Charles River Laboratories International Inc. Agrees to Pay United States $1.8 Million to Settle False Claims Act Allegations

Charles River Laboratories International Inc. has agreed to pay the U.S. government $1.8 million to settle claims that it violated the False Claims Act by improperly charging for labor and other associated costs that were not actually provided on...

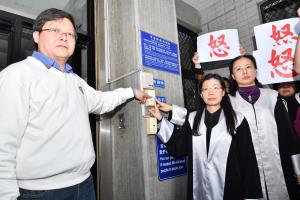

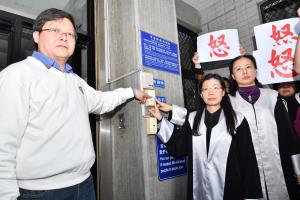

Taiwan’s National Taxation Bureau continues to lie

More than 100 Tai Ji Men dizi attending the court proceeding expressed their anger at the ruling.

Court Orders Return Preparation Business Owner to Pay Nearly $950,000 to the United States for Preparing Fraudulent Returns

A federal court in Orlando, Florida, has permanently barred Jason Stinson, of Longwood, Florida, from preparing federal tax returns for others and from owning or operating a tax return preparation business, following a six-day bench trial held in 2016...

ZTE Corporation Agrees to Plead Guilty and Pay Over $430.4 Million for Violating U.S. Sanctions by Sending U.S.-Origin Items to Iran

ZTE Corporation has agreed to enter a guilty plea and to pay a $430,488,798 penalty to the U.S. for conspiring to violate the International Emergency Economic Powers Act (IEEPA) by illegally shipping U.S.-origin items to Iran, obstructing justice and...

Pennsylvania Woman Pleads Guilty to Conspiring to File Tax Returns Using IDs of Puerto Rico Residents

An Allentown, Pennsylvania woman pleaded guilty to conspiring to file federal tax returns using stolen IDs, announced Acting Deputy Assistant Attorney General Stuart M. Goldberg of the Justice Department’s Tax Division and Acting U.S. Attorney Louis D...

Nevada Liquor Store Owner Sentenced To Prison For Conspiring To Defraud The United States And Tax Evasion

Jeffrey Nowak, a Las Vegas, Nevada liquor store owner was sentenced to serve 41 months in prison for conspiring to defraud the United States and tax evasion, announced Acting Deputy Assistant Attorney General Stuart M. Goldberg of the Justice...

Louisiana Attorneys Plead Guilty To Failure To File Tax Returns

Two Louisiana attorneys pleaded guilty in the U.S. District Court for the Western District of Louisiana to willfully failing to file federal tax returns, on March 6, announced Acting Deputy Assistant Attorney General Stuart M. Goldberg of the Justice...

Tennessee Doctor and his Wife Plead Guilty to Conspiring to Defraud the United States

A Brentwood, Tennessee doctor and his wife pleaded guilty on March 3, to conspiring to defraud the United States, announced Acting Deputy Assistant Attorney General Stuart M. Goldberg of the Justice Department’s Tax Division and U.S. Attorney David...