Law Enforcement

U.S. Navy Admiral and Eight Other Officers Indicted for Trading Classified Information in Massive International Fraud and Bribery Scheme

Retired U.S. Navy Rear Admiral Bruce Loveless and eight other high-ranking Navy officers are charged in a federal indictment with accepting luxury travel, elaborate dinners and services of prostitutes from foreign defense contractor Leonard Francis, the former Chief Executive Officer (CEO) of Glenn Defense Marine Asia (GDMA), in exchange for classified and internal U.S. Navy information.

- Read more

- 411 reads

Virginia Woman Pleads Guilty to Filing False Tax Return and Using Customer Ids to Make Fraudulent Credit Card Charges

A Haymarket, Virginia woman on March 13, pleaded guilty in U.S. District Court in the Eastern District of Virginia to filing a false income tax return and aggravated identity theft, announced Acting Deputy Assistant Attorney General Stuart M. Goldberg of the Justice Department’s Tax Division and U.S. Attorney Dana J. Boente for the Eastern District of Virginia.

- Read more

- 381 reads

Charles River Laboratories International Inc. Agrees to Pay United States $1.8 Million to Settle False Claims Act Allegations

Charles River Laboratories International Inc. has agreed to pay the U.S. government $1.8 million to settle claims that it violated the False Claims Act by improperly charging for labor and other associated costs that were not actually provided on certain National Institutes of Health contracts, the Justice Department announced March 13. Charles River is a for-profit corporation headquartered in Wilmington, Massachusetts.

- Read more

- 378 reads

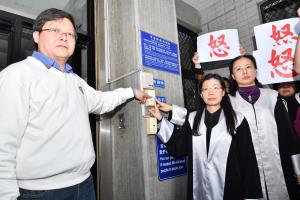

Taiwan’s National Taxation Bureau continues to lie

More than 100 Tai Ji Men dizi attending the court proceeding expressed their anger at the ruling.

- Read more

- 447 reads

Court Orders Return Preparation Business Owner to Pay Nearly $950,000 to the United States for Preparing Fraudulent Returns

A federal court in Orlando, Florida, has permanently barred Jason Stinson, of Longwood, Florida, from preparing federal tax returns for others and from owning or operating a tax return preparation business, following a six-day bench trial held in 2016, the Justice Department announced on March 7. The civil order, signed by Judge Anne C. Conway of the U.S. District Court for the Middle District of Florida, also requires Stinson to disgorge to the United States $949,952.47 of funds he received from “improper and fraudulent tax return preparation.”

- Read more

- 385 reads

ZTE Corporation Agrees to Plead Guilty and Pay Over $430.4 Million for Violating U.S. Sanctions by Sending U.S.-Origin Items to Iran

ZTE Corporation has agreed to enter a guilty plea and to pay a $430,488,798 penalty to the U.S. for conspiring to violate the International Emergency Economic Powers Act (IEEPA) by illegally shipping U.S.-origin items to Iran, obstructing justice and making a material false statement. ZTE simultaneously reached settlement agreements with the U.S. Department of Commerce’s Bureau of Industry and Security (BIS) and the U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC).

- Read more

- 393 reads

Pennsylvania Woman Pleads Guilty to Conspiring to File Tax Returns Using IDs of Puerto Rico Residents

An Allentown, Pennsylvania woman pleaded guilty to conspiring to file federal tax returns using stolen IDs, announced Acting Deputy Assistant Attorney General Stuart M. Goldberg of the Justice Department’s Tax Division and Acting U.S. Attorney Louis D. Lappen for the Eastern District of Pennsylvania.

- Read more

- 388 reads

Nevada Liquor Store Owner Sentenced To Prison For Conspiring To Defraud The United States And Tax Evasion

Jeffrey Nowak, a Las Vegas, Nevada liquor store owner was sentenced to serve 41 months in prison for conspiring to defraud the United States and tax evasion, announced Acting Deputy Assistant Attorney General Stuart M. Goldberg of the Justice Department’s Tax Division and U.S. Attorney Daniel G. Bogden for the District of Nevada.

- Read more

- 381 reads

Louisiana Attorneys Plead Guilty To Failure To File Tax Returns

Two Louisiana attorneys pleaded guilty in the U.S. District Court for the Western District of Louisiana to willfully failing to file federal tax returns, on March 6, announced Acting Deputy Assistant Attorney General Stuart M. Goldberg of the Justice Department’s Tax Division and U.S. Attorney Stephanie A. Finley for the Western District of Louisiana.

- Read more

- 391 reads

Tennessee Doctor and his Wife Plead Guilty to Conspiring to Defraud the United States

A Brentwood, Tennessee doctor and his wife pleaded guilty on March 3, to conspiring to defraud the United States, announced Acting Deputy Assistant Attorney General Stuart M. Goldberg of the Justice Department’s Tax Division and U.S. Attorney David Rivera for the Middle District of Tennessee.

- Read more

- 408 reads

Human Rights

Fostering a More Humane World: The 28th Eurasian Economic Summi

Conscience, Hope, and Action: Keys to Global Peace and Sustainability

Ringing FOWPAL’s Peace Bell for the World:Nobel Peace Prize Laureates’ Visions and Actions

Protecting the World’s Cultural Diversity for a Sustainable Future

Puppet Show I International Friendship Day 2020