EU structural financial indicators: End of 2015

Decline in number of bank branches continues in most EU countries

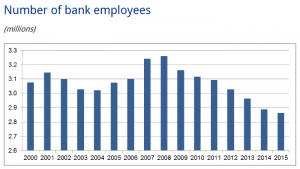

Number of bank employees down by about 24,000 to around 2.86 million

Share of assets of five largest institutions at national level varies from 31% to 95%

The European Central Bank (ECB) has published a comprehensive dataset of structural financial indicators for the banking sector in the European Union (EU). The yearly report comprises statistics on the number of branches and employees of EU credit institutions, data on the degree of concentration of the banking sector in each EU Member State, and data on the share of foreign-controlled institutions in EU national banking markets.

The structural financial indicators show, for instance, that in most EU Member States the number of branches of domestic credit institutions has continued to decline. The number of employees of credit institutions in the EU has also fallen, to around 2.86 million in 2015, a decrease of some 24,000 compared with the figure for 2014. The number has been steadily decreasing since 2008.

The data also indicate that the degree of concentration in the banking sector (measured by the share of assets held by the five largest banks) and the share of foreign-controlled institutions continue to vary significantly across national markets. The share of total assets of the five largest credit institutions, at national level, ranged from 31% to 95% at the end of 2015.

Source: European Central Bank

- 217 reads

Human Rights

Ringing FOWPAL’s Peace Bell for the World:Nobel Peace Prize Laureates’ Visions and Actions

Protecting the World’s Cultural Diversity for a Sustainable Future

The Peace Bell Resonates at the 27th Eurasian Economic Summit

Declaration of World Day of the Power of Hope Endorsed by People in 158 Nations

Puppet Show I International Friendship Day 2020