IMF Executive Board Concludes 2016 Article IV Consultation with the Republic of Equatorial Guinea

On August 29, 2016, the Executive Board of the International Monetary Fund (IMF) concluded the Article IV consultation with the Republic of Equatorial Guinea.

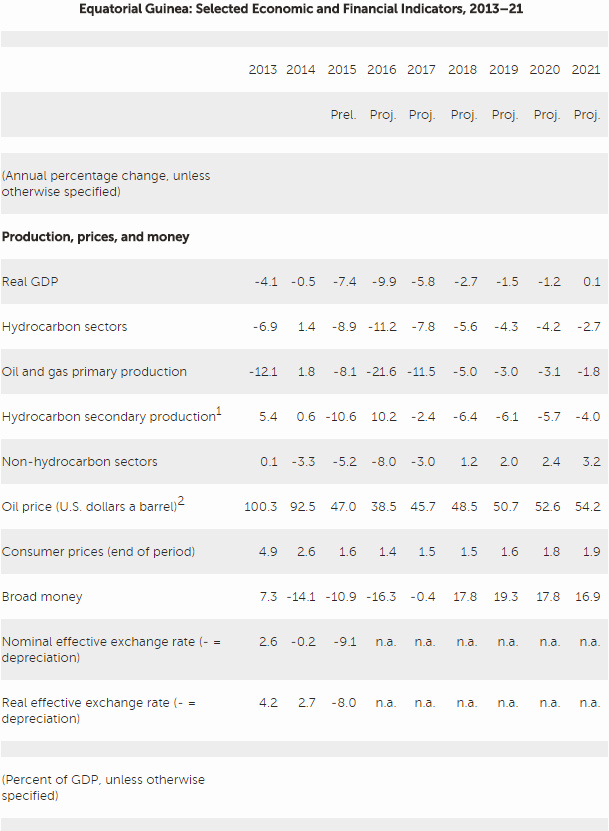

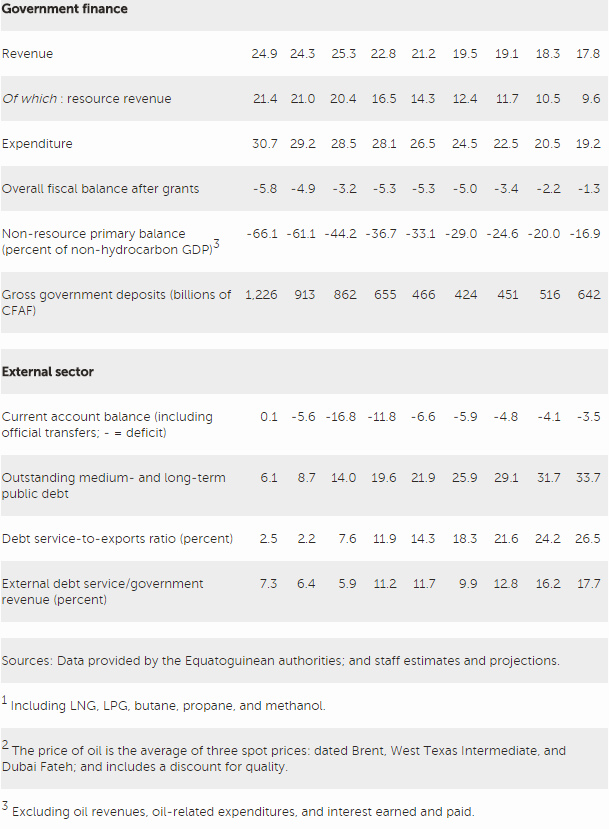

Equatorial Guinea’s overall real GDP growth has been weak in recent years averaging

-0.5 percent from 2010-14, largely due to a trend decline of the dominant hydrocarbon sector. Economic performance deteriorated substantially in the wake of the 2014 oil-price shock. In 2015, the pace of the contraction intensified, and economic activity declined by 7.4 percent. Hydrocarbon activity fell 8.9 percent, as lower oil prices prompted producers to cut costs, resulting in lower production. Non-hydrocarbon activity slumped by 5.2 percent, as fiscal adjustment slowed public investment and private sector construction. Ongoing fiscal adjustment helped to reduce the overall deficit from 4.9 percent of GDP in 2014 to 3.2 percent in 2015. However, the fiscal position remains under pressure, with deficit financing needs requiring domestic borrowing in the form of central bank credit and further use of government deposits. The terms-of-trade deterioration resulted in a widening of the current account deficit to 16.8 percent of GDP. Inflation is very low at 0.6 percent during the second quarter of 2016, down from over 4 percent in 2014.

