IMF Executive Board Concludes 2016 Article IV Consultation with Guatemala

On August 22, 2016, the Executive Board of the International Monetary Fund (IMF) concluded the Article IV consultation with Guatemala, and considered and endorsed the staff appraisal without a meeting.

The Guatemalan economy withstood the 2015 political crisis well. A solid policy track record together with favorable external conditions contributed to the resilience. The new administration, who took office in January, 2016, is undertaking important efforts to tackle corruption, one of the major challenges facing the country’s economy and society at large. The main strands of these efforts include a broad-based reform of the tax and customs administration, more transparent public procurement, increased accountability of Congress, a more independent Judiciary, and stricter application of the rule of law.

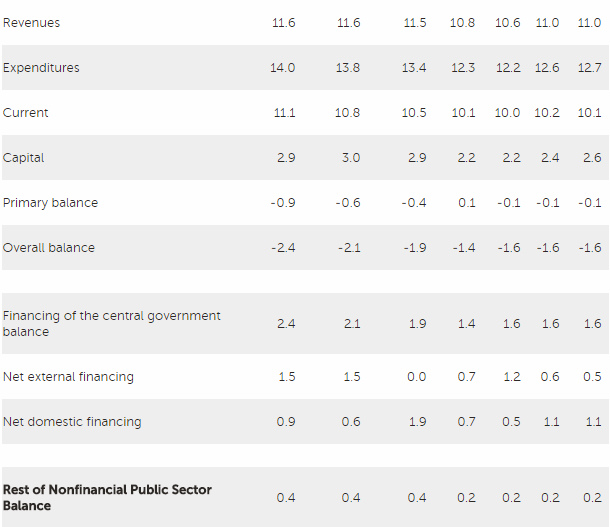

Macroeconomic performance has been solid. The economy grew at 4.1 percent in 2015, slightly above potential, despite a slowdown in public consumption and investment during the crisis. Private consumption was lifted by lower oil prices and strong remittances. The latter also boosted the external position, creating a comfortable reserve cushion. With inflation well-anchored, monetary policy was eased to support growth. The financial system remained stable with no material loss of correspondent banking relationships. Fiscal revenues, however, fell well below expectations. The shortfall was offset by even larger spending cuts, resulting in a fiscal deficit below the budget target.

Progress on social objectives is lagging. Only one fourth of the Millennium Development Goals (MDGs) for 2015 were met, with none met for the rural and indigenous population. Moreover, there have been reversals in reducing extreme poverty and raising school enrollment.

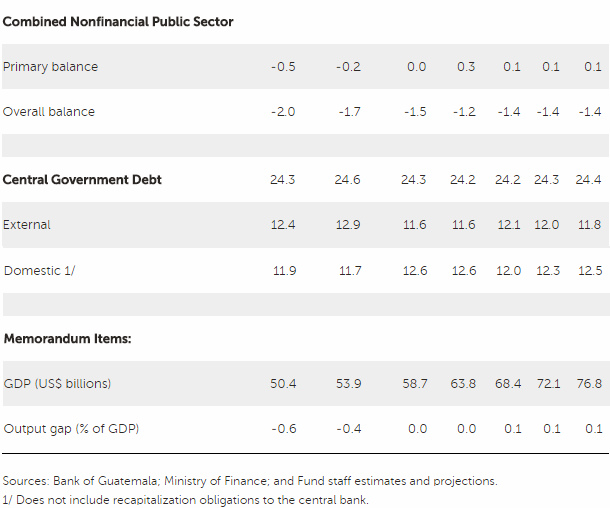

The macroeconomic outlook remains benign. Growth is set to return to its trend rate of 3.8 percent in 2016 and gradually rise to 4 percent in the medium term, reflecting the positive impact of efforts to increase transparency and efficiency of public spending. Despite a pick-up in food price inflation, headline inflation has remained within the target range so far in 2016 and is expected to stay on course in the medium term. The external position is set to widen to 1.7 percent of GDP by 2021, driven by gradual reversal of the oil price decline and strong domestic demand. Fiscal deficit is projected to remain close to 1.5 percent of GDP in the medium term. Risks, however, are tilted towards the downside due to global uncertainties and domestic policy constraints.

