IMF Executive Board Concludes 2016 Article IV Consultation with St. Kitts and Nevis

On July 8, 2016, the Executive Board of the International Monetary Fund (IMF) concluded the Article IV consultation with St. Kitts and Nevis, and considered and endorsed the staff appraisal without a meeting.

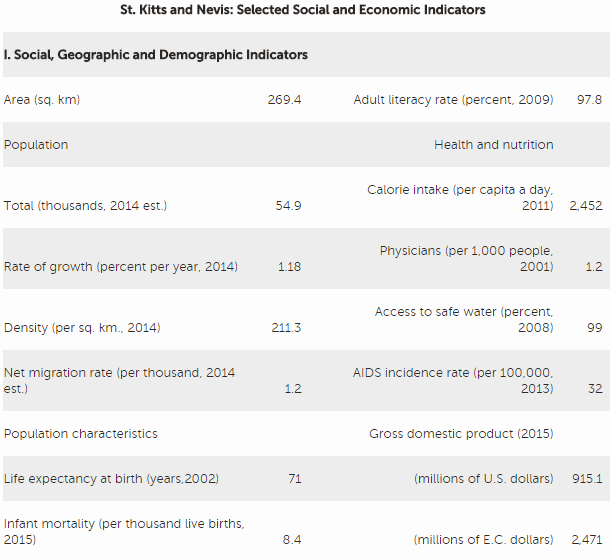

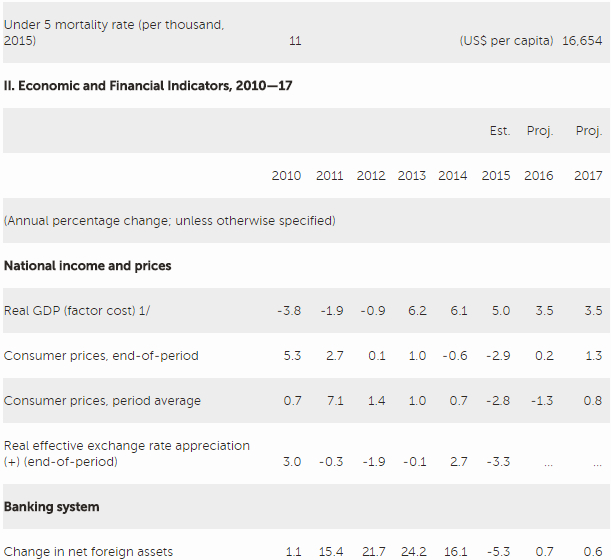

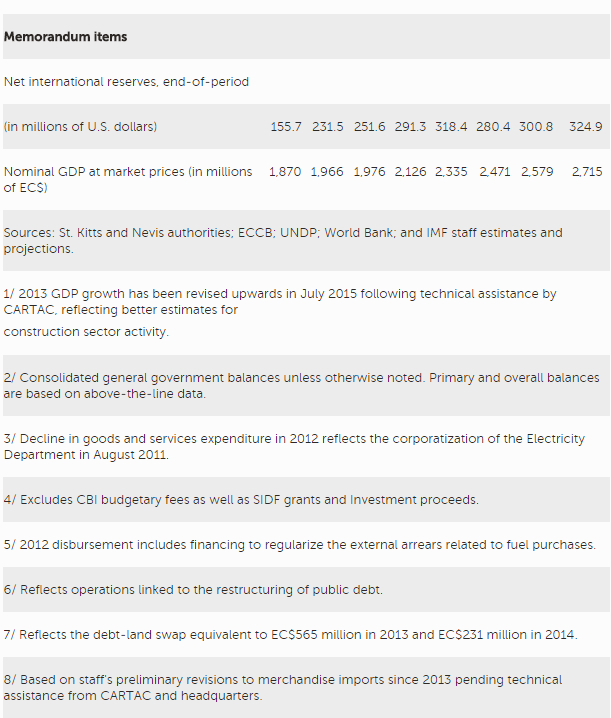

St. Kitts and Nevis successfully exited the Post-Program Monitoring Framework in October 2015, maintaining favorable macroeconomic performance and a broadly stable financial system. The economy continued its strong growth at around 5 percent, recording the strongest growth in the region over 2013-2015. Strong growth has been underpinned by construction and tourism sector activity and their favorable spillovers on the rest of the economy, supported by surging inflows from its Citizenship-by-Investment (CBI) program.

