IMF Executive Board Concludes 2016 Article IV Consultation with Japan

On July 29, 2016, the Executive Board of the International Monetary Fund (IMF) concluded the Article IV consultation with Japan.

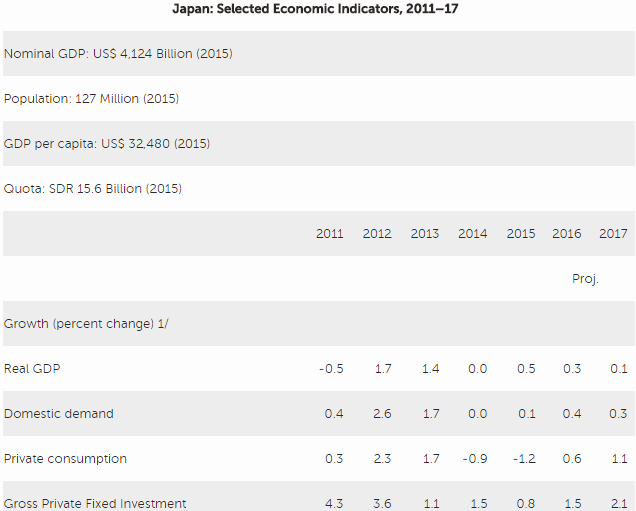

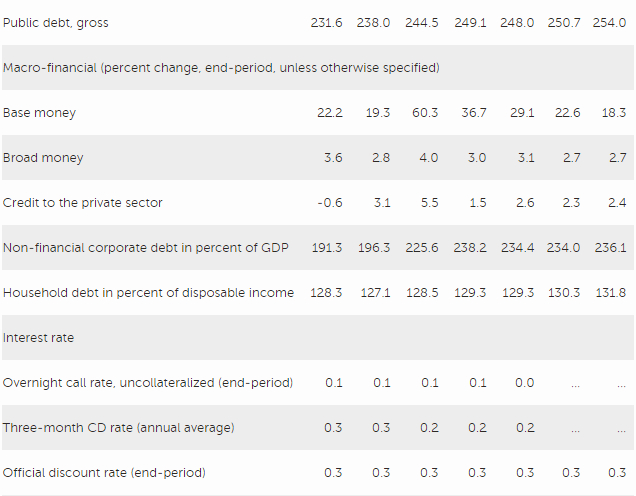

Economic growth has slowed due to weak private consumption and sluggish investment, and inflation has lost its forward momentum. While financial conditions remain accommodative, falling stock prices and the appreciation of the yen have resulted in a modest tightening. The authorities responded to the weaker domestic and external economic environment through additional monetary and fiscal support, including the adoption of the negative interest rate policy, plans for additional fiscal stimulus, and the postponement of the scheduled 2017 consumption tax hike by two and a half years.

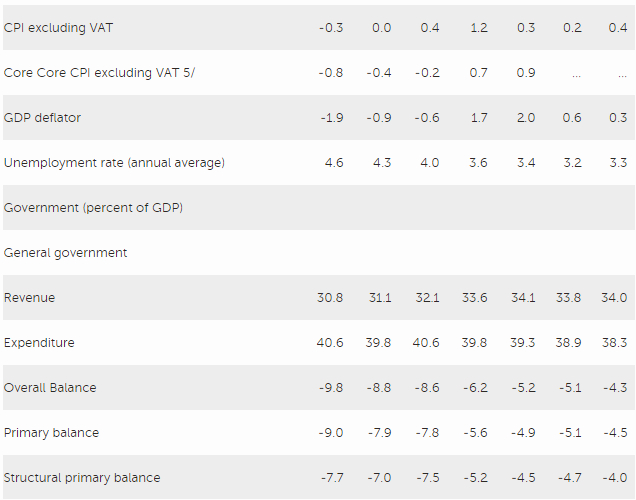

Nevertheless, the outlook for growth and inflation remains subdued. Private consumption is projected to grow modestly and weakness in the global recovery and trade, higher uncertainty, especially in the wake of the Brexit referendum, and the recent appreciation of the yen will likely pose a drag on net exports and investment. Consequently, the economy is expected to expand at a moderate pace of about 0.3 percent in 2016, before slowing to 0.1 percent in 2017, excluding the possible effect of the yet to be adopted economic stimulus package. Over the medium term growth is projected to be in line with potential (which is on a declining trend), while inflation is expected to rise to about 1 percent. Additional fiscal support could boost growth in the near term, but downside risks dominate in the medium term relating to weak external and domestic demand, uncertainty about the sustainability of low interest rates in a high public debt environment, and financial stability risks in the context of unprecedented monetary easing. These risks may affect the financial system which so far has remained sound and resilient, with good capitalization and a declining NPL ratio.

While Abenomics made initial headway in boosting expectations and revitalizing the Japanese economy, structural impediments and policy shortfalls, especially on the structural side, are making it difficult to achieve a sustained lift off. In particular, low confidence in economic growth prospects is holding back investment and credit demand. Labor market duality and inflexibility are hampering wage growth and the financial sector’s support of risk-taking is limited. In addition, the stop-go nature of fiscal policy and optimistic growth assumptions underlying medium-term budget projections have left fiscal policy without a credible medium-term anchor and are contributing to policy uncertainty. Weak monetary transmission, sluggish wage-price dynamics, and a falling natural rate of interest are preventing the needed rise in inflation expectations, creating a communication and credibility challenge for the BoJ.

