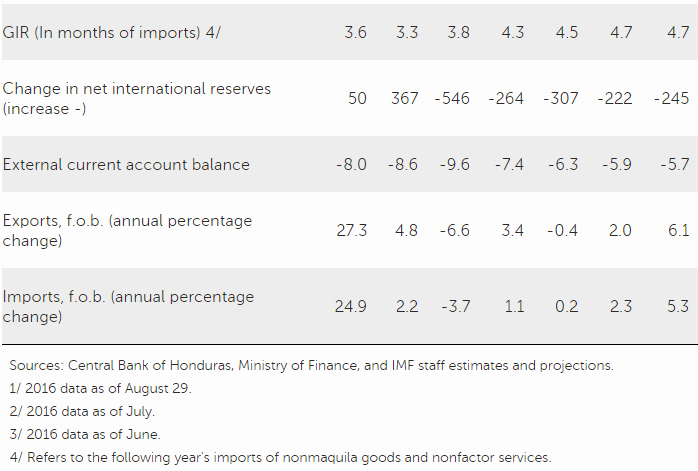

In 2015, real output grew at 3.6 percent, slightly higher than projected. From the demand side, growth was supported by the recovery in private consumption—which responded positively to a reduction in gasoline prices and strong remittances inflows—and a boost in investment. On the supply side, the recovery in manufacturing and agriculture supported greater activity. At the same time, headline inflation decelerated to 2.4 percent from 5.8 percent in the previous year, well below the inflation target of 4.5 percent—owing to strong demand management policies and lower fuel prices. The fiscal position also improved, as the primary balance moved into surplus, implying an impressive fiscal adjustment of 6.5 percentage points of GDP relative to 2013. This fiscal adjustment, along with lower oil imports, helped to narrow the external current account deficit to 6.3 percent of GDP in 2015. As a result, net international reserves increased by US$307 million, supported by private capital inflows. Together, these favorable developments have contributed to a systematic improvement in Honduras’ international sovereign debt credit ratings.

The outlook for 2016 remains favorable. Real GDP through 2016 Q2 grew by 4.1 percent (y/y) broadly consistent with staff’s projection of 3.6 percent for the year. This projected growth performance is supported by scaled up public infrastructure investment and a supportive monetary policy stance. Inflation through August 2016 was 2.5 percent (y/y), and is projected to remain low. In line with the existing program and the Fiscal Responsibility Law (FRL), the nonfinancial public sector deficit is expected to widen to 1.5 percent of GDP from 1.0 percent to accommodate planned investment in infrastructure. At the same time, consistent with expanding real sector activity and greater private sector confidence, credit to the private sector is expected to grow by 10 percent in nominal terms, in line with a sustainable pace of financial deepening.

Program performance remains satisfactory. The authorities have advanced important reforms to help create the conditions for sustained medium-term economic performance and poverty reduction. These reforms include, most notably, the adoption of caps on expenditure and the prioritizing of public investment under the FRL, reforms to tax administration, a social protection framework, and an overhaul of the electricity sector. In addition, the authorities have embarked on a comprehensive reform of the framework for bank resolution, comprising extensive legal amendments and a significant strengthening of the authorities’ capacity for dealing with financial sector distress.

Executive Board Assessment

Executive Directors commended the authorities’ improved macroeconomic policy mix under their Fund-supported program, which has stabilized the economy and has resulted in higher economic growth, low inflation, stronger fiscal and external positions, and progress in implementing social policies. Noting that important economic and social challenges remain ahead, Directors encouraged the authorities to press forward with their prudent policies and reform momentum to achieve stronger and more inclusive growth while safeguarding macroeconomic and financial stability.

Directors welcomed the authorities’ fiscal consolidation efforts and the recent adoption of the fiscal responsibility law (FRL). They encouraged the authorities to work assiduously to quickly operationalize the law’s provisions and clarify its implications for extra-budgetary programs. While also welcoming the authorities’ decision not to renew ineffective tax exemptions once they have expired, Directors urged a more proactive approach to rationalizing tax exemptions in general. On the spending side, they supported the authorities’ plan to adopt a results-based approach to spending programs in health and education, which is an initial step to increase spending efficiency. Directors called for additional reforms in the electricity sector to strengthen public finances and foster competition in the electricity market.

Directors agreed that the supportive monetary policy stance remains appropriate. Given a more neutral policy rate, the closing output gap, and the planned recovery of the real electricity costs, they urged the Central Bank of Honduras (BCH) to be cautious against further easing in the near term. Directors called on the BCH to remain vigilant and be ready to tighten policy if inflation or credit growth were to accelerate and signs of overheating were to emerge.

Directors welcomed the authorities’ decision to move toward a more flexible exchange rate regime and an inflation targeting framework. To support these decisions, they encouraged the authorities to press ahead with plans to develop domestic and foreign exchange markets, reform the central bank law to give the BCH a clear mandate to achieve price stability, and speed up the de-dollarization process.

Directors recommended focusing on key medium-term reform priorities to achieve higher growth and employment now that the economy has stabilized. They encouraged the authorities to press ahead with efforts to improve the rule of law, competitiveness, and the business climate. Directors welcomed the recently launched new medium-term economic development strategy Honduras 2020.

Source: International Monetary Fund

- 317 reads

Human Rights

Fostering a More Humane World: The 28th Eurasian Economic Summi

Conscience, Hope, and Action: Keys to Global Peace and Sustainability

Ringing FOWPAL’s Peace Bell for the World:Nobel Peace Prize Laureates’ Visions and Actions

Protecting the World’s Cultural Diversity for a Sustainable Future

Puppet Show I International Friendship Day 2020