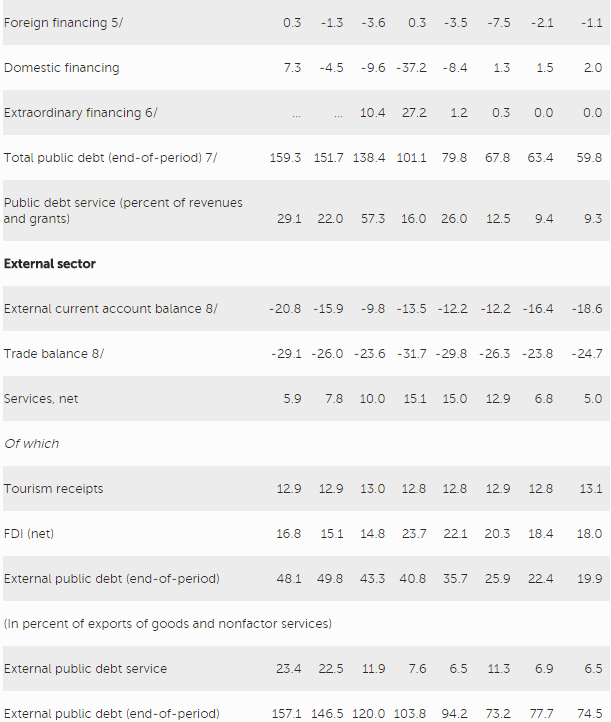

Large CBI inflows continued in 2015, albeit at a slower pace, reflecting the temporary impact of the program reform and increased competition from similar programs in the region. Consumer price inflation turned negative, owing to lower global commodity prices and recent VAT and Import Duty exemptions on food items that carry a large weight in the CPI basket. The banking system remained broadly stable with comfortable capital and liquidity buffers, but high levels of nonperforming loans (NPLs), low profitability, and slow progress with land sales have created pockets of vulnerability, adding to the risks from regional financial developments.

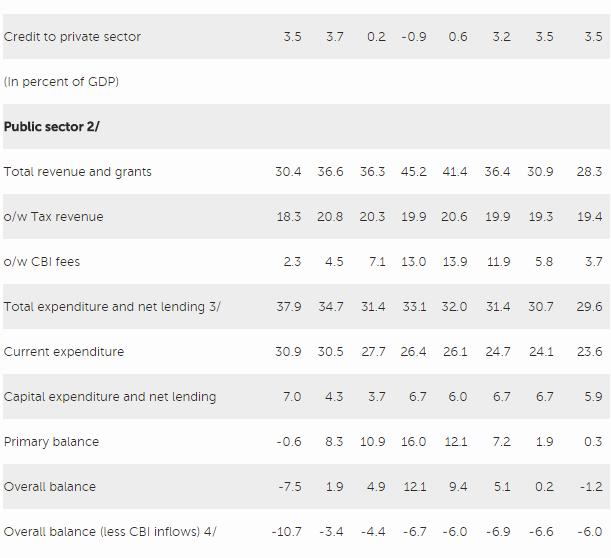

The fiscal position remained in surplus, but weakened compared to previous years, owing to a slowdown in CBI receipts to the budget, delays in grants, and the impact of the 2014-2015 VAT and Import Duty exemptions. Notwithstanding, the debt-to-GDP ratio continued its impressive downward trajectory and is projected to reach the ECCU’s 60 percent target in 2017, well ahead of peers.

The medium-term outlook is positive, but remains dependent on developments in CBI inflows. Growth is expected to moderate to 3.5 percent in 2016 and 3 percent, on average, over the medium term, reflecting projected tapering of CBI-related construction activity as the pace of new CBI applications normalize from recent peaks, including due to higher competition. Potential spillovers from weak growth prospects in key tourism source markets, regional financial sector challenges, including derisking trends, and exposure to natural disasters pose additional downside risks to the outlook. However, CBI inflows and favorable spillovers from a protracted low oil price could surprise on the upside.

Executive Board Assessment

In concluding the 2016 Article IV Consultation with St. Kitts and Nevis, Executive Directors endorsed staff’s appraisal as follows:

Although St. Kitts and Nevis continued to enjoy strong macroeconomic performance in recent years, the outlook is highly dependent on developments in the CBI program. A multi-pronged strategy is needed to preserve macro-financial stability and hard-earned gains in debt sustainability. The elements of such a strategy include: (i) strengthening the fiscal framework to reduce reliance on CBI inflows, while preserving the accumulated savings from the CBI program and further improving public financial management; (ii) resolving the debt-land swap to safeguard financial stability, while mitigating emerging financial sector risks; and (iii) enhancing competitiveness, diversification, and resilience to shocks, including from natural disasters.