The near-term outlook is very challenging, given prospects for depressed energy prices and a continued decline in hydrocarbon production. Weak oil revenues and limited buffers will require further cuts to public investment, leading to a deep contraction of the large construction sector and public administration. As such, overall economic activity in 2016 is expected to decline further by nearly 10 percent. The overall economy is unlikely to grow in the medium term given the still large weight of the hydrocarbons and the impact of fiscal consolidation on non-hydrocarbon activities. However, the pace of the overall contraction should lessen over time as the national development strategy shifts focus to human resource development and facilitates the emergence of new drivers of non-hydrocarbon growth.

Executive Board Assessment

Executive Directors noted that Equatorial Guinea is facing challenging circumstances, as declining hydrocarbon production and depressed oil prices have led to a deep economic contraction. Given limited buffers, Directors underscored that, in the face of the sharp drop in hydrocarbon income, sustained policy adjustment is needed to restore fiscal sustainability. They noted that achieving sustainable and inclusive growth will require significant efforts to diversify the economy toward non‑resource sectors, as well as enhancing human capital development and improving the business climate.

Directors welcomed the fiscal adjustment already underway, which reflects the improving receptiveness to IMF policy advice, but encouraged the authorities to increase the pace of consolidation. They were encouraged by the authorities’ efforts to contain current spending and freeze new public investment projects. However, Directors urged swift progress in defining other key elements of the adjustment strategy, including measures to mobilize non‑resource revenues, rationalize tax exemptions, and increase investment efficiency. They emphasized the need to prioritize ongoing projects, while retaining investment in social development, particularly in health and education. The consolidation process would benefit from a comprehensive review of tax policy, and a strategy to develop debt management capacity, supported by IMF technical assistance as needed.

Directors highlighted the importance of decisive action to engender growth in the non‑resource economy. In order to leverage the potential of Equatorial Guinea’s considerable infrastructure, they recommended developing a comprehensive reform agenda to improve the business climate, strengthen governance, foster human capital development, and reduce factor costs, including through fiscal consolidation. Greater cooperation with the World Bank on business climate diagnostics could help establish the immediate structural reform priorities.

Directors cautioned that while the country’s banks appear well capitalized, the high level of non‑performing loans and declining profitability call for renewed vigilance. They noted that financial sector vulnerabilities stem from fiscal‑financial linkages, as fiscal consolidation and government arrears to contractors affect firms’ ability to service loans. Directors encouraged the authorities to adopt a repayment strategy for accumulated arrears, which threaten the credibility of the fiscal adjustment and financial stability. They also emphasized the importance of maintaining adequate capital buffers in the banking sector, strengthening bank supervision at the regional level, and promoting financial inclusion.

Directors commended Equatorial Guinea’s recent steps to improve statistical production and dissemination, notably the adoption of legislation and a development strategy for the national statistical system, the rebasing of the national accounts, and the application to join the enhanced General Data Dissemination Standard (e‑GDDS) of the IMF. Nonetheless, Directors urged continued efforts, with assistance from the IMF and other partners, to address remaining data gaps to support effective surveillance and policy formulation.

Source: International Monetary Fund

- 266 reads

Human Rights

Fostering a More Humane World: The 28th Eurasian Economic Summi

Conscience, Hope, and Action: Keys to Global Peace and Sustainability

Ringing FOWPAL’s Peace Bell for the World:Nobel Peace Prize Laureates’ Visions and Actions

Protecting the World’s Cultural Diversity for a Sustainable Future

Puppet Show I International Friendship Day 2020