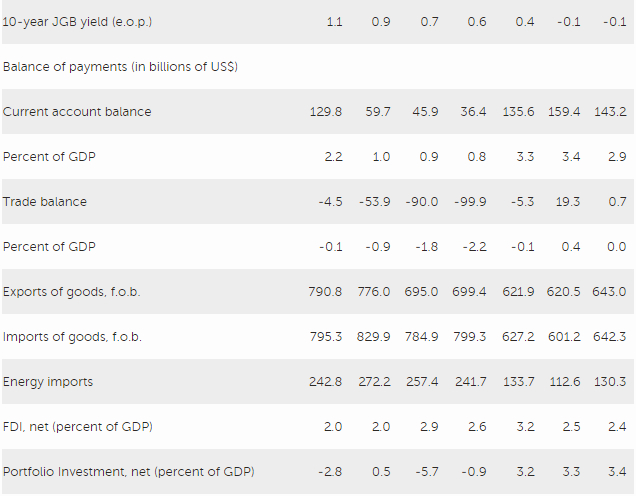

Abenomics has also faced external headwinds, with global weakness and volatility complicating matters. Sluggish global growth and overcapacity in the traded goods sector prevented the weaker yen from materially boosting exports. Declining commodity prices failed to boost activity as expected, but instead put downward pressure on headline inflation and forced the BoJ to repeatedly push out its timeline for hitting the inflation target. Moreover, concerns in emerging markets and revisions to the expected path of monetary policy in advanced economies led to heightened volatility in financial markets and safe haven appreciation pressures. In light of this, while Japan’s 2015 external position was moderately stronger than the level consistent with medium-term fundamentals and desired policies, the subsequent appreciation of the real effective exchange rate has moved it towards a level consistent with medium-term fundamentals suggested by the 2015 assessment, while it may undermine the effort to lower deflation risks.

Executive Board Assessment

Executive Directors welcomed the initial success of Abenomics and the authorities’ forceful implementation of policies to lift growth and inflation. Nevertheless, growth remains subdued and deflation persists, on the back of weak consumption, lackluster private investment, and sluggish exports. Directors noted strong headwinds from a weak global recovery, the appreciation and volatility of the exchange rate, and adverse demographics. They generally agreed that a comprehensive and coordinated policy upgrade is now needed to achieve the ambitious targets on growth, reflation, and fiscal consolidation.

Directors considered structural reforms as an essential component of the reloaded Abenomics, aimed at raising productivity, labor supply, and potential growth. They supported labor market reforms to reduce duality and increase labor force participation by female, older, and foreign workers. As part of the overall policy mix, Directors generally saw a role for policies that could help generate wage-price dynamics without excessive interference in market mechanisms. In this regard, they welcomed the decision to lift minimum wage growth, and recommended consideration of options to strengthen incentives for companies to raise wages and promote flexible labor contracts. Directors stressed the importance of complementing these measures with fiscal and monetary demand support, carefully balancing short-term growth with the medium-term objectives of fiscal sustainability and financial stability. They cautioned that, absent a full policy upgrade, macroeconomic policies may need to be recalibrated, implying larger fiscal consolidation needs and a looser monetary policy over a longer period of time, which could increase potential risks, with negative spillovers to the global economy. In this context, Directors took note of the recent announcements of the additional monetary easing and economic stimulus plans.

Directors underscored the need to chart a credible course for fiscal consolidation to place debt on a downward trajectory, reduce policy uncertainty, and create near-term fiscal policy space. They broadly agreed that a pre-announced path for gradual but sustained increase in the consumption tax, insofar as it is administratively feasible, would mitigate any negative impact on the economy and enhance policy credibility. Directors also recommended containing social security spending growth and broadening the tax base.

Directors encouraged further efforts to strengthen policy frameworks, particularly fiscal institutions. Most Directors saw merit in the adoption of spending rules and an independent assessment of the outlook and budget projections, noting that the authorities’ initiatives to enhance the existing framework are in the right direction. Directors emphasized the need for clear, effective communication around monetary policy and better use of forward guidance.

Directors commended the authorities for maintaining a sound and stable financial sector. They noted that financial stability risks could nonetheless arise from prolonged unconventional monetary policies and the delay in achieving reflation and fiscal sustainability. Directors therefore encouraged the authorities to continue to strengthen the macroprudential policy toolkit; and enhance the monitoring of liquidity in the government bond market, financial institutions’ profitability, and foreign exchange risks. Efforts should also continue to improve the resilience of regional banks and inter-agency coordination.

Directors noted the staff’s assessment that the yen appreciation earlier this year has moved Japan’s external position toward a level broadly consistent with fundamentals. Noting that a stronger yen would make reflation efforts more challenging, they underscored the importance of strengthening domestic policies to mitigate inward spillovers and secure external balance over the medium term.

Source: International Monetary Fund

- 283 reads

Human Rights

Fostering a More Humane World: The 28th Eurasian Economic Summi

Conscience, Hope, and Action: Keys to Global Peace and Sustainability

Ringing FOWPAL’s Peace Bell for the World:Nobel Peace Prize Laureates’ Visions and Actions

Protecting the World’s Cultural Diversity for a Sustainable Future

Puppet Show I International Friendship Day 2020