A prudent medium-term fiscal framework with a zero primary balance target, net of CBI receipts and Sugar Industry Diversification Foundation (SIDF) grants, would help safeguard fiscal sustainability, with the adjustment paced over the medium-term. The framework would help build resilience to negative surprises in future CBI inflows, and facilitate accumulation of fiscal buffers to address external shocks and absorb unforeseen financing needs if tax performance disappoints after CBI flows decline. Implementing this framework requires broadening the tax base, including by streamlining tax incentives and further improving compliance, especially at the Nevis Island Administration (NIA) level, as well as containing recurrent spending. The authorities’ commitment to a comprehensive review of the concessions regime is welcome, as well as plans to contain the wage bill and spending on goods and services.

Establishing a ‘Growth and Resilience Fund’ can help preserve the accumulated savings from the CBI program, while providing a contingency buffer for future shocks, such as costly natural disasters. The fund should have a prudent investment strategy, with appropriate governance and accountability, and its flows fully integrated with the fiscal framework with the zero primary-balance-target. Investing the funds in safe instruments abroad according to appropriate investment guidelines should help reduce risks to financial stability by easing banks’ excess liquidity pressures. A comprehensive investment and debt management strategy that optimizes the government balance sheet through further debt reduction and improves the cost and composition of debt would complement efforts to build adequate buffers as self-insurance for future shocks.

The authorities should press ahead with structural reforms that strengthen public financial management. In this context, strengthening the NIA’s budget framework, tax policy, and revenue administration, and better coordination with central government on the sharing of VAT and CBI revenues are crucial for the Federation’s fiscal sustainability. Enhancing oversight of public corporations and enforcing timely reporting of their audited financial statements are also critical to safeguarding the sustainability of the consolidated public sector position. Staff welcomes the authorities’ efforts to enhance the transparency of SIDF financial reporting and commitment to streamline and re-orient the People Employment Program. Plans for potential integration of the SIDF with the government’s Consolidated Fund should enhance assessment and management of the overall fiscal policy stance.

A clear framework for resolving the debt-land swap is crucial to preserve the credibility of debt restructuring, the hard-earned gains in debt sustainability, and financial sector stability. With the appointment of the SLSC board of directors and approval of the two sale offers recently, the SLSC can be operationalized as a marketing agent to sell the remaining plots of land, including to the diaspora. A clear strategy should be developed to enable reasonable progress with land sales, to remove the policy uncertainty around the swap. While setting up this framework, staff recommends the consideration of a temporary extension of the dividend guarantee on unsold land, at possible renegotiated terms, and agreement on the reporting treatment of the swap by all parties—the banks, the regulator, and the government.

Preserving financial stability also calls for further strengthening of the supervisory frameworks for banks and nonbanks and more systematic coordination between their regulatory authorities. Further supervisory strengthening would help capture weaknesses in growing market segments. A more systematic coordination between the Eastern Caribbean Central Bank (ECCB) and the Financial Services Regulatory Commission (FSRC) will help limit potential risks from linkages between banks and nonbanks and between onshore financial institutions and those operating internationally. Implementing the new Banking Law will also enable the ECCB to conduct consolidated and risk-based supervision and address potential spillover risks. Trends in Correspondent Banking Relationships (CBRs) need to be systematically monitored to limit the risk of losing CBRs, as well as maintaining a watertight AML/CFT regime with adequate financial disclosure, and full compliance with international standards on transparency and exchange of tax information.

A structural reform agenda that focuses on economic diversification, improved business environment, and contingency planning should enhance resilience to external shocks and bolster long-run growth potential. Ongoing efforts to improve the business environment and addressing the skills gap will provide an enabling environment for private sector development and help attract foreign investment crucial to financing the current account. Investing in targeted transformative projects (including by broadening options under the CBI program to include business investment in renewable energy, education and health) will improve competitiveness, diversification, and resilience of the economy, including to natural disasters.

Urgent attention is needed to improve the quality of statistical data. In particular, addressing shortfalls in Balance of Payments, National Accounts, and labor market statistics is critical to enhancing surveillance and providing better basis for policy decisions.

Source: International Monetary Fund

- 279 reads

Human Rights

Fostering a More Humane World: The 28th Eurasian Economic Summi

Conscience, Hope, and Action: Keys to Global Peace and Sustainability

Ringing FOWPAL’s Peace Bell for the World:Nobel Peace Prize Laureates’ Visions and Actions

Protecting the World’s Cultural Diversity for a Sustainable Future

Puppet Show I International Friendship Day 2020