IMF Executive Board Concludes 2016 Article IV Consultation with the Republic of Korea

On July 29, 2016, the Executive Board of the International Monetary Fund (IMF) concluded the Article IV consultation with the Republic of Korea.

After decades of impressive economic progress, Korea’s growth has slowed, and the economy is facing a number of structural headwinds, including: unfavorable demographics; heavy export reliance; pockets of corporate vulnerabilities; labor-market distortions; lagging productivity; a limited social safety net; and high household debt. Inequality and poverty are also of concern. On the positive side, Korea has considerable fiscal space to manage these challenges.

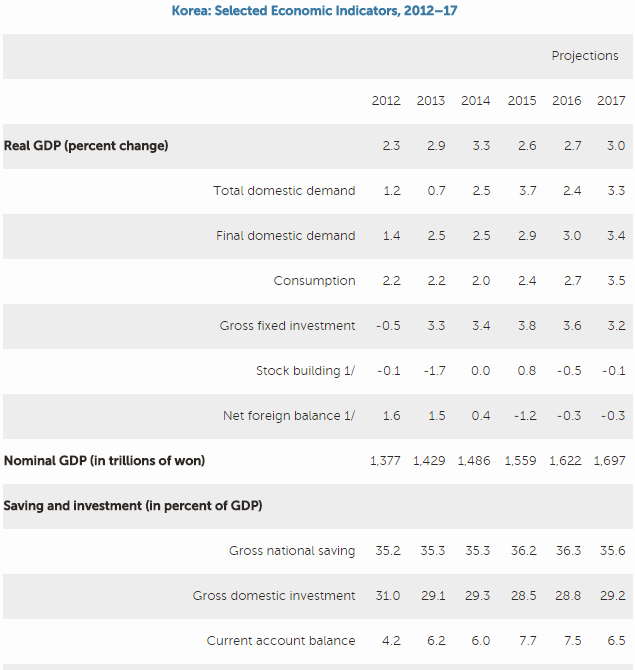

Growth has been sluggish since 2012, reflecting not only a series of shocks but also a steady decline in the economy’s growth potential. The authorities have responded proactively with fiscal and monetary support, along with measures to contain the rapid increase in household debt. Activity started to pick up in the second half of last year but slowed again in the first quarter, reflecting the expiry of the consumption tax cut (which was later extended), weaker fixed investment, and a payback in inventory accumulation.

Growth is projected to tick up to 2.7 percent this year and 3.0 percent in 2017, with inflation remaining subdued. The anticipated pickup in activity is based on growing private consumption, a stronger housing market, and the impact of fiscal and monetary easing. On the other hand, export prospects will likely remain difficult, weighing on fixed investment. Credit is expected to continue to grow, partly reflecting the impact of interest rate cuts, but at a slower pace consistent with the tightening of prudential measures and the envisaged moderation in construction investment after 2017.

Executive Board Assessment

Executive Directors commended Korea’s remarkable economic achievements over the past sixty years. They noted, however, that the Korean economy now faces structural constraints to sustain its strong growth, including rapid population aging, a heavy reliance on exports, rising corporate vulnerabilities, labor market distortions, and lagging productivity. Directors supported the authorities’ strong emphasis on structural reforms to overcome these constraints and raise growth potential.

Directors broadly agreed that, given Korea’s low public debt, fiscal support can be used to incentivize structural reforms, cushion any adverse effects, and support growth. They concurred that a carefully targeted expansion of social expenditure over the medium term could help reduce poverty and inequality and aid rebalancing by bolstering consumption and raising productivity. In this context, they acknowledged the authorities’ aim to safeguard long run fiscal sustainability, in view of future challenges arising from demographic change and possible reunification. A few Directors noted that there is room to accommodate higher social spending in the medium term without being offset by additional revenue or expenditure cut. A few other Directors felt that any additional spending should be budget neutral or met by a revenue enhancement. Directors welcomed the authorities’ consideration of a fiscal rule to anchor fiscal sustainability over the medium term.

Directors supported the authorities’ efforts on corporate restructuring, and urged timely implementation of such efforts for distressed firms while ensuring an adequate social safety net for affected workers. They welcomed the plan to recapitalize the policy banks, but stressed the importance of sufficient budgetary resources and the need to unwind the bridge financing provided by the Bank of Korea.

Directors concurred that labor market reforms are critical to address segmentation and boost female labor force participation. They underscored the need to promote competition in the service sector and among small and medium enterprises to raise productivity. They also welcomed the authorities’ strategy to develop a “creative economy” by fostering innovation.

Directors broadly agreed that fiscal and monetary policies should remain supportive, in view of the current weak conjuncture and downside risks, and welcomed the authorities’ announced fiscal stimulus and recent policy rate cut. A few Directors, however, expressed caution regarding the effectiveness and potential implications of further fiscal and monetary stimulus. Directors recommended tightening and harmonizing macroprudential standards across banks and nonbanks to contain risks from rising household debt.

Regarding the external sector, some Directors called for a more explicit focus on reduction of the current account surplus. Directors stressed the need to continue to allow the exchange rate to move flexibly to facilitate rebalancing and adjustment to shocks. They recommended limiting intervention to addressing disorderly market conditions and encouraged disclosure of such interventions. Directors supported the authorities’ plan to ease capital flow management measures.

Source: International Monetary Fund

- 281 reads

Human Rights

Fostering a More Humane World: The 28th Eurasian Economic Summi

Conscience, Hope, and Action: Keys to Global Peace and Sustainability

Ringing FOWPAL’s Peace Bell for the World:Nobel Peace Prize Laureates’ Visions and Actions

Protecting the World’s Cultural Diversity for a Sustainable Future

Puppet Show I International Friendship Day 2020