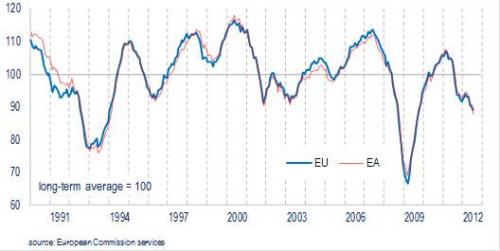

July 2012: Economic sentiment declines in the EU and the euro area

In July the Economic Sentiment Indicator (ESI) decreased by 1.4 points in the EU, to 89.0, and by 2.0 points in the euro area, to 87.9. The decline resulted from lower confidence in all sectors entering the calculation of the ESI. However, a loss of confidence in the services sector was the main driver of the decrease in the EU, while the euro area saw the biggest declines in industry and among consumers.

While three quarters of the Member States witnessed a drop in economic sentiment, this was only the case for three out of the seven largest Member States: The ESI registered sharp falls in Germany (-3.7) and France (‑2.3) and also decreased in Spain (-1.4). However, the ESI continued last month's recovery in the UK (+1.7) and Italy (+1.3) and rose slightly in the Netherlands (+0.6). The figure for Poland is broadly unchanged (-0.1).

Economic sentiment indicator (s.a.)

July EU: 89.0

Euro Area: 87.9

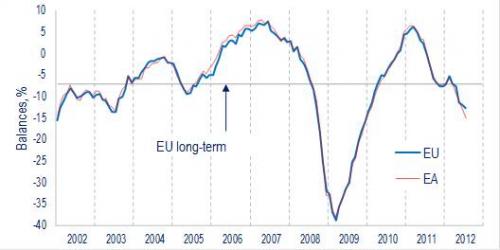

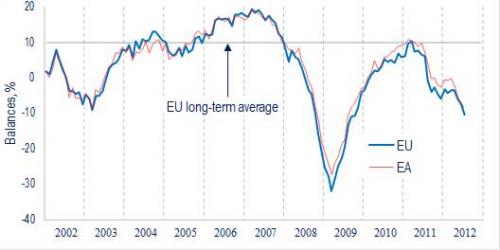

Confidence in industry continued the downward trend reported since March. While relatively moderate in the EU (-0.7), July's decrease in the euro area was sharp (-2.2). In both regions, the decline can be attributed to decreasing production expectations, as well as a more negative assessment of the current level of overall order books and increasing stocks of finished products. In line with these results, managers' assessment of their companies' past production and current level of export order books also deteriorated. Confidence in services declined in the EU and euro area for the fourth consecutive month, the fall being more significant in the EU (-3.1) than in the euro area (-1.1). The evaluation of the past business situation and past demand, as well as the demand expectations, deteriorated in the EU. Figures for the euro area, however, report a stable assessment of the past business situation. After the sharp increases of June, July's confidence in retail trade eased slightly in both the EU (-0.3) and the euro area (-0.6). While the present business situation and the development of the current volume of stocks were viewed more positively, the expected business situation deteriorated significantly. Also in the construction sector, confidence decreased only slightly in the EU (-0.5) and the euro area (-0.3). In the EU, the decrease is attributable to a more negative assessment of both order books and employment expectations, while in the euro area only order books contributed to the decline.

In both regions, employment plans were further revised downwards for industry and retail trade. They were revised upwards in the services sector and remained virtually unchanged in construction. Selling price expectations varied across sectors, with construction showing clear and industry slight downward expectations, counterbalanced by expected price increases in services and, albeit only in the euro area, also in retail trade.

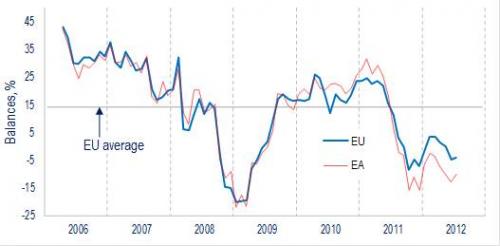

Consumer confidence weakened in both the EU and the euro area by 0.5 and 1.7 points respectively, amid higher unemployment fears, as well as worsened expectations about the future general economic situation and savings. While in case of the euro area the negative outlook is also reflected in consumers' assessment of their households' financial situation over the next 12 months, this was not the case for the EU as a whole.

In contrast to all other sectors, confidence in financial services, which is not included in the ESI, increased in both the EU (+0.9) and the euro area (+2.6). The scores are driven by markedly improved demand expectations and a better assessment of the past business situation, which clearly outweigh the more negative assessment of past demand.

In the quarterly survey of the manufacturing industry, carried out in July, industrial managers in the EU and the euro area reported no significant changes in the number of months of production assured by orders on hand. However, the assessment of new orders and export volume expectations decreased sharply, to levels well below the respective averages reported since 1990. Also, managers' appraisal of their competitive position on foreign markets outside the EU fell short of previous results, but remained close to its long-term average. The balance of managers reporting more than sufficient, rather than insufficient, production capacity increased. Accordingly, capacity utilisation decreased markedly, to 78.2% in the EU and 77.8% in the euro area. Strong heterogeneity in capacity utilisation persists among Member States. In Germany, capacity utilisation fell below its long-term average, to 82.6%.

Industrial confidence indicator (s.a.)

July EU: -12.8

Euro Area: -15.0

Service confidence indicator (s.a.)

July EU: -10.4

Euro Area: -8.5

Consumer confidence indicator (s.a.)

July EU: -20.2

Euro Area: -21.5

Retail trade confidence indicator (s.a.)

July EU: -10.3

Euro Area: -15.0

Construction confidence indicator (s.a.)

July EU: -31.4

Euro Area: -28.4

Financial services confidence indicator (n.s.a.)

July EU: -3.9

Euro Area: -10.2

The next Business and Consumer Survey is due to be published on 30 August 2012.

Source:European Commission

- 465 reads

Human Rights

Fostering a More Humane World: The 28th Eurasian Economic Summi

Conscience, Hope, and Action: Keys to Global Peace and Sustainability

Ringing FOWPAL’s Peace Bell for the World:Nobel Peace Prize Laureates’ Visions and Actions

Protecting the World’s Cultural Diversity for a Sustainable Future

Puppet Show I International Friendship Day 2020