Executive Board Assessment

The economy weathered the 2015 political crisis well. Despite the impact of revenue shortfalls on public expenditure, growth remained robust in 2015, supported by low oil prices and strong remittances. The exchange rate has been stable and inflation has remained within the central bank’s target range. These trends are expected to continue in the medium term, with GDP growing at potential and inflation within the target range. The current account deficit is projected to increase only gradually. However, there are downside risks to growth from global uncertainties and domestic policy constraints.

A higher fiscal deficit could be justified on structural and social grounds. With the output gap closed, the current broadly neutral fiscal stance is reasonable. However, a fiscal relaxation to bring the overall deficit to around 2 percent of GDP may be justified to maintain capital and social spending and to implement the anti-corruption reform agenda. However, this should be a temporary increase in the deficit while efforts to raise the revenue-GDP ratio are put in place.

Monetary policy should be attuned to signs of an increase in inflation. Core inflation remains below the target range, inflation expectations well-anchored, and inflation is forecasted to remain within the target range. However, the central bank should stand ready to increase the policy rate promptly if inflationary pressures intensify.

Structural objectives should guide fiscal policy over the medium-term. A gradual increase in fiscal revenues to at least 15 percent of GDP would be essential to meet critical social, security and infrastructure needs and to support long-term growth. This will require both improvements in tax administration and a revamp of the tax policy framework, including through an increase in tax rates. Tax reform should be presented in the context of a more comprehensive reform strategy to help secure public support. Measures to improve fiscal transparency and efficiency on the expenditure side would help raise government credibility.

The central bank should transition to a full-fledged inflation targeting. Additional measures to strengthen the monetary transmission, including continuing efforts to increase exchange rate flexibility, discourage dollarization, cover past and current operational losses of the Central Bank in the short term and recapitalize the Central Bank in the longer term, and develop capital markets would help with that transition.

Guatemala's external position is moderately stronger than the level consistent with medium term fundamentals and desirable policy settings. A lower-than-desirable fiscal deficit accounts for most of the identified policy gap. Reducing crime and corruption, investing in education and infrastructure, strengthening legal protection, and deepening the financial system would help mitigate the competitiveness gap.

Efforts to fortify the financial system should continue. The financial system appears sound, though moderately high credit dollarization, fast growing foreign bank liabilities, and exposure to sovereign debt represent vulnerabilities. The system has not been materially affected by the loss of correspondent banking relationships. However, this should not slow efforts to strengthen risk-based Anti-Money Laundering/Combating the Financing of Terrorism supervision and bring the framework into line with the Financial Action Task Force standards, especially as it would complement efforts to combat crime and corruption. Continued implementation of the 2014 Financial Sector Assessment Program update and regional cluster surveillance report recommendations, including strengthening capital and liquidity buffers as well as enhancing consolidated supervision of financial conglomerates, will help strengthen financial system’s resilience.

Structural reforms should support higher and more inclusive growth. Increasing the size and efficiency of social assistance programs as well as raising public expenditures on education, infrastructure, and security will be important to continue building human and physical capital. Improved childcare and support to indigenous women could help raise female labor force participation. Continued progress on regional and international integration, stronger competition policies, and measures to support financial deepening and inclusion, will also help stimulate long-term inclusive growth. Articulating an overarching long-term growth and social strategy would help garner public support for the reforms.

Source: International Monetary Fund

- 233 reads

Human Rights

Fostering a More Humane World: The 28th Eurasian Economic Summi

Conscience, Hope, and Action: Keys to Global Peace and Sustainability

Ringing FOWPAL’s Peace Bell for the World:Nobel Peace Prize Laureates’ Visions and Actions

Protecting the World’s Cultural Diversity for a Sustainable Future

Puppet Show I International Friendship Day 2020